Massachusetts Estate Planning Data Sheet

Description

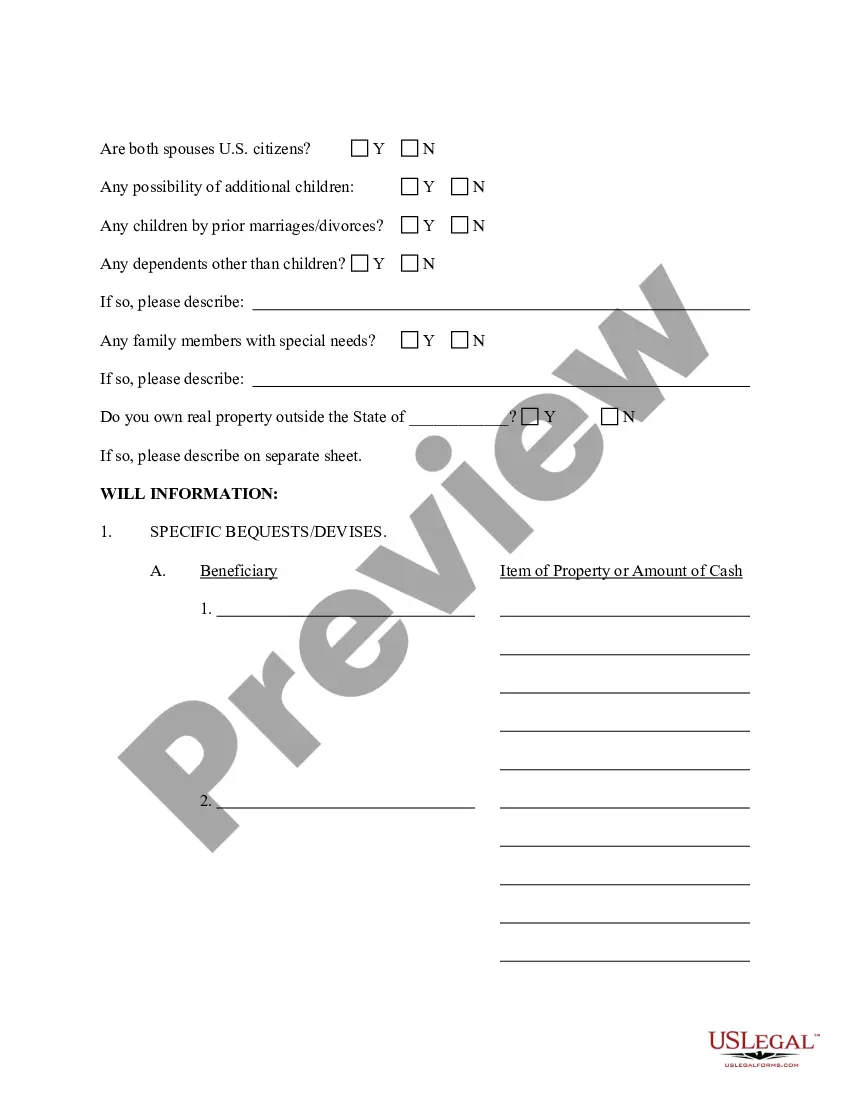

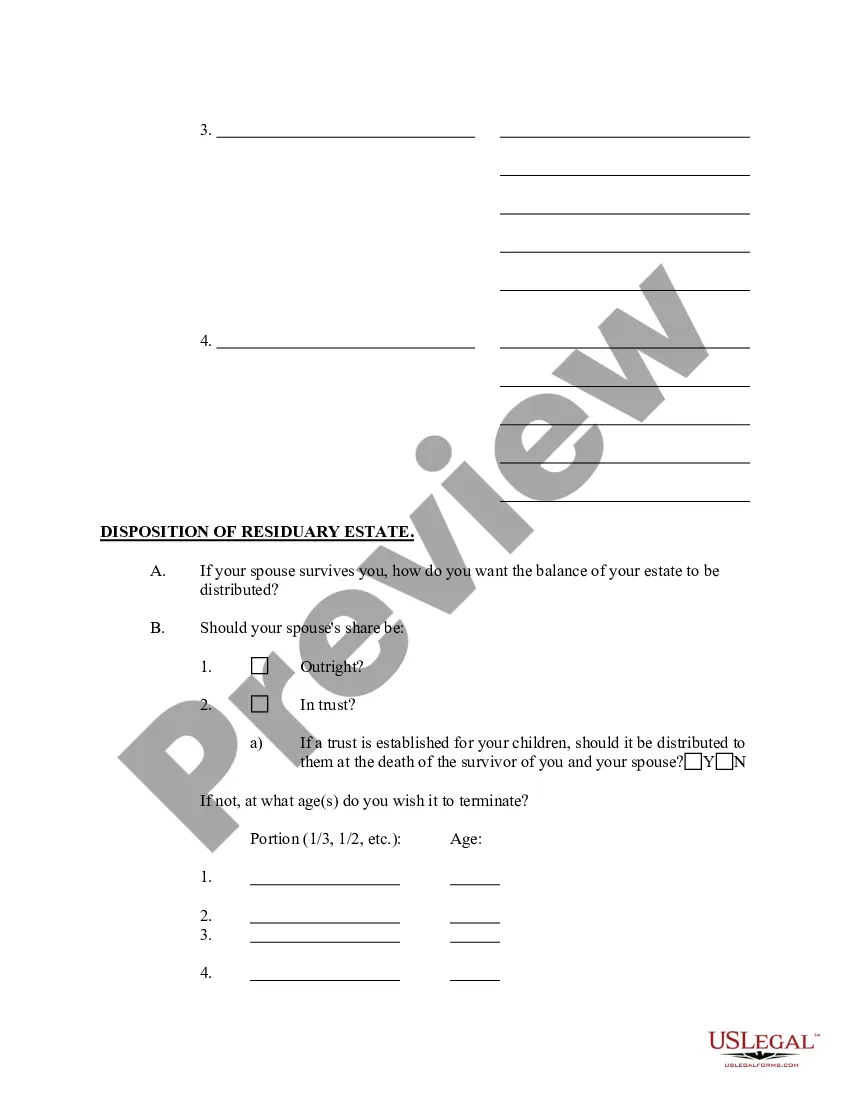

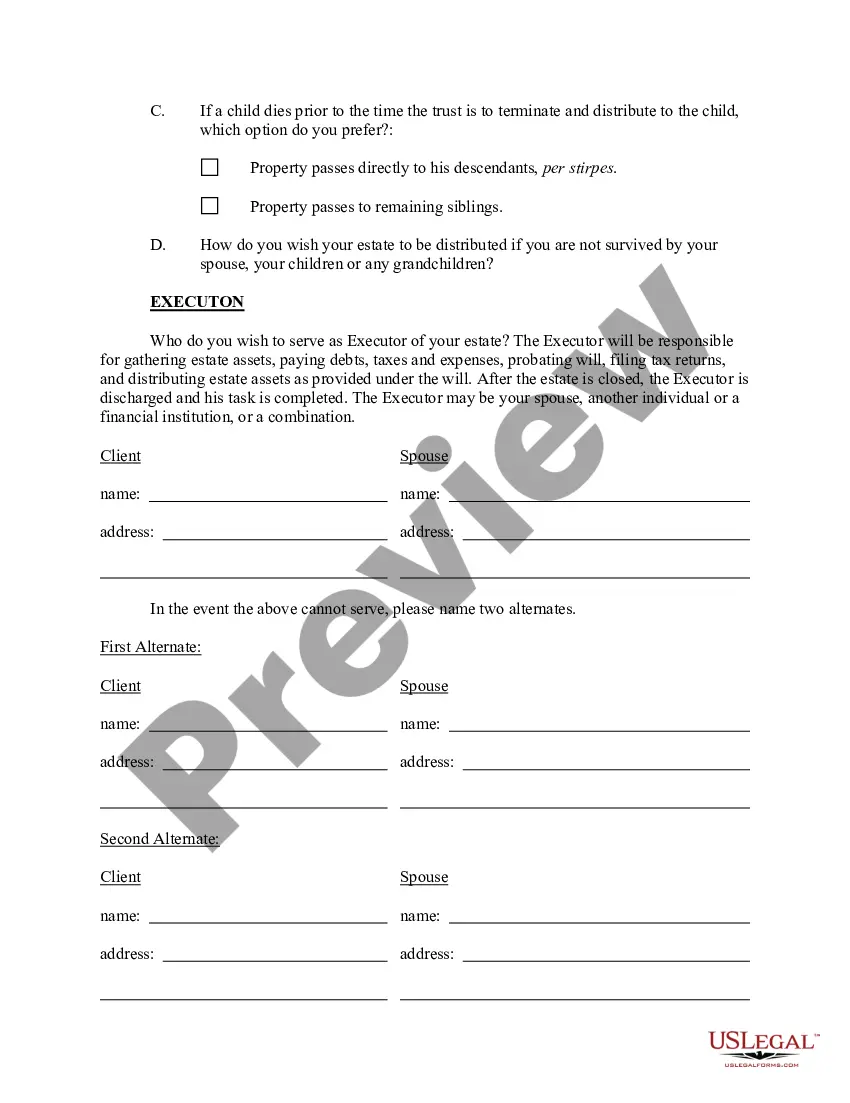

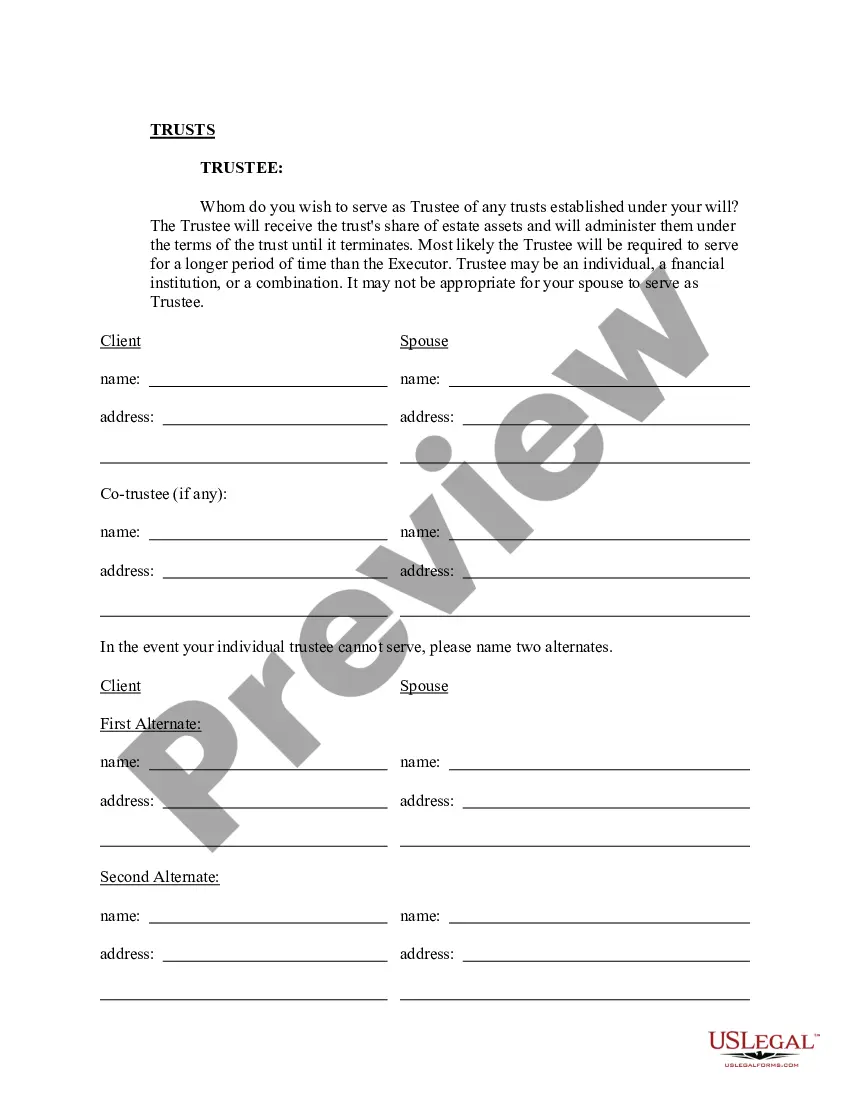

How to fill out Estate Planning Data Sheet?

You can commit time online looking for the legal file design that meets the federal and state specifications you require. US Legal Forms provides a large number of legal kinds that happen to be analyzed by professionals. You can actually download or printing the Massachusetts Estate Planning Data Sheet from the assistance.

If you already possess a US Legal Forms accounts, you can log in and click on the Obtain button. After that, you can full, change, printing, or sign the Massachusetts Estate Planning Data Sheet. Every legal file design you purchase is yours permanently. To have one more backup associated with a acquired form, visit the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms site initially, keep to the basic recommendations listed below:

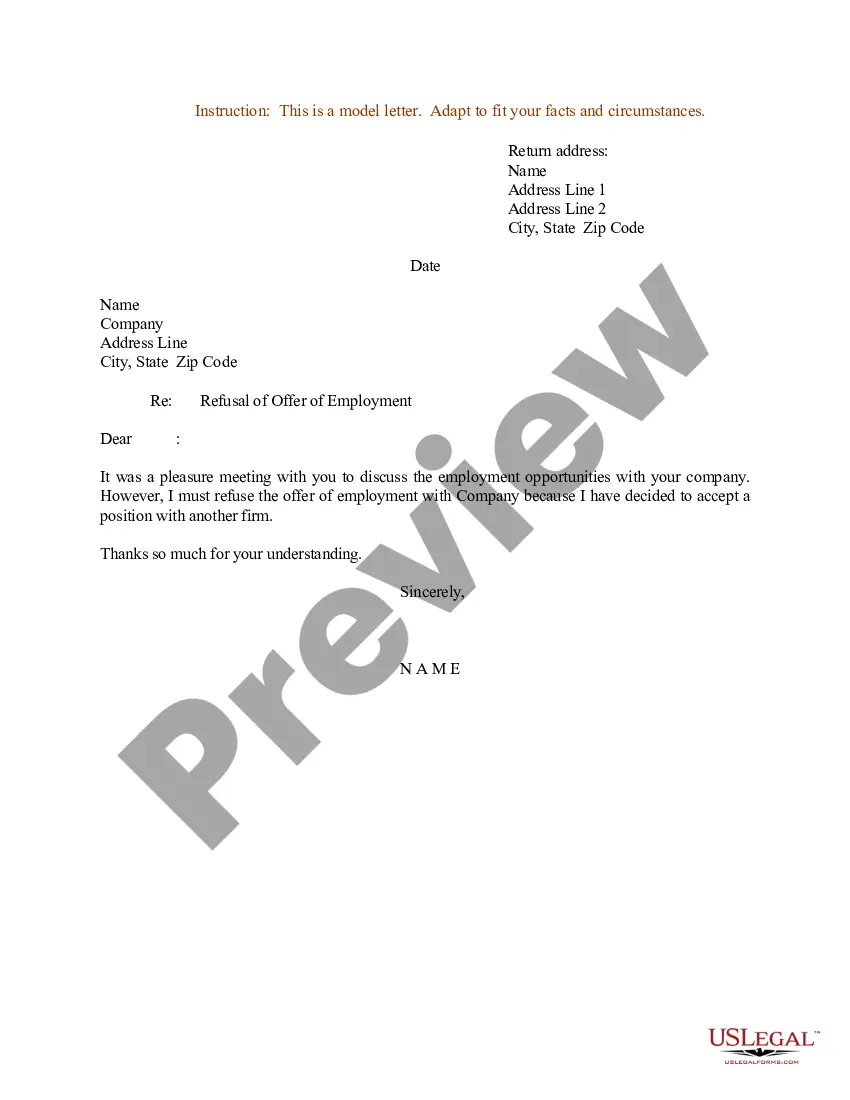

- Very first, be sure that you have chosen the best file design for the region/metropolis that you pick. See the form outline to ensure you have picked out the appropriate form. If accessible, make use of the Review button to look with the file design at the same time.

- If you would like get one more model of the form, make use of the Search industry to get the design that meets your needs and specifications.

- When you have located the design you want, click Acquire now to proceed.

- Select the rates strategy you want, type your accreditations, and sign up for your account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal accounts to cover the legal form.

- Select the structure of the file and download it in your system.

- Make adjustments in your file if needed. You can full, change and sign and printing Massachusetts Estate Planning Data Sheet.

Obtain and printing a large number of file web templates making use of the US Legal Forms Internet site, which offers the biggest collection of legal kinds. Use specialist and express-distinct web templates to handle your organization or person needs.

Form popularity

FAQ

?Generally, if you're married and have no children from another relationship, your assets will go to your surviving spouse. If there's no spouse or children, the distribution proceeds to your closest family members, starting with your parents, then siblings or their descendants.

Is there a deadline to probate an estate? The general rule is that an estate has to be probated within 3 years of when the decedent died. However, this deadline doesn't apply to: A voluntary administration. Find out when it's necessary to probate an estate - Mass.gov mass.gov ? info-details ? find-out-when-its-... mass.gov ? info-details ? find-out-when-its-...

In other words, Massachusetts law actually prohibits a person from completely disinheriting a spouse. Elective share cases in Massachusetts are governed by G.L.C. 191, § 15.

The Spousal Share is determined based on various factors, including the presence of children and other relatives: Spousal Share with Children: If you and your spouse have children together, the Spousal Share consists of the first $25,000 in assets and a life interest or life estate in 1/3 of the remaining assets.

$25,000 Massachusetts does not have what's known as an Affidavit procedure for small estates, but they do have a summary probate procedure. An estate value must be less than $25,000 and have no real property to qualify. Probate Fees in Massachusetts [Updated 2021] | Trust & Will trustandwill.com ? learn ? massachusetts-probate-f... trustandwill.com ? learn ? massachusetts-probate-f...

Distribution of Assets if You Are Married with Children If you die without a will, your spouse inherits 100% of the remaining assets. However, over time, circumstances can change. Your spouse may remarry and have more children, potentially leaving your original children without the legacy you intended. Inheritance without a will in Massachusetts - slnlaw slnlaw.com ? inheritance-without-a-will slnlaw.com ? inheritance-without-a-will

Ing to MA Intestate Succession Laws, the spouse receives the first $200k of the estate and then 2/3 of remaining assets. The rest is inherited by the parents. For example, let's assume an estate is worth $800k. A surviving spouse would receive $200k and $400k (2/3 of $600k).

$1 million In Massachusetts, estates must file an estate tax return if the estate value is over $1 million. This tax will also apply to the entire estate value, not just the portion above the million-dollar mark. In addition to this rule, only the value over $40,000 will be subjected to the tax. Understanding the Basics of the Massachusetts Estate Tax boydandboydpc.com ? basics-massachusetts... boydandboydpc.com ? basics-massachusetts...