Massachusetts General Letter of Credit with Account of Shipment

Description

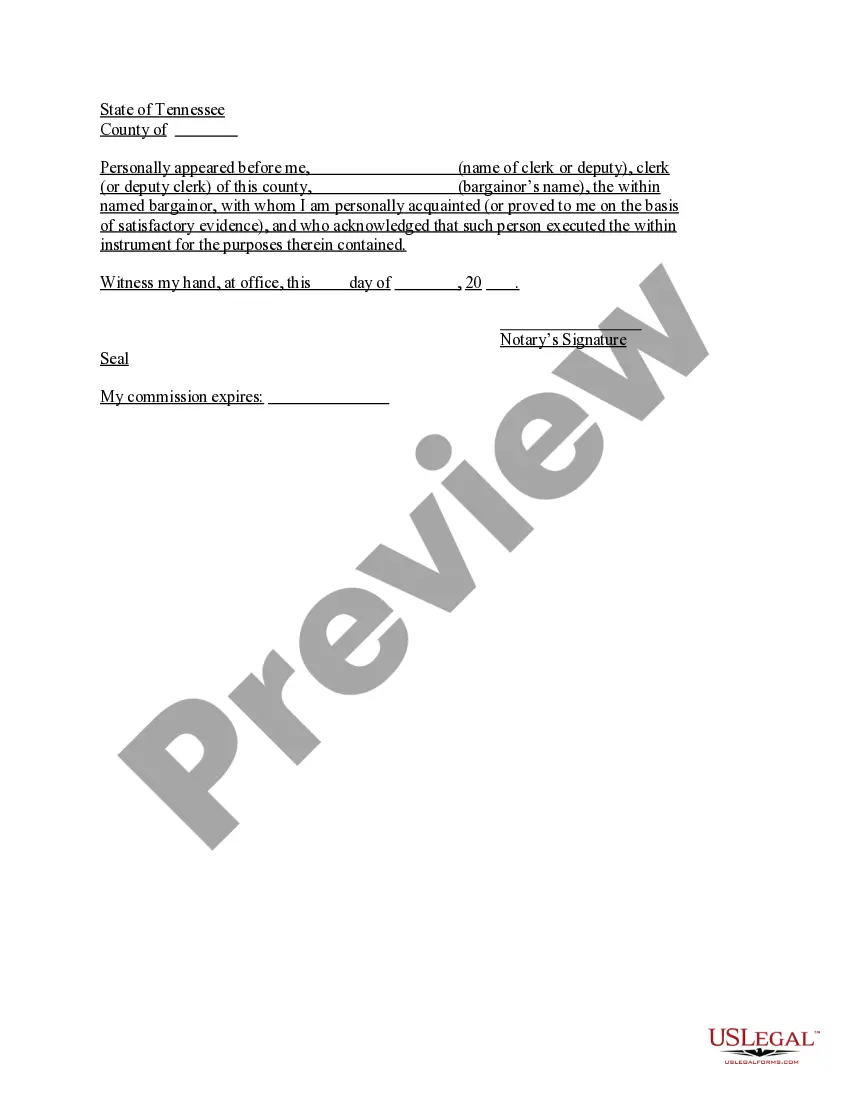

How to fill out General Letter Of Credit With Account Of Shipment?

Finding the right lawful file web template can be quite a have a problem. Obviously, there are a lot of layouts accessible on the Internet, but how will you obtain the lawful type you will need? Make use of the US Legal Forms site. The assistance gives a huge number of layouts, like the Massachusetts General Letter of Credit with Account of Shipment, that can be used for organization and personal requires. All of the varieties are examined by experts and fulfill state and federal needs.

If you are previously authorized, log in to the profile and then click the Download option to find the Massachusetts General Letter of Credit with Account of Shipment. Make use of profile to appear from the lawful varieties you possess ordered previously. Visit the My Forms tab of your respective profile and have another version from the file you will need.

If you are a whole new customer of US Legal Forms, allow me to share basic recommendations for you to adhere to:

- Very first, ensure you have chosen the right type for your metropolis/county. You may look through the form while using Review option and browse the form explanation to make certain it is the best for you.

- When the type will not fulfill your preferences, utilize the Seach industry to obtain the appropriate type.

- Once you are certain that the form is proper, go through the Purchase now option to find the type.

- Opt for the pricing plan you would like and type in the necessary details. Design your profile and pay for the order making use of your PayPal profile or credit card.

- Pick the submit formatting and down load the lawful file web template to the device.

- Complete, change and print out and indicator the acquired Massachusetts General Letter of Credit with Account of Shipment.

US Legal Forms may be the most significant collection of lawful varieties in which you will find various file layouts. Make use of the company to down load skillfully-manufactured documents that adhere to condition needs.

Form popularity

FAQ

A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade. Bank Guarantee vs. Letter of Credit: What's the Difference? - Investopedia investopedia.com ? ask ? answers ? differen... investopedia.com ? ask ? answers ? differen...

An unconfirmed LC means that only the issuing bank is responsible for payment. Generally, irrevocable and confirmed LCs are more secure and preferable for sellers, while revocable and unconfirmed LCs are more flexible and cheaper for buyers.

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several other types of letters of credit. Types of Letters of Credit - Investopedia investopedia.com ? ask ? answers ? what-are... investopedia.com ? ask ? answers ? what-are...

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry. Letter of Credit: What It Is, Examples, and How One Is Used - Investopedia investopedia.com ? terms ? letterofcredit investopedia.com ? terms ? letterofcredit

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. Irrevocable. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

The types of letters of credit include a commercial letter of credit, a revolving letter of credit, a traveler's letter of credit, and a confirmed letter of credit.

Different types of Letter of Credit Revocable. Notably, the Letter can be canceled or amended at any time by either the buyer or the issuing bank without any formal notification. ... Confirmed. ... Transferrable. ... Straight. ... Restricted. ... Term (Usance)

You can open an LC and choose to make it available again in its original amount after the goods have been shipped, documents presented and credit is settled. Such an LC is a revolving LC. Under a revolving LC the amount is reinstated or renewed without any specific amendments to the LC. 2. Letters of Credit - An Overview oracle.com ? html ? LC02_Intro oracle.com ? html ? LC02_Intro