A motion to release property is a pleading asking a judge to issue a ruling that will result in the release of property or a person from custody. When property is held in custody, a motion to release must be filed in order to get it back. There are a number of situations where this may become necessary. These can include cases where property is confiscated and the cause of the confiscation is later deemed spurious, as well as situations where people deposit money with a court as surety in a case or in response to a court order. For example, someone brought to small claims court and sued for back rent might write a check to the court for the amount owed, and the landlord would need to file a motion to release for the court to give him the money.

Massachusetts Motion to Release Property from Levy upon Filing Bond

Description

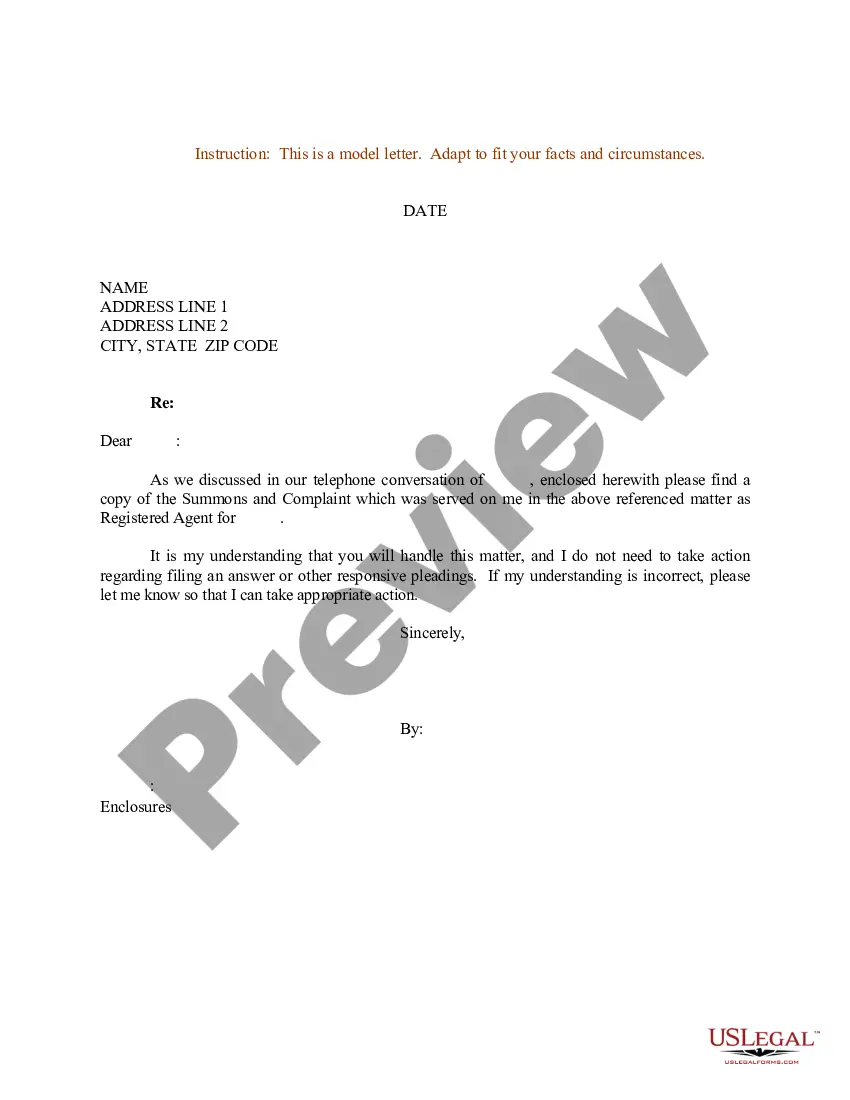

How to fill out Motion To Release Property From Levy Upon Filing Bond?

US Legal Forms - among the most significant libraries of legitimate forms in the States - offers a variety of legitimate papers templates you can download or print. Using the internet site, you can get a huge number of forms for enterprise and person reasons, categorized by groups, suggests, or keywords.You will discover the latest models of forms just like the Massachusetts Motion to Release Property from Levy upon Filing Bond in seconds.

If you currently have a membership, log in and download Massachusetts Motion to Release Property from Levy upon Filing Bond from your US Legal Forms library. The Obtain key can look on each and every form you see. You have access to all formerly acquired forms inside the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, listed here are simple recommendations to help you get started off:

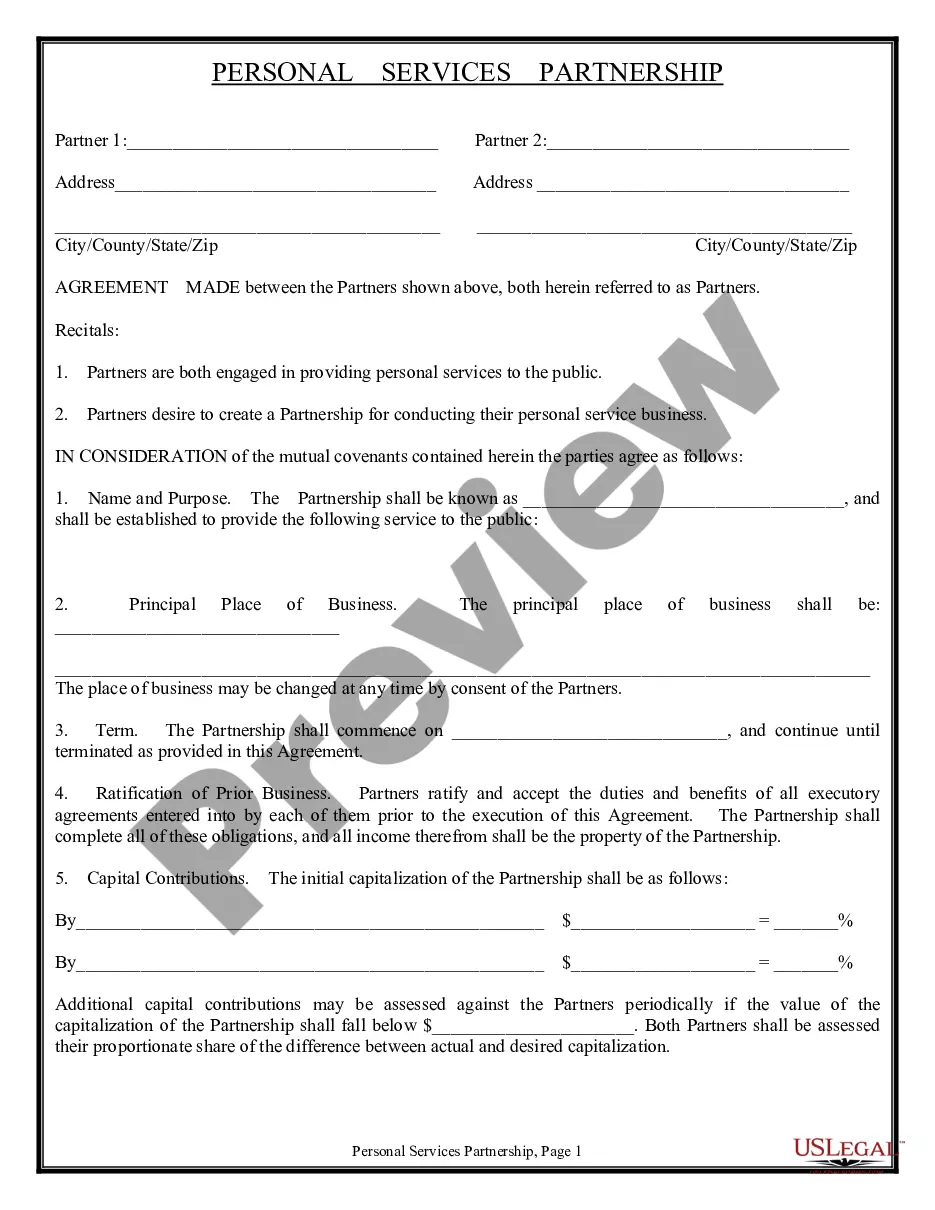

- Ensure you have selected the right form to your metropolis/state. Select the Review key to check the form`s content material. Look at the form description to ensure that you have chosen the proper form.

- If the form does not satisfy your demands, take advantage of the Look for area on top of the monitor to obtain the the one that does.

- Should you be pleased with the form, verify your decision by visiting the Buy now key. Then, opt for the pricing program you want and offer your accreditations to sign up on an profile.

- Method the purchase. Make use of credit card or PayPal profile to finish the purchase.

- Select the formatting and download the form in your system.

- Make adjustments. Fill up, revise and print and signal the acquired Massachusetts Motion to Release Property from Levy upon Filing Bond.

Every single web template you included with your account does not have an expiry day and is also your own property for a long time. So, if you wish to download or print yet another backup, just check out the My Forms segment and then click around the form you will need.

Gain access to the Massachusetts Motion to Release Property from Levy upon Filing Bond with US Legal Forms, the most considerable library of legitimate papers templates. Use a huge number of professional and express-specific templates that fulfill your company or person demands and demands.

Form popularity

FAQ

If you lose your eviction trial and think you have a good case, you may appeal and have your case reviewed in a higher court. To appeal, you must act quickly. If you cannot afford the cost of appealing your case, make sure you have Booklet 9: Affidavit of Indigency.

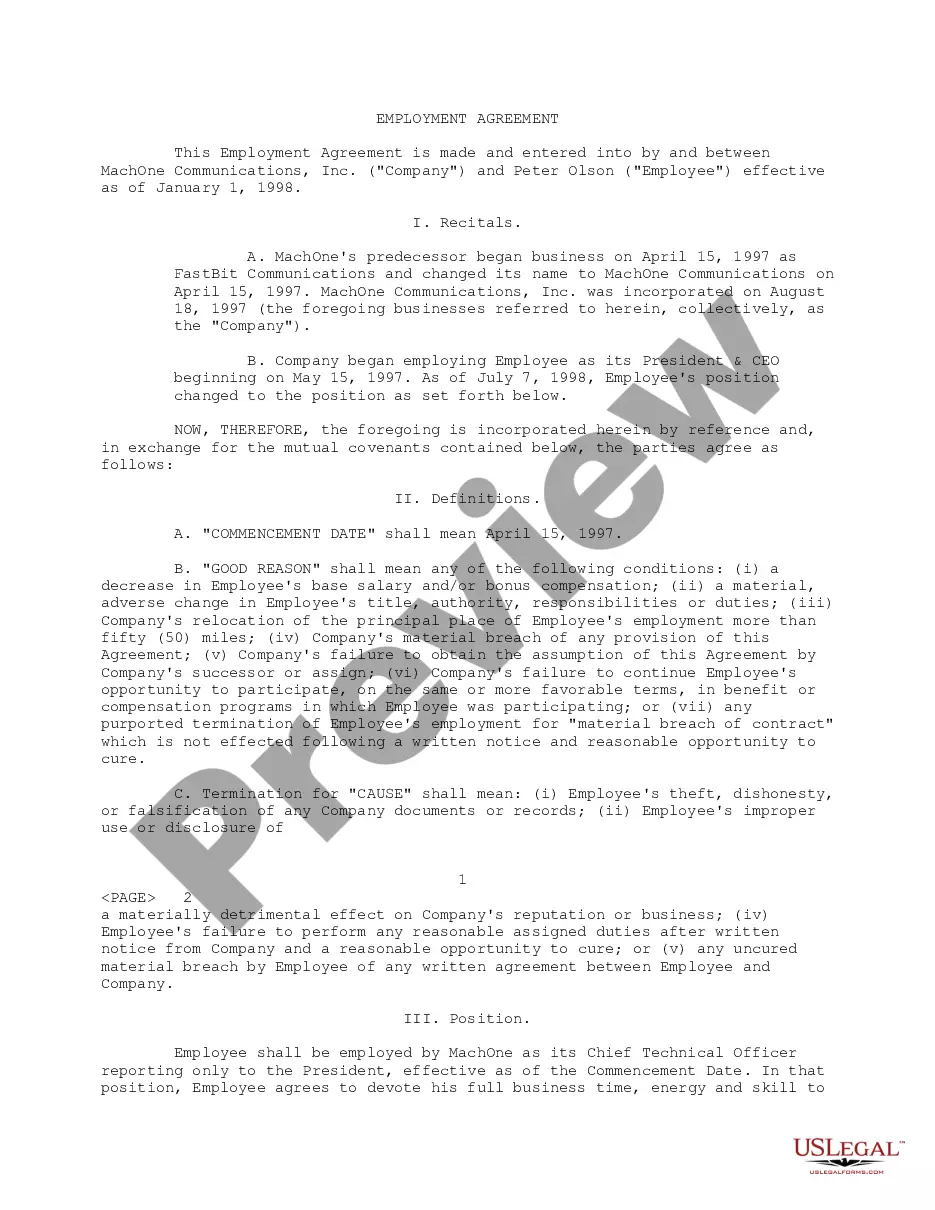

A supersedeas bond is typically required during the appeal of a civil judgment, and is sometimes referred to as an appeal bond as well. This type of court surety bond is posted by the appellant in civil litigation matters to prevent enforcement of a judgment while their appeal is in process.

A notice of appeal is a written statement you prepare that includes the name of your case and the District Court docket number, and that states that you intend to appeal. The notice must include: The name of the party taking the appeal. A short statement on the issue of law you're presenting for review.

The appeal bond is money that is held by the court to be paid to the plaintiff if the plaintiff prevails on appeal, or returned to the defendant if the appeal is successful.

The Massachusetts Appeals Court is a court of general appellate jurisdiction. That means that the justices review decisions that the trial judges from the several Departments of the Trial Court have already made in many different kinds of civil and criminal cases.

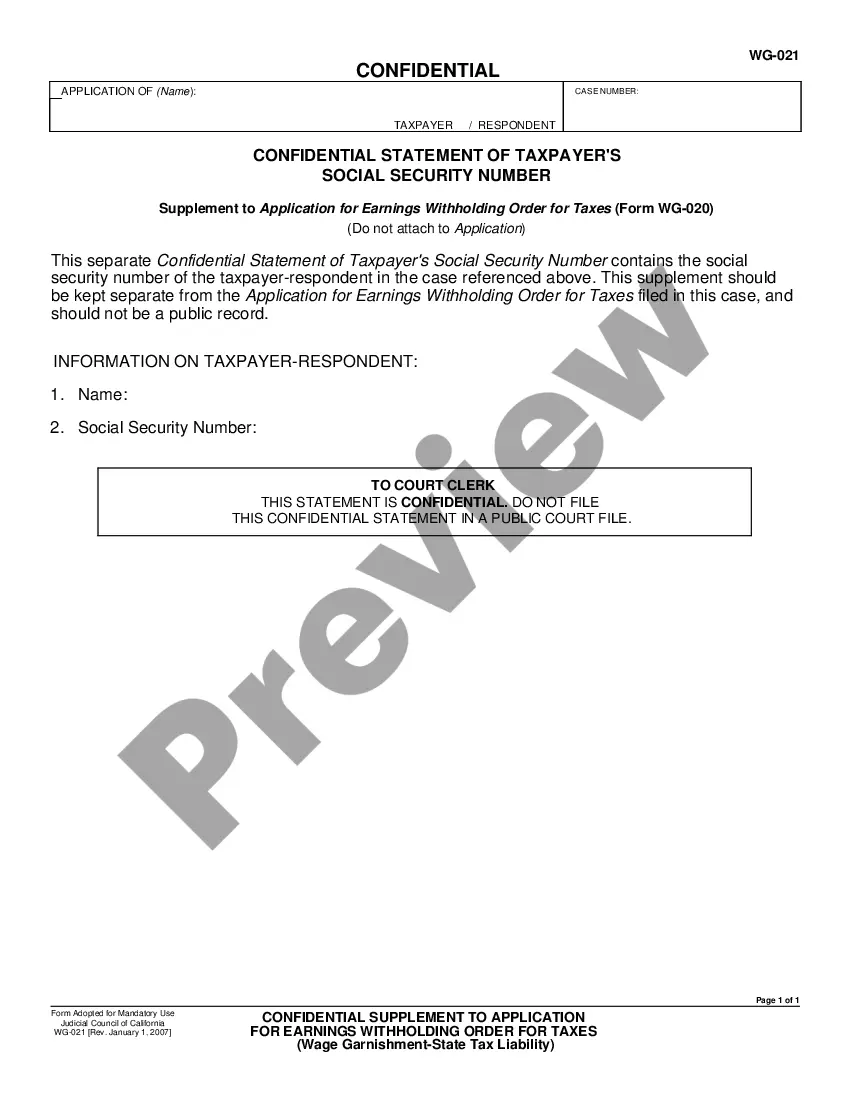

If the judgment debtor isn't following the magistrate's payment order, then both parties must go to the scheduled payment hearing. If the judgment debtor doesn't appear, without further notice a magistrate may issue a civil arrest warrant (capias) for their arrest.

Section 49A: Certain levies made void by operation of law In case a levy becomes void under the provisions of this section the creditor may resort to any other legal remedy for the satisfaction of his judgment.

Massachusetts General Law enables the Sheriff's Department to attach real property through Writs of Attachment issued by the Superior of District Courts. These attachments are made by a Deputy Sheriff who records the attachments at the Registry of Deeds.