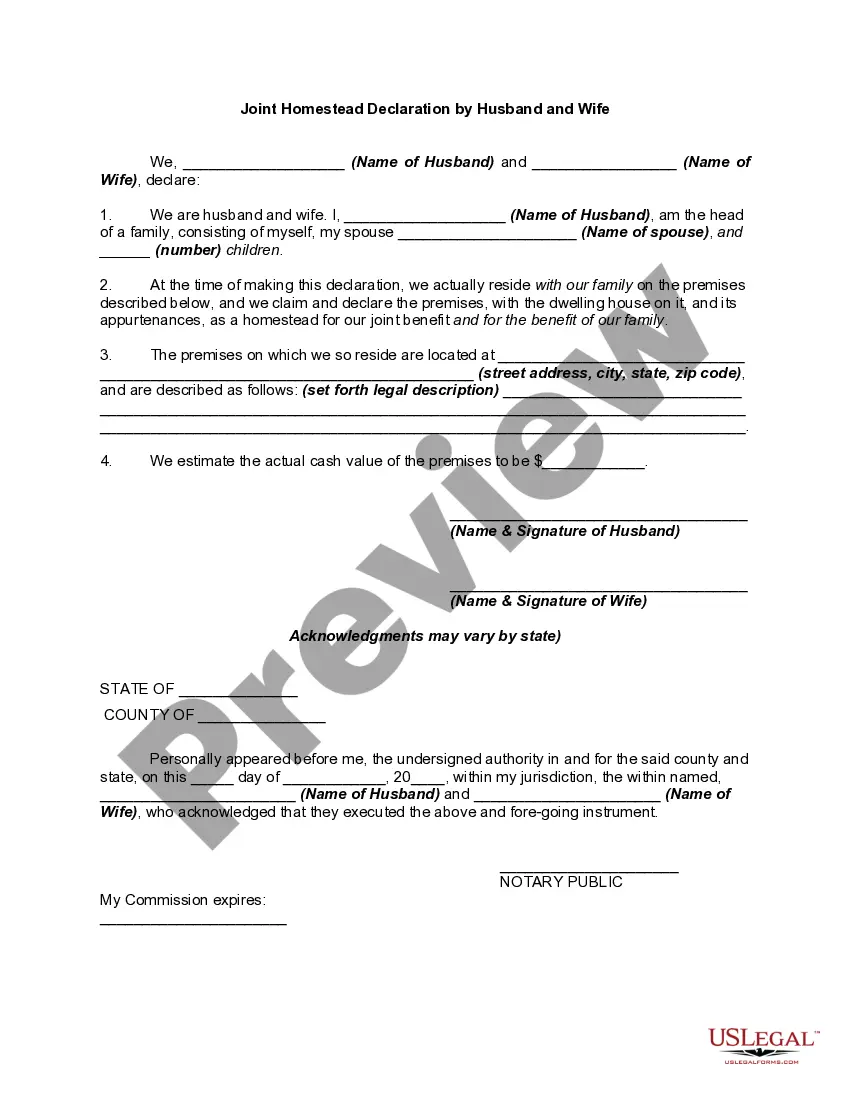

Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

The Massachusetts Joint Homestead Declaration by Husband and Wife is a legal document that provides homeowners with protection against the forced sale of their primary residence to satisfy creditors' claims. This declaration is available to married couples who own and occupy their home as their principal place of residence in Massachusetts. By filing a Joint Homestead Declaration, spouses can assert their rights as owners and protect their property from certain types of debts and creditors. This protection applies to both current and future debts, ensuring that homeowners have a secure place to live despite financial difficulties. The Massachusetts Joint Homestead Declaration grants a limited exemption to homeowners, which is determined by the type of creditor. For general unsecured debts, such as credit card bills or medical expenses, the exemption amount is $125,000 per spouse. This means that creditors cannot force the sale of the residence to recover these types of debts. However, it's important to note that this exemption does not apply to mortgage debt, real estate taxes, or certain other specific exemptions outlined in Massachusetts law. It is crucial to understand that the Joint Homestead Declaration does not provide complete protection from all types of claims. In certain circumstances, such as claims from the Department of Revenue or claims arising from a mortgage refinance, the exemption provided by the declaration may not be applicable. Furthermore, filing for bankruptcy may also impact the effectiveness of the Joint Homestead Declaration. There are different variations of the Massachusetts Joint Homestead Declaration by Husband and Wife, depending on the situation of the homeowners. These include: 1. Automatic Homestead: This is the default homestead protection granted to homeowners in Massachusetts. It provides a $125,000 exemption per spouse without the need for filing a formal declaration. However, it is highly recommended filing a formal declaration to increase the protection to $500,000. 2. Voluntary Homestead: Homeowners who wish to enhance their protection can file a Voluntary Homestead Declaration. This allows them to claim an exemption of up to $500,000 per spouse, shielding their property from various types of creditors and debts. 3. Elderly or Disabled Homestead: Massachusetts law provides additional protection for homeowners who are 62 years or older, or who have a disability as defined by law. This variation allows for an increased exemption of up to $500,000 for qualifying individuals or married couples. In conclusion, the Massachusetts Joint Homestead Declaration by Husband and Wife is a vital legal instrument for homeowners to safeguard their primary residence from creditors. Understanding the different types of declarations available and their limitations is essential to ensure maximum protection under Massachusetts law.The Massachusetts Joint Homestead Declaration by Husband and Wife is a legal document that provides homeowners with protection against the forced sale of their primary residence to satisfy creditors' claims. This declaration is available to married couples who own and occupy their home as their principal place of residence in Massachusetts. By filing a Joint Homestead Declaration, spouses can assert their rights as owners and protect their property from certain types of debts and creditors. This protection applies to both current and future debts, ensuring that homeowners have a secure place to live despite financial difficulties. The Massachusetts Joint Homestead Declaration grants a limited exemption to homeowners, which is determined by the type of creditor. For general unsecured debts, such as credit card bills or medical expenses, the exemption amount is $125,000 per spouse. This means that creditors cannot force the sale of the residence to recover these types of debts. However, it's important to note that this exemption does not apply to mortgage debt, real estate taxes, or certain other specific exemptions outlined in Massachusetts law. It is crucial to understand that the Joint Homestead Declaration does not provide complete protection from all types of claims. In certain circumstances, such as claims from the Department of Revenue or claims arising from a mortgage refinance, the exemption provided by the declaration may not be applicable. Furthermore, filing for bankruptcy may also impact the effectiveness of the Joint Homestead Declaration. There are different variations of the Massachusetts Joint Homestead Declaration by Husband and Wife, depending on the situation of the homeowners. These include: 1. Automatic Homestead: This is the default homestead protection granted to homeowners in Massachusetts. It provides a $125,000 exemption per spouse without the need for filing a formal declaration. However, it is highly recommended filing a formal declaration to increase the protection to $500,000. 2. Voluntary Homestead: Homeowners who wish to enhance their protection can file a Voluntary Homestead Declaration. This allows them to claim an exemption of up to $500,000 per spouse, shielding their property from various types of creditors and debts. 3. Elderly or Disabled Homestead: Massachusetts law provides additional protection for homeowners who are 62 years or older, or who have a disability as defined by law. This variation allows for an increased exemption of up to $500,000 for qualifying individuals or married couples. In conclusion, the Massachusetts Joint Homestead Declaration by Husband and Wife is a vital legal instrument for homeowners to safeguard their primary residence from creditors. Understanding the different types of declarations available and their limitations is essential to ensure maximum protection under Massachusetts law.