This form may be used to collect information necessary for the preparation of the most common forms of material contracts for a business. The term sheet may be used as a guide when conduct client interviews and should also be consulted during the drafting process. The items in the term sheet are also useful when reviewing contracts that may be drafted by other parties.

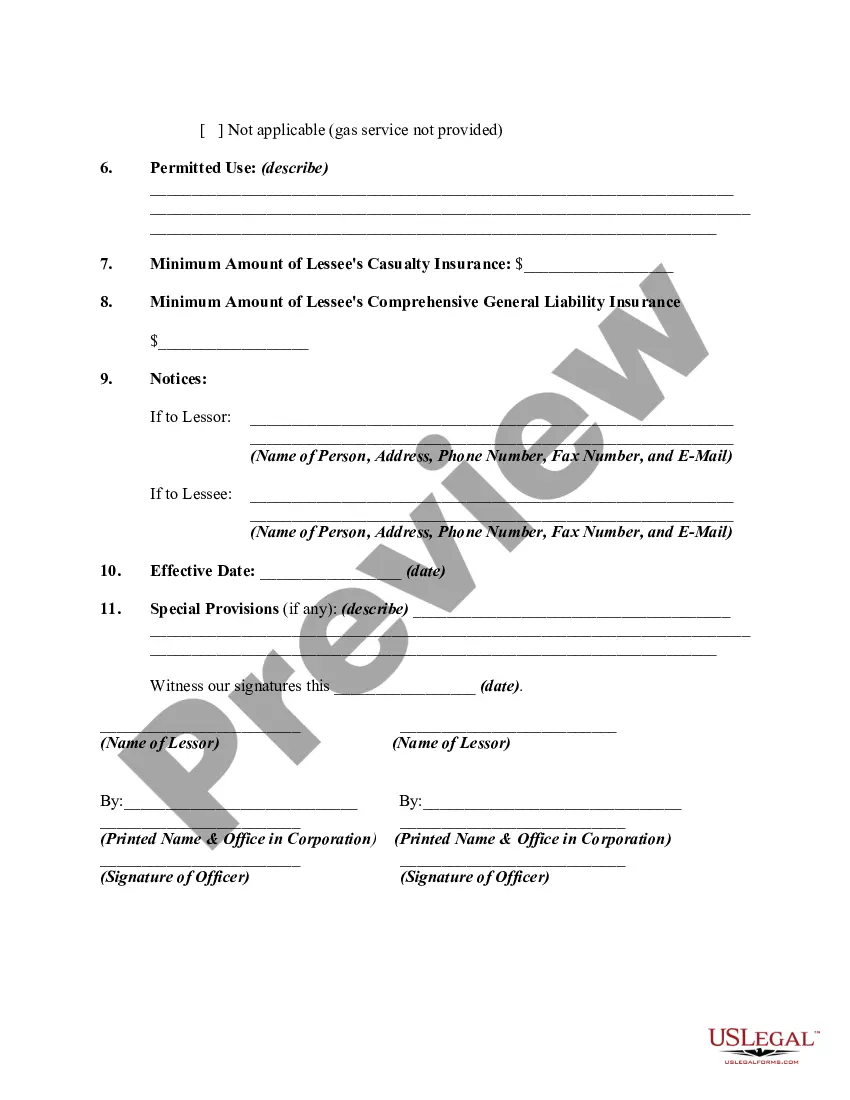

A Massachusetts Terms Sheet for a Commercial Lease Agreement is a document that outlines the key terms and conditions of a lease agreement between a landlord and a tenant in the state of Massachusetts. It acts as a summary or blueprint that precedes the more comprehensive lease agreement. These terms sheet serves as a crucial initial step in the leasing process, allowing both parties to establish a clear understanding of the fundamental aspects of the lease agreement before proceeding to the formal documentation. It acts as a guide and reference point for negotiations and ensures that all parties are on the same page regarding the main terms of the lease. Key elements typically included in a Massachusetts Terms Sheet for a Commercial Lease Agreement are: 1. Tenant Information: Introduction of the tenant, including their legal name, business entity, contact information, and any relevant background details. 2. Property Description: Detailed information about the commercial property being leased, including the address, square footage, floor/room number, and any specific characteristics or amenities. 3. Lease Term: The duration of the lease, specifying the start date, end date, and any options for renewal or extension. 4. Rent: Clearly defined rental structure, including the base rent amount, frequency of payment (monthly, quarterly, etc.), and any possible rent escalations or decreases. 5. Security Deposit: The amount of the security deposit required by the landlord, as well as any provisions regarding its return at the end of the lease term. 6. Common Area Maintenance (CAM) Charges: If applicable, the allocation of maintenance costs for shared spaces and facilities within the commercial property. 7. Tenant Improvements: Any alterations, modifications, or construction required for the tenant's specific use of the space, including who will be responsible for the associated costs and obtaining necessary permits. 8. Insurance and Indemnification: The tenant's obligation to provide adequate insurance coverage and hold the landlord harmless from any liabilities or damages related to the tenant's use of the property. 9. Use Restrictions: Specific details regarding the permissible use of the premises, any restrictions or limitations, and compliance with zoning regulations or building codes. 10. Default and Termination: The conditions under which the lease may be terminated by either party, such as non-payment of rent, violation of terms, or specific default events. It is important to note that various types of commercial lease agreements exist in Massachusetts, each catering to specific types of businesses or industries. Some common variations include: 1. Gross Lease: The tenant pays a fixed rent amount, and the landlord assumes responsibility for expenses such as taxes, insurance, and maintenance. 2. Triple Net Lease: The tenant pays a base rent along with proportionate shares of property taxes, insurance, and maintenance costs. 3. Percentage Lease: Typically used in retail settings, where the tenant pays a base rent plus a percentage of their gross sales. 4. Ground Lease: A long-term lease where the tenant leases the land only, constructing their own building on the property. By using a Massachusetts Terms Sheet for a Commercial Lease Agreement, landlords and tenants can establish a strong foundation for lease negotiations, ensuring that crucial elements are addressed and facilitating a smoother leasing process.