Massachusetts Angel Investor Agreement is a legal contract entered into by an angel investor and a startup company, outlining the terms and conditions of the investment. It serves as a guideline for the investment process and protects the rights and interests of both parties involved. The agreement typically covers crucial aspects such as the investment amount, equity ownership, rights and responsibilities of the investor, voting rights, board representation, anti-dilution provisions, and exit strategies. The document may also address non-disclosure agreements, non-compete clauses, and intellectual property rights. Within Massachusetts, there are various types of Angel Investor Agreements that cater to different investment scenarios and objectives, including: Convertible Note Agreement: A common form of agreement where the investor provides a loan to the startup, which converts into equity at a future financing round or specified event. SAFE (Simple Agreement for Future Equity): A relatively new type of agreement that allows investors to contribute funds in exchange for the right to obtain equity upon specific triggering events, such as subsequent funding rounds or acquisition. Equity Financing Agreement: This agreement directly offers equity ownership to the investor, determining the percentage ownership and the corresponding rights associated with it. Governing Rules Agreement: Sometimes, an Angel Investor Agreement in Massachusetts may outline specific provisions to comply with regional or industry-specific regulations or guidelines. Each type of agreement has its own advantages and considerations, depending on the investor's preferences and the startup's funding needs. It is crucial for both parties to carefully review and negotiate the terms included in the agreement to ensure a fair and mutually beneficial relationship. Seeking legal counsel is highly recommended creating a comprehensive and customized Massachusetts Angel Investor Agreement.

Massachusetts Angel Investor Agreement

Description

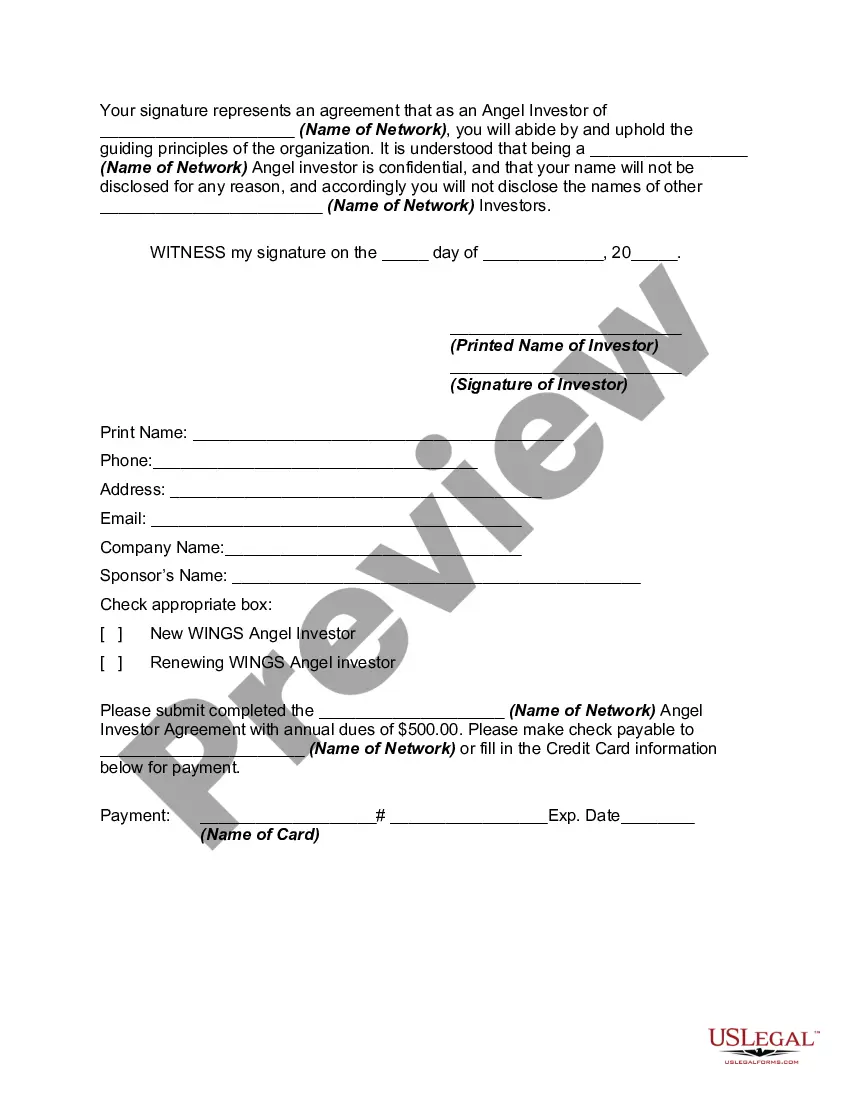

How to fill out Massachusetts Angel Investor Agreement?

US Legal Forms - one of many greatest libraries of authorized forms in the States - offers a wide array of authorized papers web templates you can download or printing. While using website, you will get a large number of forms for organization and person reasons, categorized by types, states, or search phrases.You will find the latest models of forms like the Massachusetts Angel Investor Agreement within minutes.

If you currently have a membership, log in and download Massachusetts Angel Investor Agreement from your US Legal Forms library. The Down load option will appear on each develop you look at. You have accessibility to all formerly saved forms in the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, here are simple directions to obtain started out:

- Be sure to have picked the best develop to your city/county. Select the Preview option to review the form`s content. See the develop information to ensure that you have chosen the proper develop.

- In case the develop doesn`t suit your demands, make use of the Lookup area towards the top of the display screen to obtain the the one that does.

- If you are happy with the shape, validate your choice by simply clicking the Purchase now option. Then, select the pricing program you favor and offer your references to sign up for the bank account.

- Procedure the deal. Make use of your bank card or PayPal bank account to perform the deal.

- Select the format and download the shape on the device.

- Make adjustments. Fill out, revise and printing and signal the saved Massachusetts Angel Investor Agreement.

Each and every format you put into your bank account lacks an expiry time and it is your own forever. So, in order to download or printing one more backup, just visit the My Forms area and click about the develop you need.

Get access to the Massachusetts Angel Investor Agreement with US Legal Forms, probably the most comprehensive library of authorized papers web templates. Use a large number of specialist and state-particular web templates that satisfy your organization or person needs and demands.