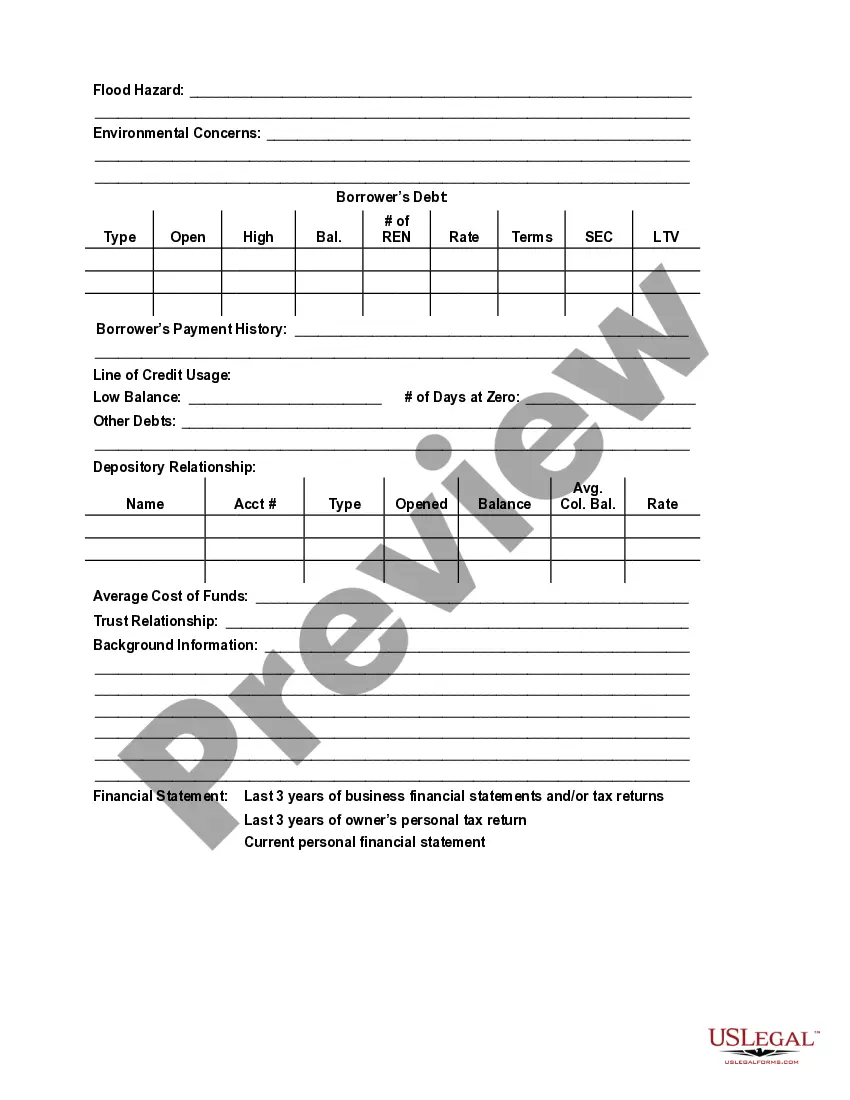

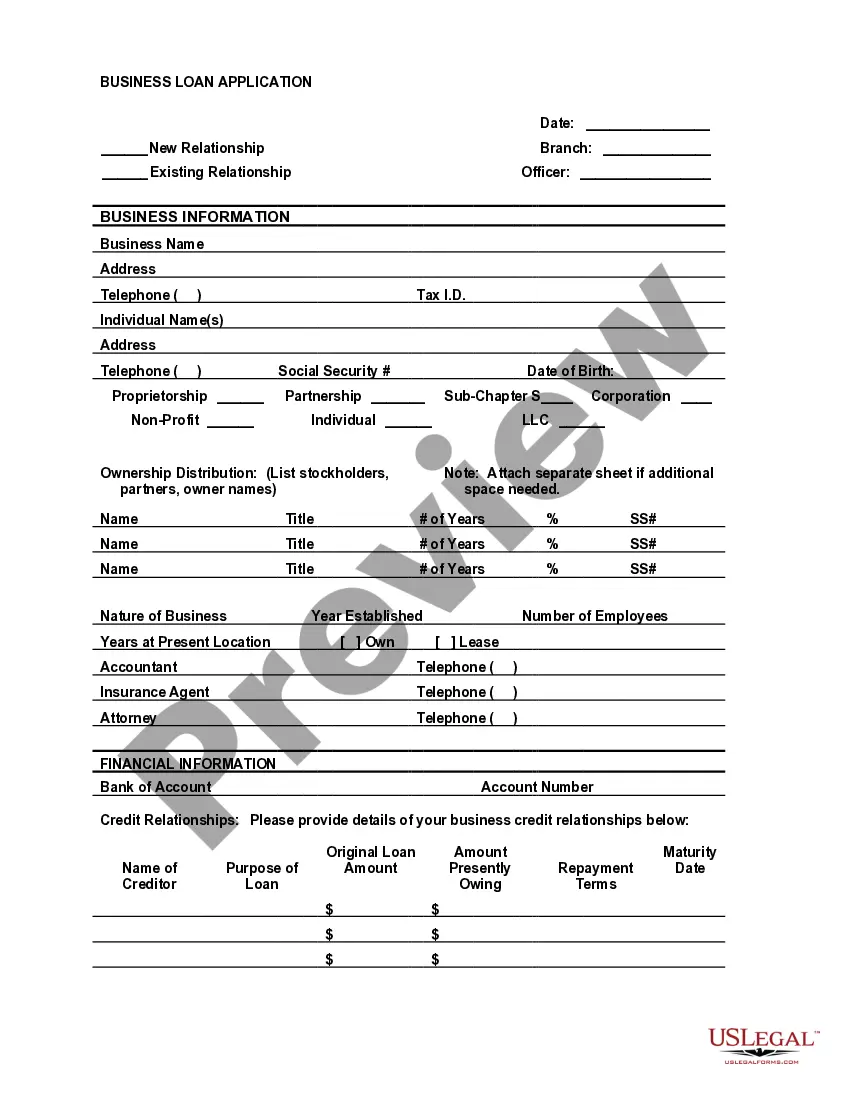

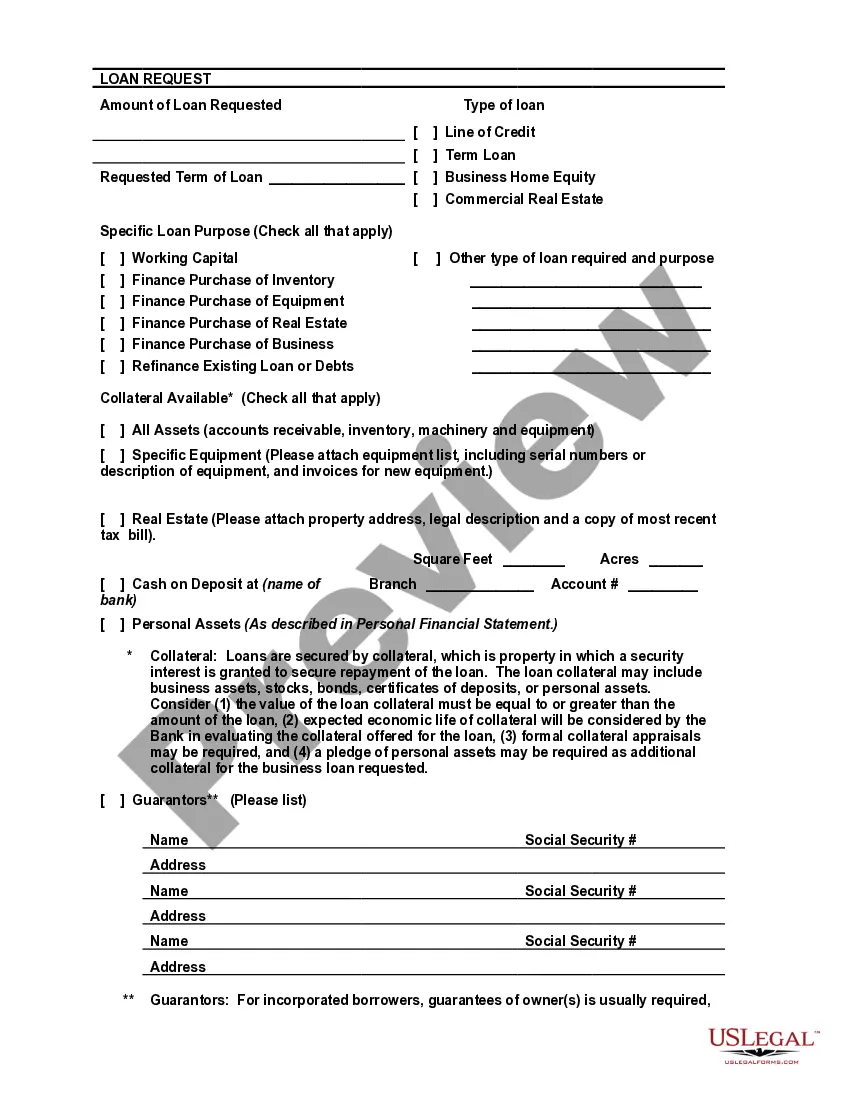

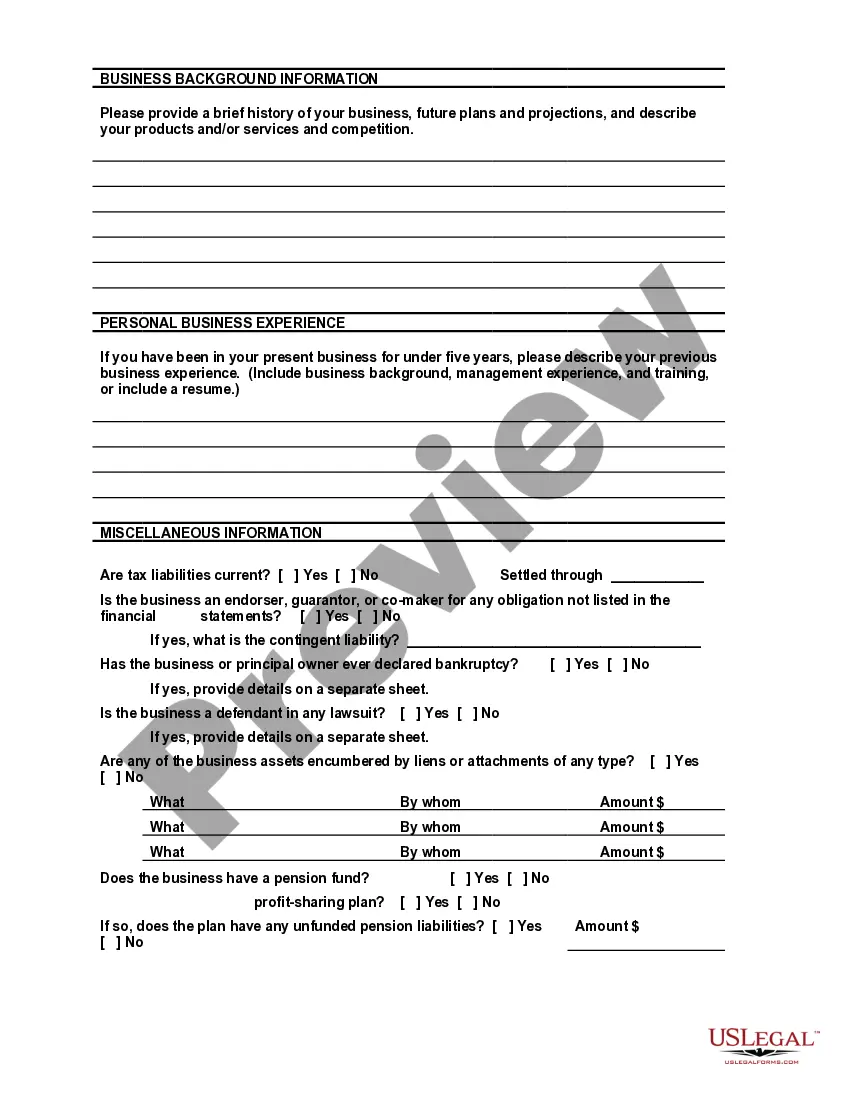

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

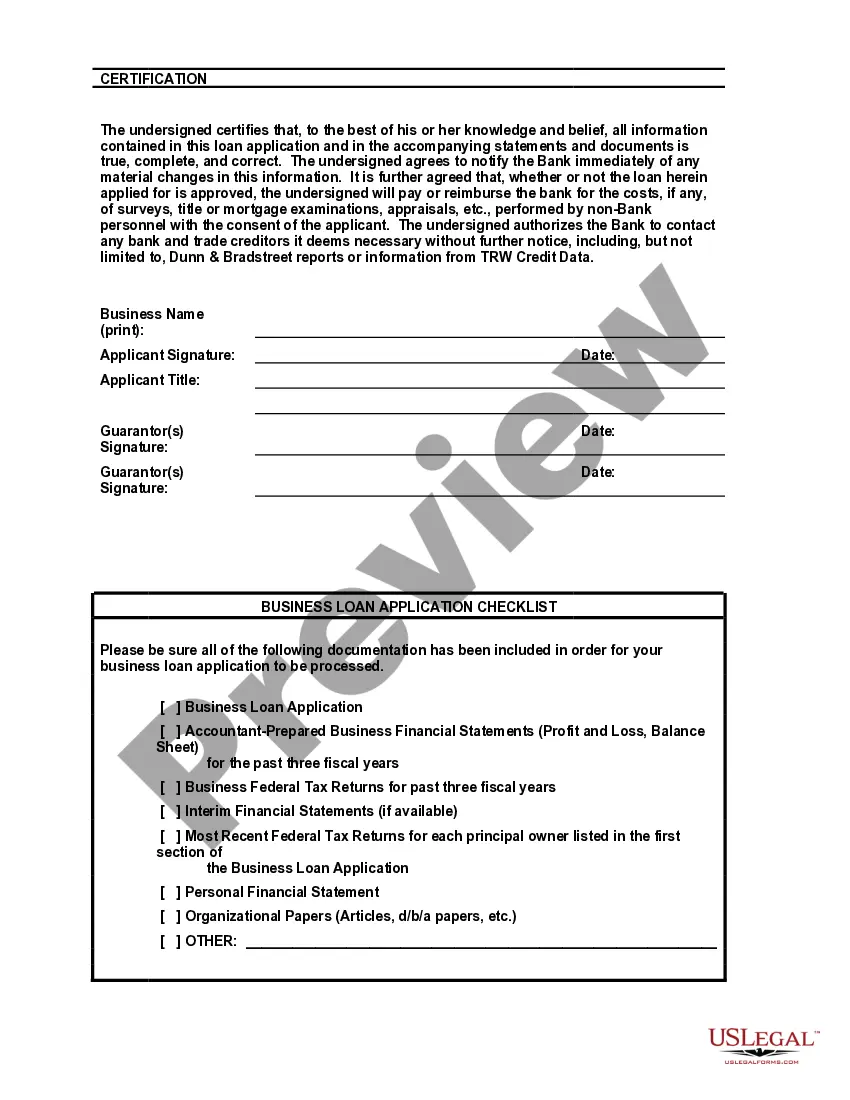

Massachusetts Bank Loan Application Form and Checklist — Business Loan The Massachusetts Bank Loan Application Form and Checklist for Business Loans is a crucial document used by individuals and businesses to apply for loans from banks operating in Massachusetts. This comprehensive and standardized form ensures that all necessary information is provided, making the loan application process smoother for both the borrower and the lending institution. The application form and checklist include vital sections that cover different aspects of the loan application process. The Massachusetts Bank Loan Application Form collects essential information from the applicant, such as personal and contact details, business information, financial statements, credit history, and collateral details. This comprehensive form aims to provide banks with a complete overview of the applicant's financial standing, business operations, and creditworthiness. The application form often comes with a checklist to assist applicants in organizing and submitting all required documents. This checklist may vary slightly depending on the type of business loan applicants are seeking. Different types of Massachusetts Bank Loan Application Form and Checklist — Business Loan include: 1. Start-up Business Loan Application Form and Checklist: Specifically tailored for entrepreneurs seeking loans to establish a new business venture. This form focuses on evaluating the feasibility of the business model, market research, and projected financial statements. 2. Small Business Loan Application Form and Checklist: Designed for small businesses looking for financial assistance to expand their operations or address working capital needs. This form emphasizes historical financial performance, growth plans, and additional collateral, if any. 3. Equipment Financing Loan Application Form and Checklist: Geared towards businesses requiring funding to purchase or lease equipment. This form concentrates on providing details about the equipment, its intended use, and its expected economic impact on the business. 4. Commercial Real Estate Loan Application Form and Checklist: Aimed at businesses seeking loans for purchasing or refinancing commercial properties. This form focuses on property details, appraisals, environmental assessments, and cash flow projections related to the real estate investment. 5. Working Capital Loan Application Form and Checklist: Catering to businesses looking for short-term funds to manage day-to-day operations, such as inventory purchases or payroll expenses. This form underscores cash flow, accounts receivable/payable, and financial ratios. It is important for loan applicants to carefully review and complete the specific Massachusetts Bank Loan Application Form and Checklist that corresponds to their desired loan type. By ensuring the accurate completion of the application form and providing all necessary documents, applicants increase their chances of securing financing from Massachusetts banks for their business endeavors.Massachusetts Bank Loan Application Form and Checklist — Business Loan The Massachusetts Bank Loan Application Form and Checklist for Business Loans is a crucial document used by individuals and businesses to apply for loans from banks operating in Massachusetts. This comprehensive and standardized form ensures that all necessary information is provided, making the loan application process smoother for both the borrower and the lending institution. The application form and checklist include vital sections that cover different aspects of the loan application process. The Massachusetts Bank Loan Application Form collects essential information from the applicant, such as personal and contact details, business information, financial statements, credit history, and collateral details. This comprehensive form aims to provide banks with a complete overview of the applicant's financial standing, business operations, and creditworthiness. The application form often comes with a checklist to assist applicants in organizing and submitting all required documents. This checklist may vary slightly depending on the type of business loan applicants are seeking. Different types of Massachusetts Bank Loan Application Form and Checklist — Business Loan include: 1. Start-up Business Loan Application Form and Checklist: Specifically tailored for entrepreneurs seeking loans to establish a new business venture. This form focuses on evaluating the feasibility of the business model, market research, and projected financial statements. 2. Small Business Loan Application Form and Checklist: Designed for small businesses looking for financial assistance to expand their operations or address working capital needs. This form emphasizes historical financial performance, growth plans, and additional collateral, if any. 3. Equipment Financing Loan Application Form and Checklist: Geared towards businesses requiring funding to purchase or lease equipment. This form concentrates on providing details about the equipment, its intended use, and its expected economic impact on the business. 4. Commercial Real Estate Loan Application Form and Checklist: Aimed at businesses seeking loans for purchasing or refinancing commercial properties. This form focuses on property details, appraisals, environmental assessments, and cash flow projections related to the real estate investment. 5. Working Capital Loan Application Form and Checklist: Catering to businesses looking for short-term funds to manage day-to-day operations, such as inventory purchases or payroll expenses. This form underscores cash flow, accounts receivable/payable, and financial ratios. It is important for loan applicants to carefully review and complete the specific Massachusetts Bank Loan Application Form and Checklist that corresponds to their desired loan type. By ensuring the accurate completion of the application form and providing all necessary documents, applicants increase their chances of securing financing from Massachusetts banks for their business endeavors.