Massachusetts Checklist — Action to Improve Collection of Accounts: A Detailed Description The Massachusetts Checklist — Action to Improve Collection of Accounts is a comprehensive guide that provides individuals and businesses with a step-by-step approach to enhance the collection of accounts receivable and ensure a smooth cash flow. This checklist is specifically designed to help businesses in Massachusetts, but its principles and strategies can also be applied in other locations. The checklist starts by outlining the importance of having a well-defined credit policy in place to effectively manage accounts and minimize bad debt. It emphasizes the need to conduct thorough credit checks on customers, establish clear payment terms and conditions, and communicate them consistently. Once the foundation is set, the checklist moves on to discuss various actions that can be taken to improve the collection of accounts. It suggests implementing efficient invoicing practices, ensuring the accuracy and clarity of invoices, and promptly sending them to customers. Clear and concise statements are recommended to avoid confusion and discrepancies. The checklist also advises businesses to establish a reliable accounts receivable management system. This system should include regular monitoring of outstanding payments, promptly identifying overdue accounts, and creating a systematic process for follow-up communication with customers. It also suggests setting up reminders for invoice due dates and utilizing automated payment reminders. To optimize collection efforts, the Massachusetts Checklist suggests offering various payment options to customers, such as credit cards, online payments, or installment plans. It emphasizes the importance of timely follow-ups, urging businesses to proactively reach out to customers with overdue accounts via phone, email, or mailed reminders. Furthermore, the checklist highlights the significance of maintaining accurate and up-to-date records of all financial transactions. It recommends keeping meticulous track of payment receipts, contact information, and any correspondence related to outstanding accounts. Regular reconciliation of accounts and conducting periodic reviews of collection strategies are also advised. Different Types of Massachusetts Checklists — Action to Improve Collection of Accounts: 1. For small businesses: This checklist caters specifically to the needs and challenges faced by small businesses operating in Massachusetts. It provides tailored strategies and tips to suit the unique characteristics of smaller enterprises. 2. For large corporations: Geared towards larger corporations and established businesses, this checklist focuses on more complex collection processes and offers advanced strategies to handle a higher volume of accounts receivable effectively. 3. For nonprofit organizations: Nonprofit organizations often have specific considerations when it comes to account collection. This checklist provides guidance relevant to the nonprofit sector, including tips on navigating financial challenges and managing donor accounts. In conclusion, the Massachusetts Checklist — Action to Improve Collection of Accounts is a valuable resource for individuals and businesses seeking to optimize their accounts receivable management strategies. By following the comprehensive step-by-step guidelines and implementing the suggested actions, organizations can enhance their collection processes, mitigate risks, and ensure a consistent cash flow.

Massachusetts Checklist - Action to Improve Collection of Accounts

Description

How to fill out Massachusetts Checklist - Action To Improve Collection Of Accounts?

Are you presently inside a situation in which you require paperwork for both business or specific purposes just about every day? There are a lot of authorized file templates accessible on the Internet, but locating kinds you can trust isn`t easy. US Legal Forms gives a huge number of type templates, much like the Massachusetts Checklist - Action to Improve Collection of Accounts, that are written to satisfy federal and state requirements.

When you are presently knowledgeable about US Legal Forms internet site and get your account, simply log in. After that, you may download the Massachusetts Checklist - Action to Improve Collection of Accounts format.

Unless you come with an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for the right area/state.

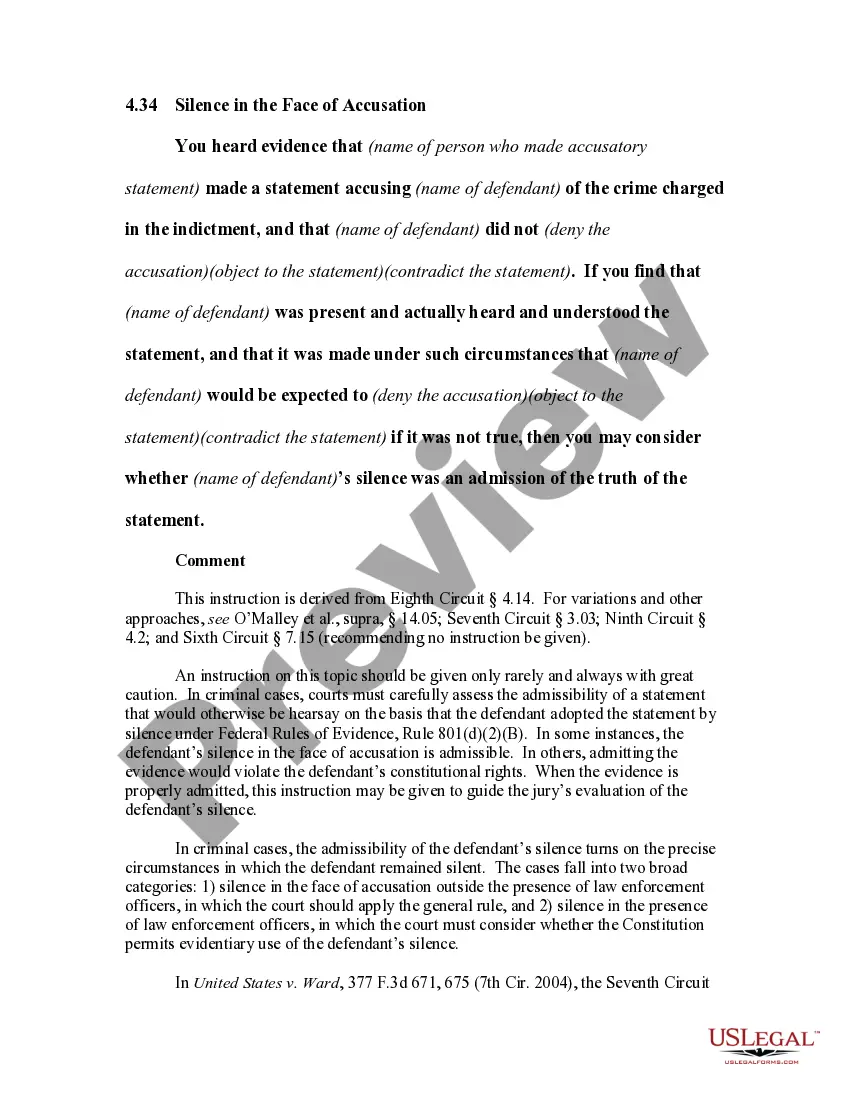

- Utilize the Review button to examine the form.

- Read the description to actually have selected the right type.

- If the type isn`t what you are looking for, make use of the Look for field to obtain the type that meets your requirements and requirements.

- When you obtain the right type, click on Acquire now.

- Choose the costs strategy you need, fill out the required info to generate your account, and pay for an order making use of your PayPal or charge card.

- Select a handy document formatting and download your duplicate.

Get all of the file templates you might have purchased in the My Forms food list. You may get a additional duplicate of Massachusetts Checklist - Action to Improve Collection of Accounts anytime, if necessary. Just select the necessary type to download or print out the file format.

Use US Legal Forms, by far the most considerable assortment of authorized types, in order to save some time and stay away from faults. The service gives appropriately produced authorized file templates that can be used for an array of purposes. Make your account on US Legal Forms and begin producing your lifestyle easier.