This form is a type of asset-financing arrangement in which a company uses its receivables (money owed by customers) as collateral in a financing agreement. The company receives an amount that is equal to a reduced value of the receivables pledged. The age of the receivables have a large effect on the amount a company will receive. The older the receivables, the less the company can expect.

This type of financing helps companies free up capital that is stuck in accounts receivables. Accounts receivable financing transfers the default risk associated with the accounts receivables to the financing company. This transfer of risk can help the company using the financing to shift focus from trying to collect receivables to current business activities.

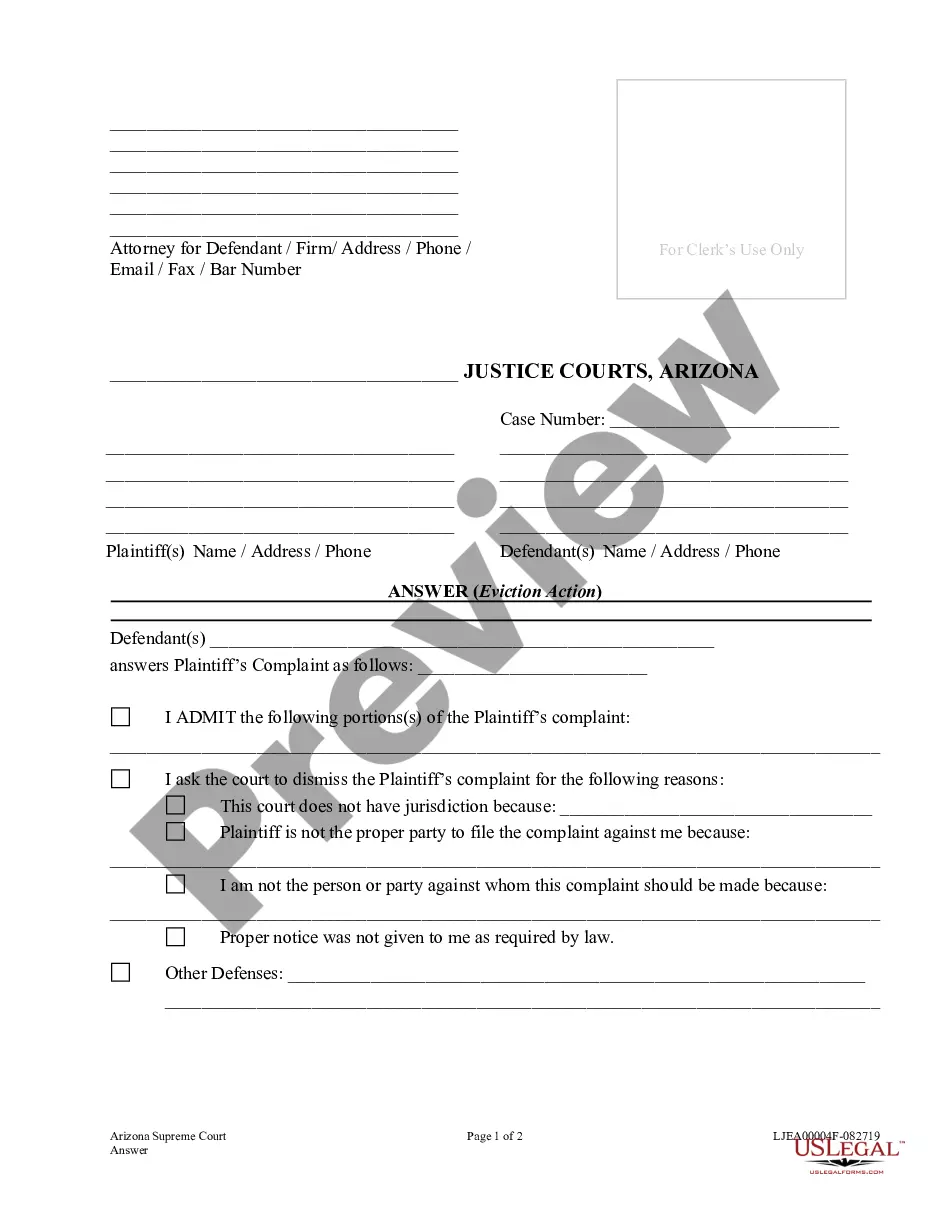

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Massachusetts Financing Agreement between a Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles is a legally binding contract that outlines the terms and conditions of a financial arrangement between a dealer and a credit corporation. In this type of agreement, the dealer obtains financing from the credit corporation to support their wholesale operations. The agreement establishes a security interest in the dealer's accounts and general intangibles to secure the credit corporation's interest in the event of default or non-payment by the dealer. This financing agreement is designed specifically for wholesale financing transactions in Massachusetts and may vary depending on the nature of the business, the parties involved, and other specific circumstances. Here are some different types of financing agreements that fall under this category: 1. Dealer Financing Agreement: This type of financing agreement is commonly used when a dealer needs capital to purchase inventory or support their wholesale operations. The credit corporation provides the dealer with a line of credit or a loan, which is secured by the dealer's accounts and general intangibles. 2. Floor Plan Financing Agreement: This agreement is typically used in industries like automotive, recreational vehicles, or manufactured homes, where dealers need financing to purchase and maintain inventory. The credit corporation provides a revolving line of credit, allowing the dealer to continually replenish their inventory by replacing sold units with new ones. 3. Dealer Inventory Financing Agreement: This agreement focuses solely on financing the dealer's inventory and can be used in various industries. The credit corporation provides a specific amount of funds to the dealer, which is secured by the accounts and general intangibles related to the inventory. 4. Wholesale Financing Agreement: In this type of agreement, the credit corporation provides financing to support the dealer's wholesale transactions. The funds may be used to purchase goods for resale or to cover operational expenses related to the wholesale business. The dealer's accounts and general intangibles serve as collateral for the financing. The Massachusetts Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles outlines essential terms and provisions, including the loan amount, interest rate, payment terms, default and remedy provisions, and the rights and responsibilities of both parties. It also specifies the procedure for handling accounts and general intangibles in the event of default or non-payment. Keywords: Massachusetts, financing agreement, dealer, credit corporation, wholesale financing, security interest, accounts, general intangibles, dealer financing, floor plan financing, dealer inventory financing, wholesale financing, loan, line of credit, collateral, default, remedies, terms and conditions.