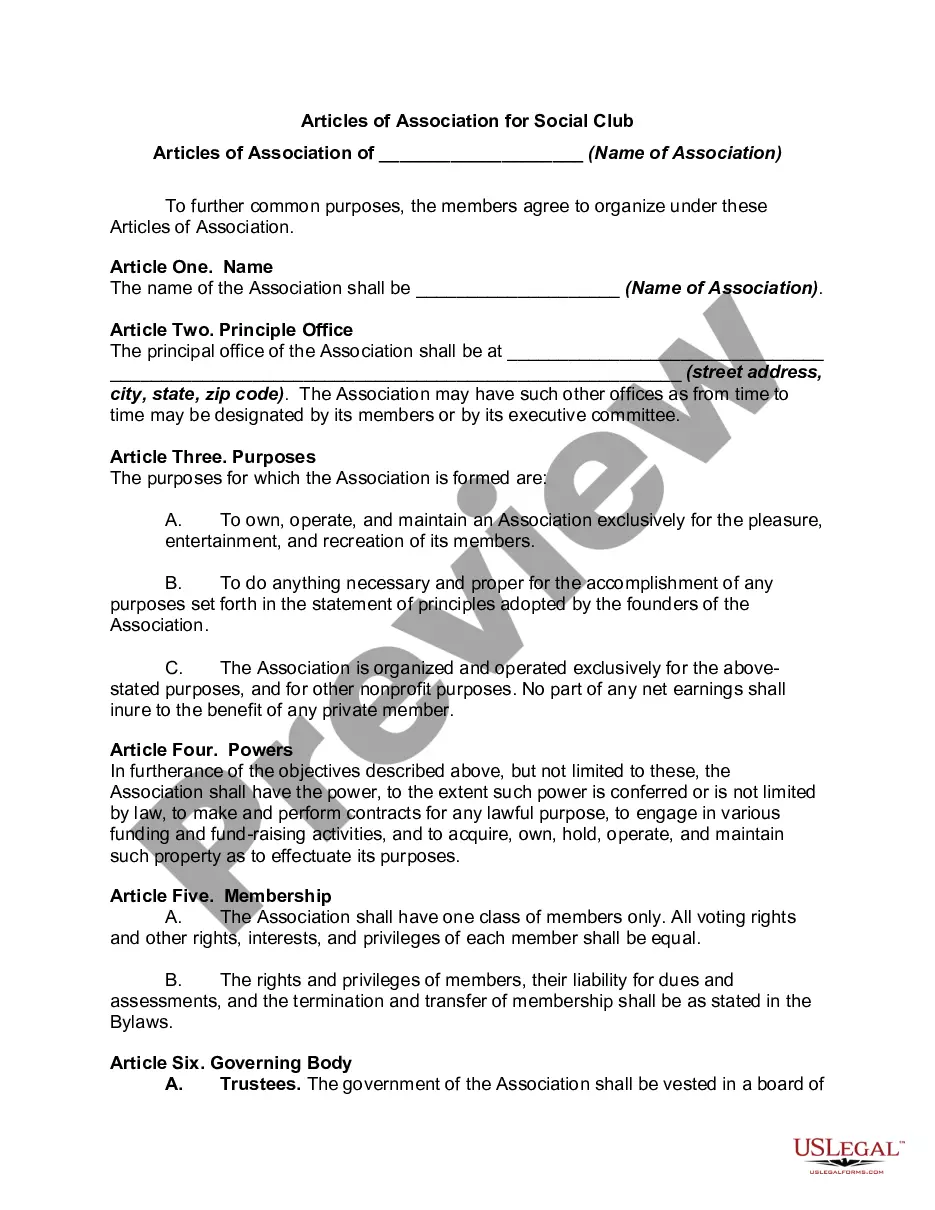

Massachusetts Articles of Association

Description

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association?

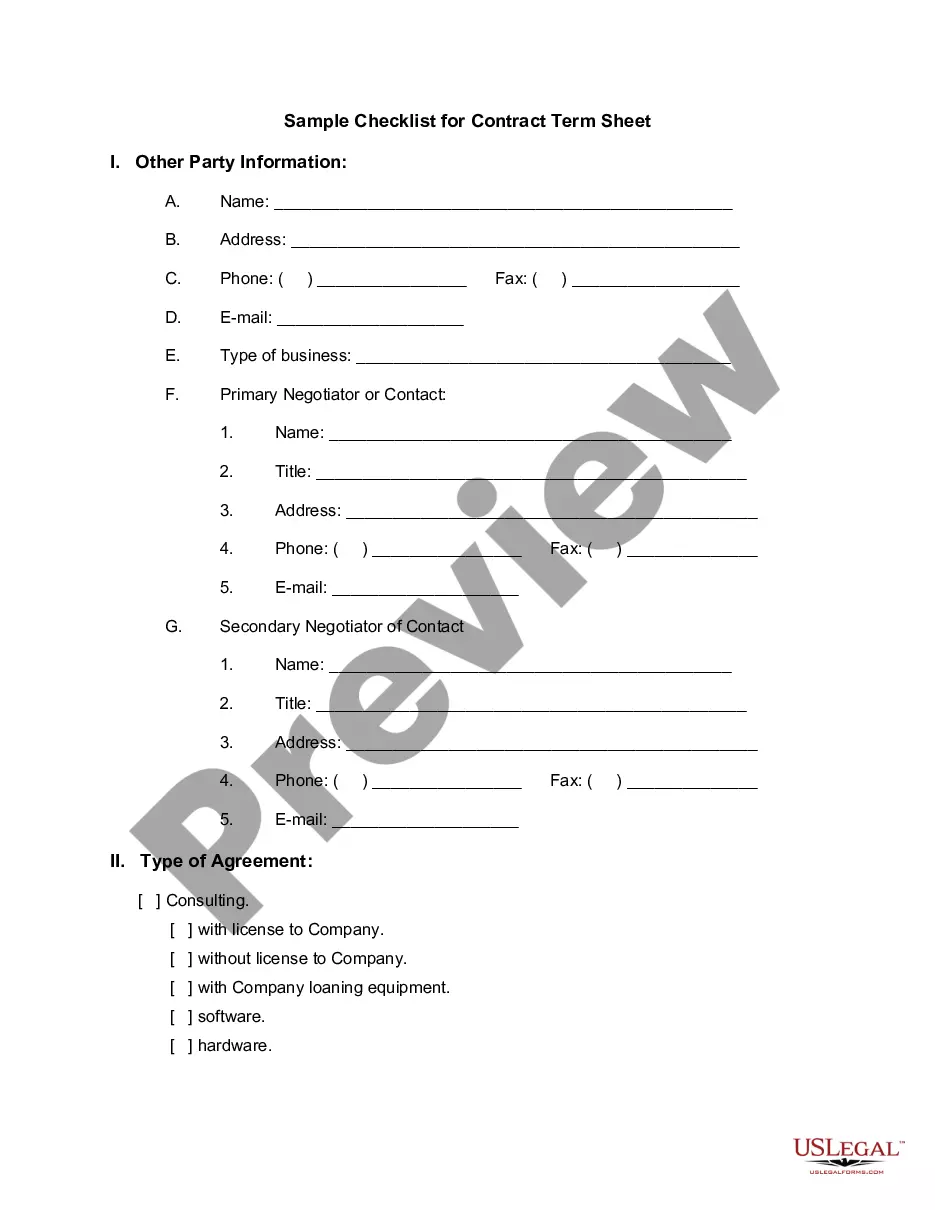

Finding the correct legitimate document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you locate the official form you require.

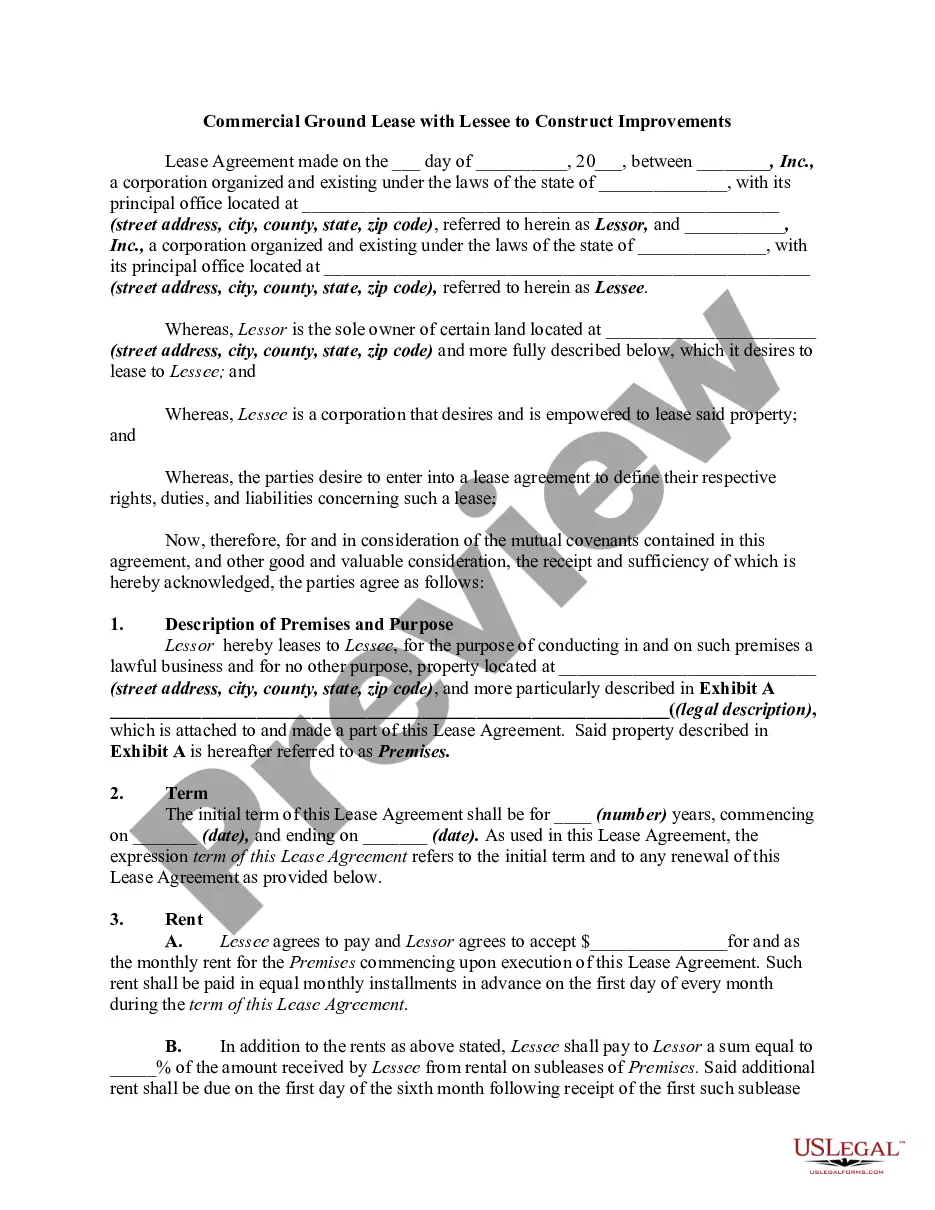

Utilize the US Legal Forms website. The service offers a wide array of templates, including the Massachusetts Articles of Association, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to retrieve the Massachusetts Articles of Association.

- Use your account to keep track of the legal forms you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to consider.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

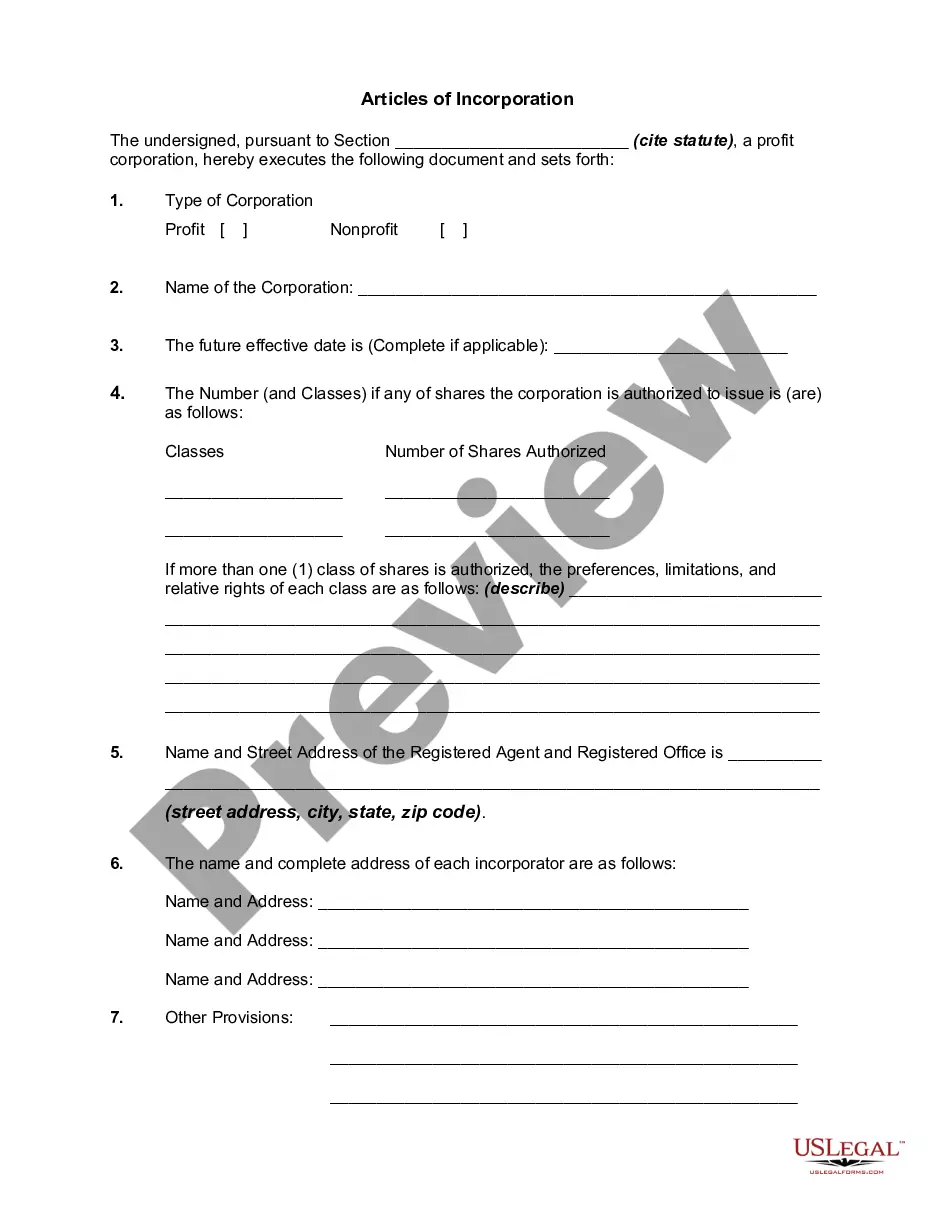

Articles of association are fundamental documents that outline the structure, purpose, and regulations governing a company. In Massachusetts, these are referred to as Massachusetts Articles of Association. They are essential for registering your business and ensuring legal compliance with state regulations.

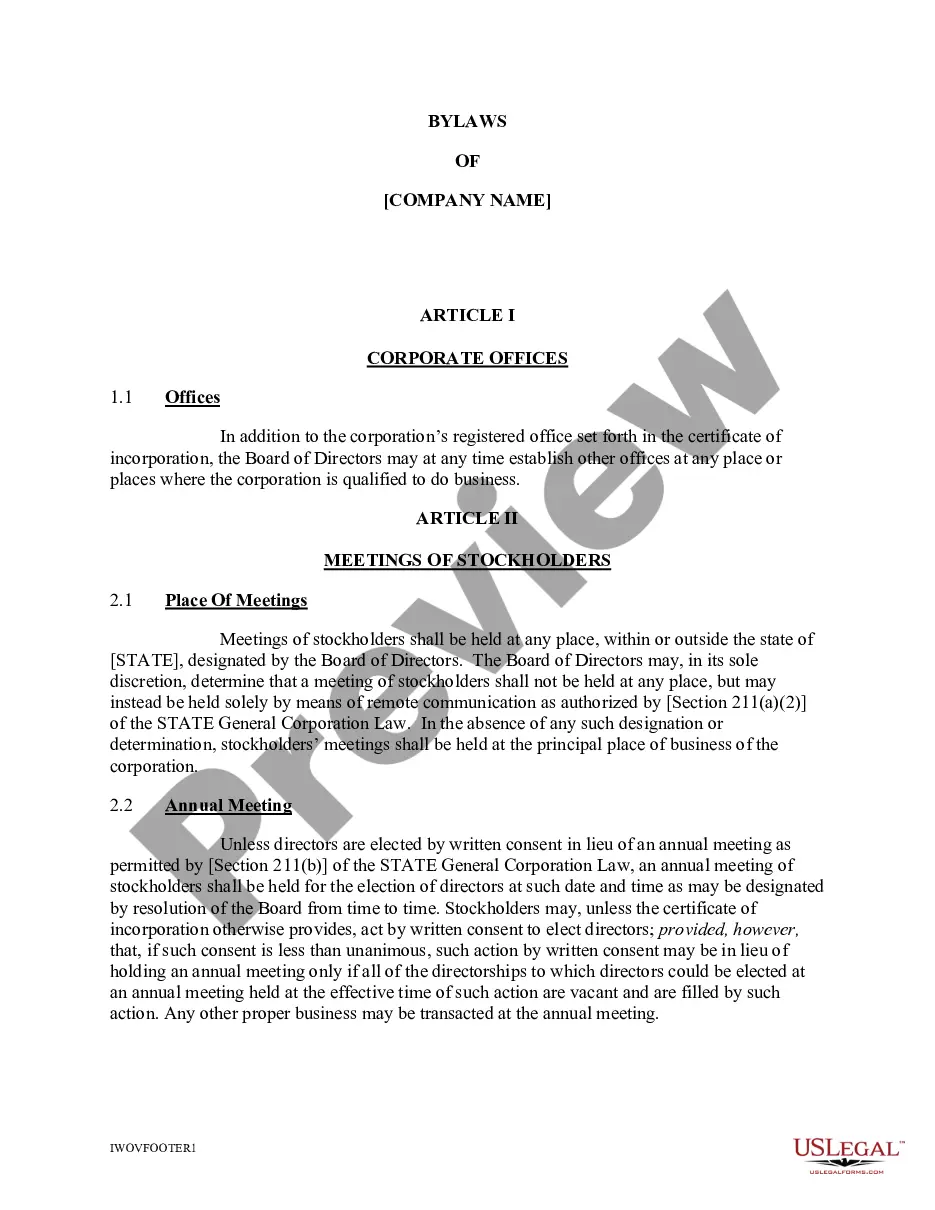

The key difference lies in their functions. While the articles of association, including Massachusetts Articles of Association, outline the company’s existence and basic governance structure, bylaws detail the day-to-day rules for the management of the business. Knowing the distinctions helps you maintain compliance.

Yes, articles of incorporation generally take precedence over bylaws. The Massachusetts Articles of Association serve as the foundational document for your business structure, while the bylaws can provide more flexibility in operations. When conflict arises, refer to the articles for guidance.

No, articles of association are not the same as bylaws. The articles of association, such as Massachusetts Articles of Association, provide essential information about the company, while bylaws detail the rules for its governance. Understanding this distinction is key to effective business management.

Bylaws do not supersede articles of incorporation, including Massachusetts Articles of Association. In fact, they serve different purposes. The articles outline fundamental company details, while bylaws govern internal operations. Thus, both documents work together to maintain structure.

If an LLC neglects to file an annual report, its status may become inactive or dissolved. This can lead to losing valuable licenses, permits, and protections that the LLC provides. Additionally, the owners may become personally liable for the LLC's debts. Therefore, it is advisable to keep track of deadlines and utilize platforms like uslegalforms to help manage your Massachusetts Articles of Association and ensure compliance.

Not filing an annual report for your LLC in Massachusetts can result in administrative dissolution by the state. This means your business will no longer be recognized legally, and you lose any liability protection. Furthermore, you may also face fines or penalties. To prevent this, regularly review your Massachusetts Articles of Association and stay compliant with filing requirements.

The primary distinction between an LLC and articles of incorporation lies in their structure and purpose. An LLC, or Limited Liability Company, provides flexibility and personal liability protection for its owners. On the other hand, articles of incorporation are formal documents that establish a corporation, outlining its structure and management. When considering types of business formation in Massachusetts, understanding Massachusetts Articles of Association is crucial.

The Articles of Incorporation for your business can typically be found in the filing records of the state where you registered your corporation. For Massachusetts, these documents are accessible through the Secretary of the Commonwealth’s website. If you need help finding them, US Legal Forms can provide support to locate and manage these crucial documents.

No, Articles of Incorporation and Employer Identification Numbers (EIN) are not the same. The Articles of Incorporation establish your business legally, while the EIN serves as a tax identification number for your business. Both are essential for corporate operations, particularly in Massachusetts, where you will need both for various business functions.