28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

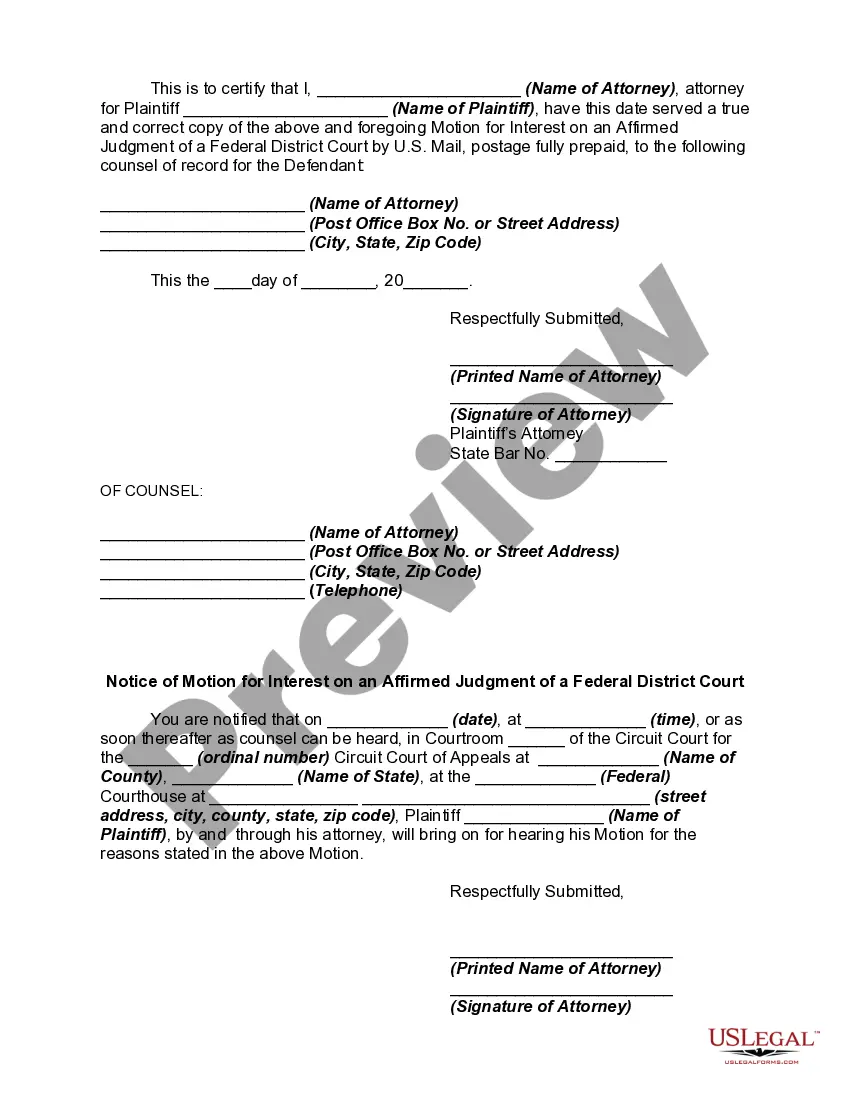

Massachusetts Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

Are you currently inside a placement that you need to have paperwork for possibly enterprise or personal uses virtually every day time? There are plenty of legitimate papers themes available online, but discovering kinds you can trust isn`t effortless. US Legal Forms delivers a huge number of develop themes, like the Massachusetts Motion for Interest on an Affirmed Judgment of a Federal District Court, that happen to be created to meet federal and state specifications.

Should you be currently acquainted with US Legal Forms website and also have a free account, merely log in. Following that, you can download the Massachusetts Motion for Interest on an Affirmed Judgment of a Federal District Court web template.

Should you not come with an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and ensure it is for your correct city/state.

- Use the Preview option to review the shape.

- Browse the outline to ensure that you have selected the correct develop.

- In the event the develop isn`t what you are searching for, make use of the Lookup area to get the develop that meets your requirements and specifications.

- Whenever you find the correct develop, click on Purchase now.

- Pick the rates program you want, fill in the required info to produce your account, and pay for an order using your PayPal or credit card.

- Choose a hassle-free document format and download your backup.

Locate every one of the papers themes you might have bought in the My Forms food list. You can aquire a additional backup of Massachusetts Motion for Interest on an Affirmed Judgment of a Federal District Court whenever, if possible. Just click on the required develop to download or print out the papers web template.

Use US Legal Forms, the most comprehensive assortment of legitimate varieties, in order to save time as well as avoid blunders. The service delivers professionally created legitimate papers themes which can be used for a range of uses. Produce a free account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

LOCAL RULE 7.2 IMPOUNDED AND CONFIDENTIAL MATERIALS Any document presented for filing under seal, without a motion to seal, will be returned to the filing party.

Judgment rates are rates that are established by judgment of an underwriter rather than by a rating authority.

Massachusetts case law indicates that a motion for judgment on the pleadings will be treated as a motion to dismiss for failure to state a claim BUT only where a party has failed to timely assert the failure to state a claim defense.

When a party brings a claim originally in a federal district court, then either party can appeal the outcome of the trial to a federal circuit court, and, after the circuit court rules, either party can appeal to the US Supreme Court, although the Supreme Court has discretion on whether to hear it (more on that below).

By statute, the clerk in any case is required to add interest to any judgment or verdict issued by a Massachusetts state court. For contract actions (G.L. c. 231, §6C), the rate of interest is either the interest rate in the contract or, if the contract does not have one (or the contract is oral), the rate of 12%.

Calculating interest owed You input the judgment amount, date, and payment history, and the program does all the calculations for you. The calculator has the interest rate set at 10%.

Massachusetts has passed a number of laws designed to protect consumers and borrowers from exploitative lenders. These usury laws (also known as interest rate limits) are common throughout the country. In Massachusetts, the maximum amount of interest a borrower can charge is 6%.

When and at what rate do judgment debts attract interest? Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.