The Massachusetts Agreement to Purchase Note and Mortgage is a legal document that outlines the terms and conditions of a real estate transaction involving the sale of property in Massachusetts. This agreement serves as a binding contract between the buyer and seller, detailing the specific obligations and rights of each party. The agreement typically includes extensive information regarding the property being sold, including its address, legal description, and any relevant encumbrances. It outlines the purchase price and the payment structure agreed upon by the parties involved. Additionally, it covers the terms of the mortgage, such as interest rates, repayment schedules, and any applicable late fees or penalties. In Massachusetts, there are different types of agreements to purchase notes and mortgages that may be used: 1. Fixed-rate Mortgage: This type of mortgage agreement stipulates a fixed interest rate for the duration of the loan. The buyer agrees to make regular payments, ensuring that the loan is repaid in equal installments over a set period of time. 2. Adjustable-rate Mortgage (ARM): An ARM provides for an interest rate that may fluctuate periodically, usually based on market conditions. The agreement specifies the initial interest rate, adjustment periods, and any applicable interest rate caps or limits. 3. Balloon Mortgage: With a balloon mortgage, the borrower makes lower monthly payments for a specified period, typically five to seven years. At the end of this period, the remaining balance becomes due in full, requiring the borrower to either pay off the remaining loan or secure additional financing. 4. Reverse Mortgage: Designed for older homeowners, a reverse mortgage allows individuals to convert a portion of their home's equity into cash. The agreement details how the loan will be repaid, typically when the homeowner relocates, sells the property, or passes away. Regardless of the type, the Massachusetts Agreement to Purchase Note and Mortgage is vital for completing a real estate transaction. It protects both the buyer and the seller by clearly outlining their rights, responsibilities, and the terms of the loan agreement. It acts as documentary evidence of the transaction and is essential for title transfers, ensuring the legal transfer of ownership upon successful completion of the agreement's terms.

Massachusetts Agreement to Purchase Note and Mortgage

Description

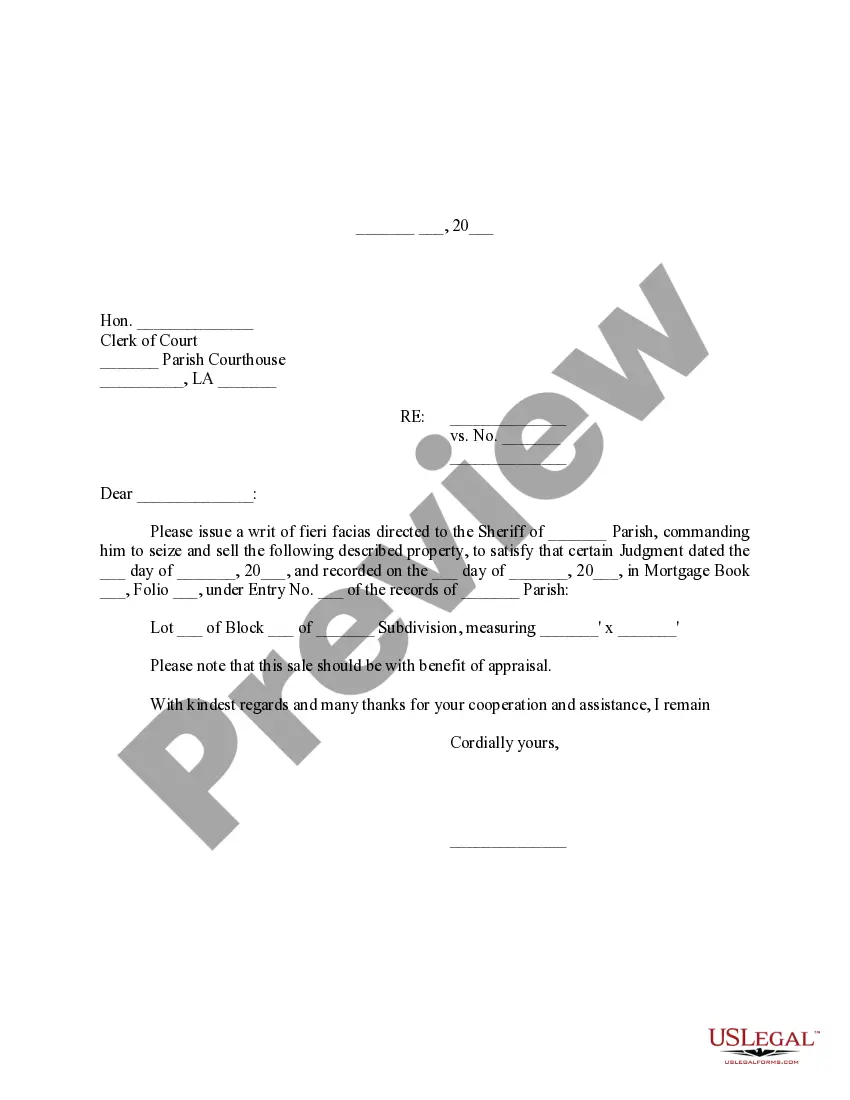

How to fill out Massachusetts Agreement To Purchase Note And Mortgage?

US Legal Forms - among the most significant libraries of legitimate kinds in the USA - gives an array of legitimate papers templates you may obtain or print. Using the internet site, you will get a large number of kinds for enterprise and individual uses, sorted by groups, claims, or search phrases.You will discover the latest models of kinds like the Massachusetts Agreement to Purchase Note and Mortgage within minutes.

If you already possess a monthly subscription, log in and obtain Massachusetts Agreement to Purchase Note and Mortgage through the US Legal Forms library. The Acquire key will show up on each type you view. You have access to all formerly downloaded kinds from the My Forms tab of your respective account.

In order to use US Legal Forms the very first time, listed here are simple recommendations to help you started out:

- Be sure to have chosen the proper type for your personal metropolis/county. Click the Preview key to review the form`s content material. Browse the type explanation to actually have chosen the right type.

- If the type doesn`t match your demands, take advantage of the Look for area towards the top of the display screen to discover the one that does.

- Should you be happy with the form, validate your option by clicking on the Purchase now key. Then, opt for the pricing program you favor and provide your references to sign up on an account.

- Method the transaction. Utilize your Visa or Mastercard or PayPal account to complete the transaction.

- Pick the format and obtain the form on your own device.

- Make alterations. Fill out, edit and print and indicator the downloaded Massachusetts Agreement to Purchase Note and Mortgage.

Each design you put into your bank account does not have an expiry day which is your own property for a long time. So, if you would like obtain or print one more version, just visit the My Forms segment and then click about the type you need.

Obtain access to the Massachusetts Agreement to Purchase Note and Mortgage with US Legal Forms, probably the most considerable library of legitimate papers templates. Use a large number of specialist and condition-certain templates that satisfy your small business or individual requires and demands.

Form popularity

FAQ

A bill of exchange is similar to a promissory note, but has some key differences. The first thing to know about a bill of exchange is that it is only used in international business transactions. It is governed by the United Nations Convention on International Bills of Exchange and International Promissory Notes.

Secured: A secured promissory note is common in traditional mortgages. It means the borrower backs their loan with collateral. For a mortgage, the collateral is the property. If the borrower fails to pay back their loan, the lender has a legal claim over the asset and, in extreme cases, may foreclose on the property.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

Some of the most significant differences between promissory notes and loan agreements include: Collateral: Most loan agreements center around loans with collateral, while promissory notes are only secured by the borrower's word. Repayment Terms: Promissory notes might require lump-sum repayment.

Even if the original note is lost, the other original documents or the copies can be used to establish the existence of the loan. You may want to hire an online service provider to assist you in preparing the replacement promissory note, as well as the Affidavit of Lost Promissory Note and Indemnity Agreement.

A borrower usually must sign a promissory note along with the mortgage. The promissory note gives legal protections to the lender if the borrower defaults on the debt and provides clarification to the borrower so that they understand their repayment obligations.

It just says the lender can take the property should the homeowner fail to pay. Mortgages are filed in the courthouse as public record, and anyone listed on the deed must be listed on the mortgage. But that person doesn't have to be the same person listed on the note as the party responsible for the debt.