Massachusetts Blind Trust Agreement

Description

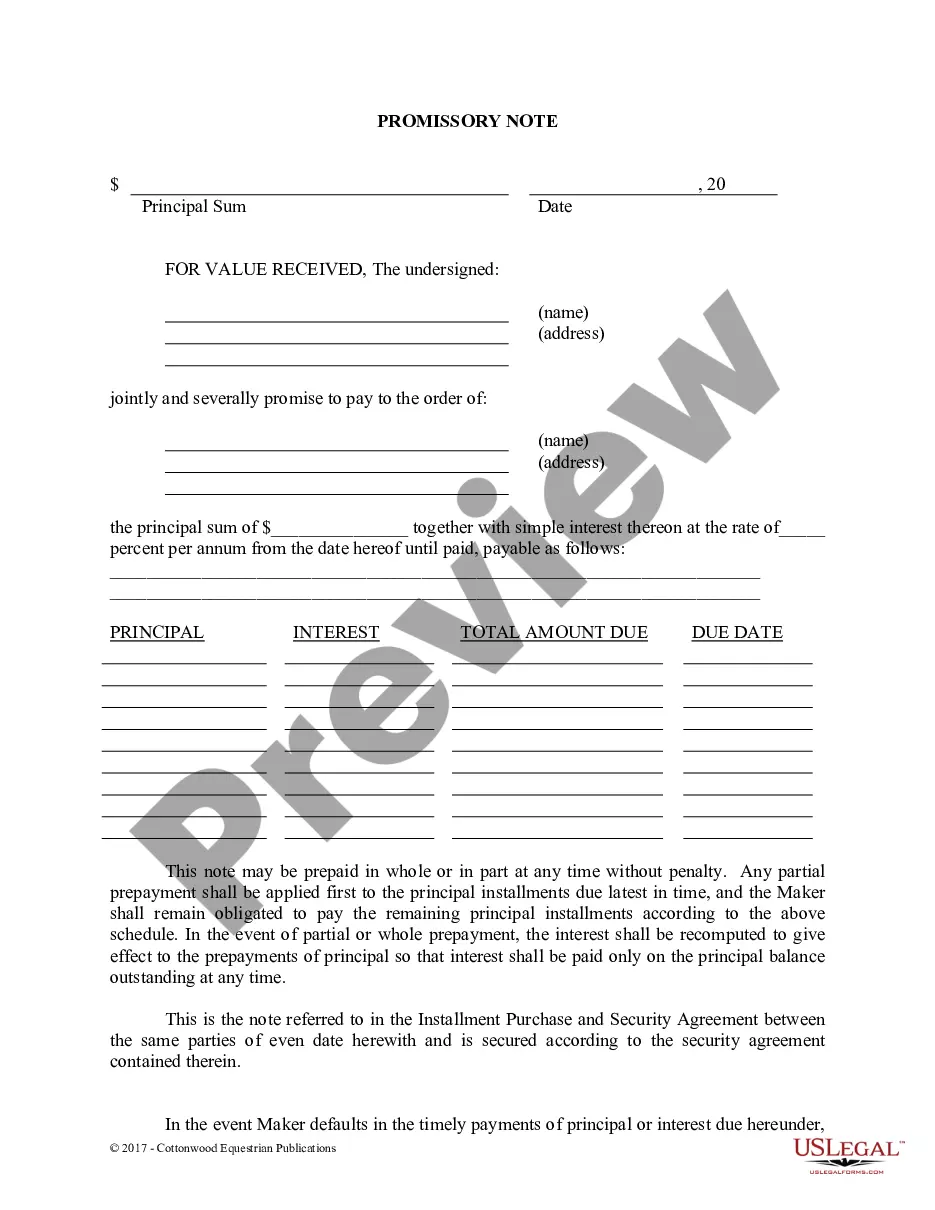

How to fill out Blind Trust Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can locate the latest versions of forms such as the Massachusetts Blind Trust Agreement within moments.

If you have an account, Log In and download the Massachusetts Blind Trust Agreement from the US Legal Forms library. The Download button will appear on every form you view.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the downloaded Massachusetts Blind Trust Agreement.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the appropriate form for your locality/county. Click on the Preview button to review the content of the form.

- Check the form description to confirm that you have chosen the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose your preferred payment plan and provide your details to sign up for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

To form a blind trust in Massachusetts, you will need to draft a Massachusetts Blind Trust Agreement. This document outlines the management of your assets without your direct involvement, ensuring your financial decisions do not conflict with your interests. Typically, it's best to consult an attorney who specializes in trust and estate planning to ensure compliance with Massachusetts laws. Additionally, using a reliable platform like US Legal Forms can simplify the process by providing templates and resources specifically tailored for creating a blind trust.

Setting up a blind trust involves selecting a trustworthy trustee to manage the assets on your behalf. First, you need to draft a Massachusetts Blind Trust Agreement that spells out the terms of the trust and the powers granted to the trustee. Lastly, funding the trust with assets will complete the process, and tools like USLegalForms can offer templates and guidance tailored to your needs.

A blind trust is created by drafting a legal document that outlines the trust's terms and conditions, including the management of assets. In Massachusetts, a Massachusetts Blind Trust Agreement must comply with specific state laws to be valid. Utilizing services like USLegalForms can simplify this process, providing you with reliable resources to ensure your trust is properly set up.

Blind trusts can limit your control and visibility over your assets. This lack of oversight may cause concern for individuals who prefer to manage their investments actively. Additionally, the initial setup of a Massachusetts Blind Trust Agreement can be complex and may involve legal fees, making it essential to weigh these factors against the benefits.

Yes, you can write your own trust in Massachusetts. However, creating an effective Massachusetts Blind Trust Agreement requires careful planning to meet legal standards and ensure your intentions are clearly expressed. It is wise to consider consulting with a legal expert or using platforms like USLegalForms, which provide templates and guidance for drafting your trust.

Establishing a Massachusetts Blind Trust Agreement begins with careful planning and consultation with a legal advisor experienced in trusts. They will guide you in creating a document that defines the trust's terms, asset management, and trustee responsibilities. Once the agreement is finalized, you can set up the trust fund by transferring your assets to it. This process ensures that your financial interests remain separate from your personal decision-making.

To start a Massachusetts Blind Trust Agreement, first, consult with a qualified attorney who specializes in trust law. This expert will help you understand the legal requirements and assist in drafting the agreement to ensure compliance with Massachusetts laws. After drafting, you should choose a trustee to manage the assets impartially. Finally, fund the trust by transferring the assets you wish to include.

Trusts are not inherently bad, but there are misconceptions surrounding them. Some people view a Massachusetts Blind Trust Agreement as a way to hide assets or avoid taxes. However, when properly used, trusts can be a strategic tool for estate planning, helping to protect assets and ensure financial security for beneficiaries.

Trust funds can sometimes create family tension or misunderstandings, particularly if beneficiaries do not clearly understand the terms. With a Massachusetts Blind Trust Agreement, family members might feel excluded from decisions, which may lead to conflict. It is essential to maintain open communication and transparency to mitigate these potential issues.

The primary downside of placing assets in a trust can be the initial setup time and costs involved. A Massachusetts Blind Trust Agreement may require legal assistance to ensure proper structuring that meets specific goals. Moreover, once assets are placed in a trust, the granter loses direct control, which might not suit everyone’s comfort level.