This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Are you in a situation where you need documents for both professional or personal use almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary, designed to meet federal and state requirements.

Once you find the right form, click on Purchase now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/region.

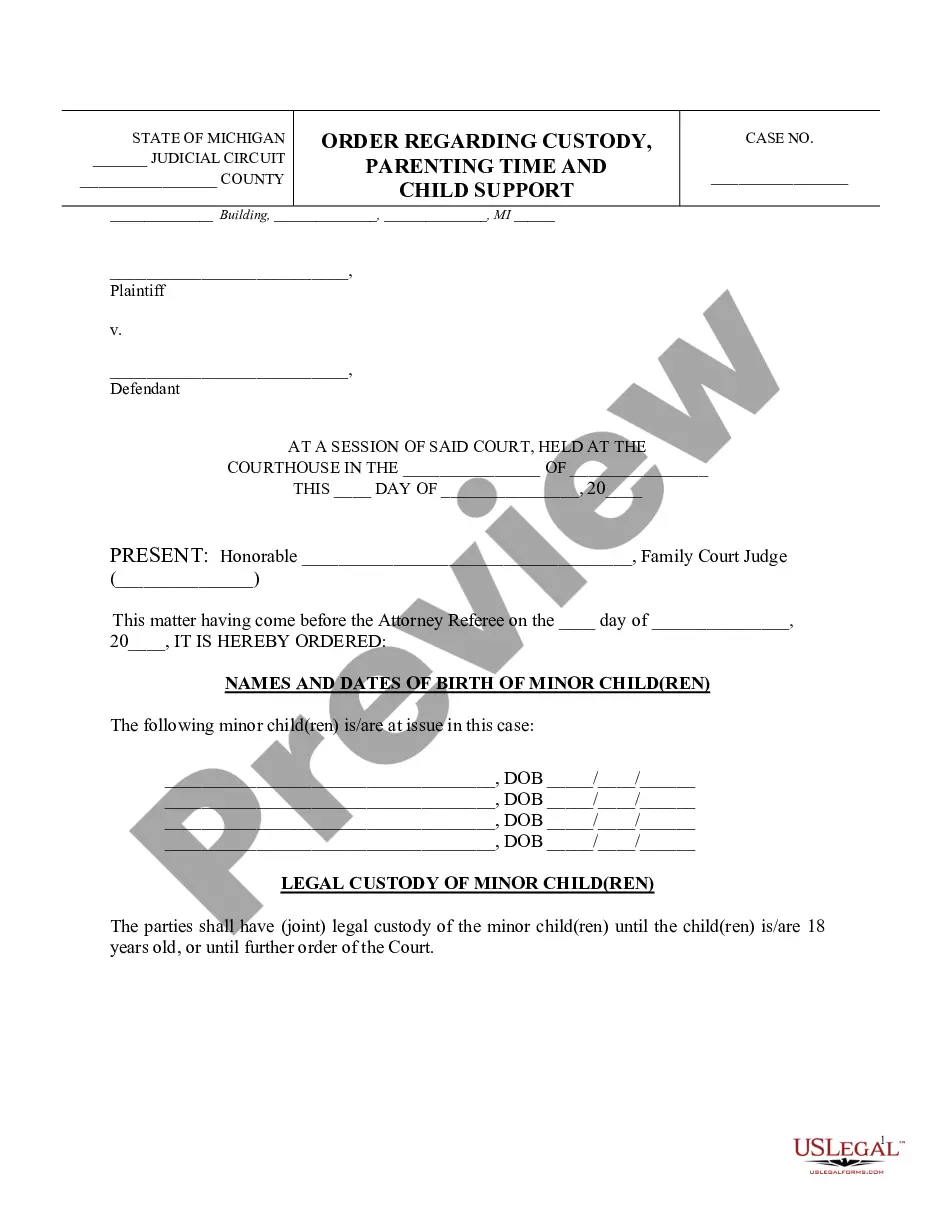

- Use the Preview option to review the document.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to find the document that suits your needs.

Form popularity

FAQ

The taxation of a third-party special needs trust, such as the Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary, often falls on the trust itself. Generally, the trust pays taxes on any income it generates. It's important to note that the distributions to the disabled beneficiary typically do not count as taxable income to them. For detailed management of tax obligations related to trusts, consider using US Legal Forms, which provides resources to navigate these complexities effectively.

There is no set maximum amount you can place in a special needs trust; however, the key is to ensure the funds do not interfere with government benefits. A Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary can hold significant assets while serving its purpose effectively. It's crucial to work with a legal expert to develop a strategy that protects the beneficiary’s benefits while allowing for the proper management of the trust funds.

The best trust for a disabled person is often the Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary. This type of trust allows you to provide financial support while preserving eligibility for important government benefits, such as Medicaid and SSI. It offers flexibility in managing assets and can cover various expenses that enhance the quality of life of the disabled individual without affecting their public assistance.

To set up a trust for a disabled person, you should start by consulting with a legal professional experienced in estate planning. They will guide you in creating a Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary, ensuring the trust complies with state laws and covers the unique needs of your beneficiary. You'll also need to choose a trustee who will manage the funds responsibly and make distributions that benefit the disabled individual without jeopardizing their government benefits.

While all qualified disability trusts are a type of supplemental needs trust, not all supplemental needs trusts qualify as disability trusts. The distinctions include beneficiary criteria and specific rules governing funding and disbursement. A Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary can be structured to meet either classification depending on your unique needs and goals.

A supplemental needs trust is a legal arrangement designed to enhance the quality of life for individuals with disabilities without interfering with public benefits. This trust can hold funds for various needs, such as medical expenses, education, or recreational activities. Establishing a Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary allows you to provide financial support while ensuring the beneficiary retains essential government assistance.

A qualified disability trust must meet specific requirements to ensure the beneficiary maintains their eligibility for government benefits. Primarily, the trust must provide that the sole beneficiary is a disabled individual under age 65, and the trust must be irrevocable. By creating a Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary, you can confidently establish a qualified disability trust that meets these criteria.

A properly structured special needs trust generally does not affect an individual’s eligibility for Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI). The Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary is designed to hold assets for the disabled individual while preserving their access to government programs. Therefore, using this trust wisely can provide additional safety and security without compromising vital benefits.

Yes, a third-party special needs trust can be established to benefit an individual with disabilities without jeopardizing their eligibility for government assistance. This type of trust allows family members or friends to fund it on behalf of the disabled beneficiary. By utilizing a Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary, you ensure that the funds support the beneficiary's quality of life while still allowing them to access essential benefits.

Establishing a special disability trust requires drafting legal documents that define the trust's purpose, funding sources, and management. You should consider working with an experienced attorney who can guide you through the process and help address specific needs. A well-designed trust, such as a Massachusetts Supplemental Needs Trust for Third Party - Disabled Beneficiary, can provide essential support and protect assets.