This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Agreement of Purchase and Sale of Business - Short Form

Description

How to fill out Agreement Of Purchase And Sale Of Business - Short Form?

It is feasible to spend several hours online seeking the legal document template that complies with the state and federal regulations you require.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

It is straightforward to download or generate the Massachusetts Agreement of Purchase and Sale of Business - Short Form from your services.

If available, use the Review option to glance through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- Subsequently, you can fill out, modify, generate, or sign the Massachusetts Agreement of Purchase and Sale of Business - Short Form.

- Every legal document template you purchase becomes your property indefinitely.

- To obtain another copy of any purchased template, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines outlined below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Review the template description to confirm you have chosen the right document.

Form popularity

FAQ

Who Creates the Purchase and Sale Agreement? A real estate agent typically creates a purchase and sale agreement. However, in some cases, depending on local real estate laws, an attorney might be the one who makes the deal. Regardless of who creates the agreement, you can always negotiate terms and conditions.

1. The seller's agent or attorney will draft the Purchase and Sale Agreement (P&S). This is the more binding legal document that is the official contract to purchase the home.

Seller- The Buyer will sign the P&S first. Once the Buyer has signed the P&S, the listing agent will send the P&S to the Seller for electronic signature. The listing agent also will let the Seller know when in receipt of the Buyer's deposit check. The listing agent will circulate the fully executed P&S.

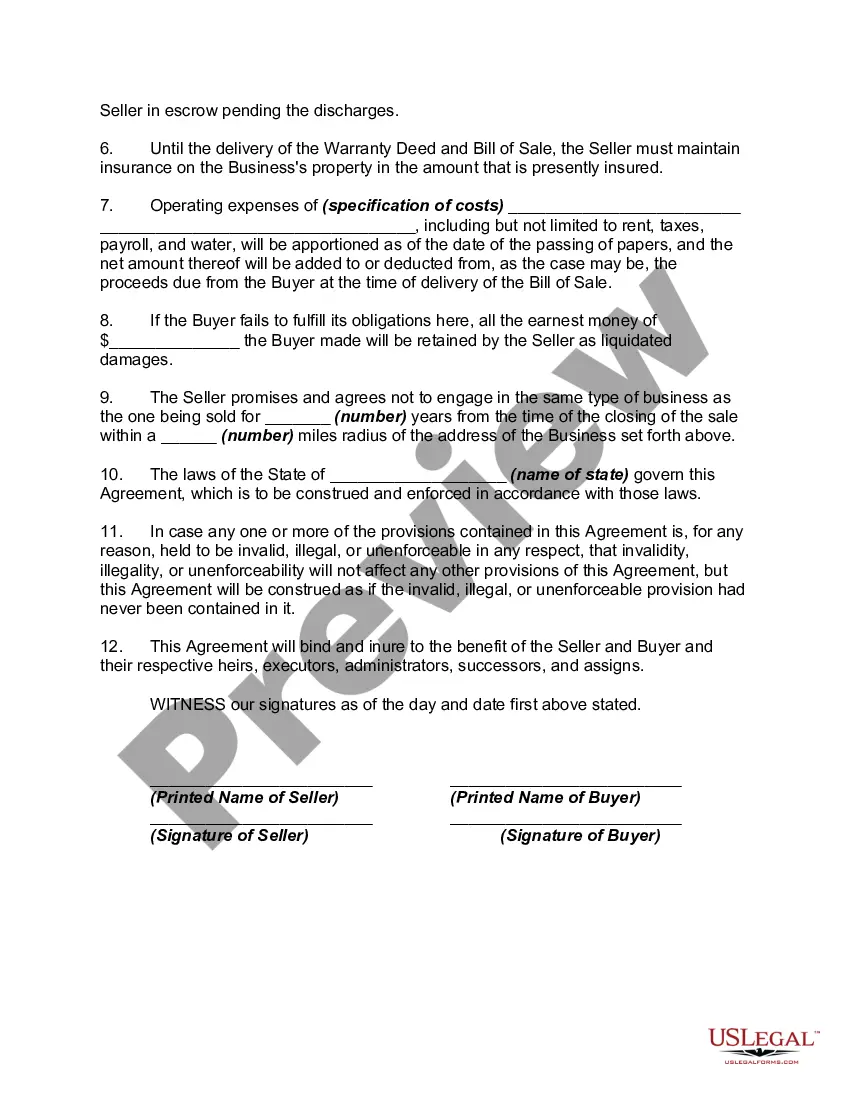

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Any purchase agreement should include at least the following information:The identity of the buyer and seller.A description of the property being purchased.The purchase price.The terms as to how and when payment is to be made.The terms as to how, when, and where the goods will be delivered to the purchaser.More items...?

The purchase and sale agreement is the contract between the buyer and seller of real estate. It sets out the obligations of each party from the time the property is taken off the market to the closing. A standard form agreement is used in most residential real estate transactions in Massachusetts.

A sale and purchase agreement provides certainty to you and the seller about what will happen when. To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

Know How to Fill Out the Business Bill of SaleDate of Sale.Buyer's name and address.Seller's name and address.Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.