Are you presently in the situation where you require papers for both business or specific uses almost every time? There are a variety of legal file web templates available on the net, but finding ones you can rely on isn`t effortless. US Legal Forms provides a huge number of form web templates, just like the Massachusetts Two Person Member Managed Limited Liability Company Operating Agreement, which can be composed to fulfill state and federal requirements.

Should you be currently knowledgeable about US Legal Forms internet site and possess your account, just log in. Afterward, you may acquire the Massachusetts Two Person Member Managed Limited Liability Company Operating Agreement design.

If you do not have an accounts and wish to begin using US Legal Forms, follow these steps:

- Find the form you require and ensure it is for your right city/state.

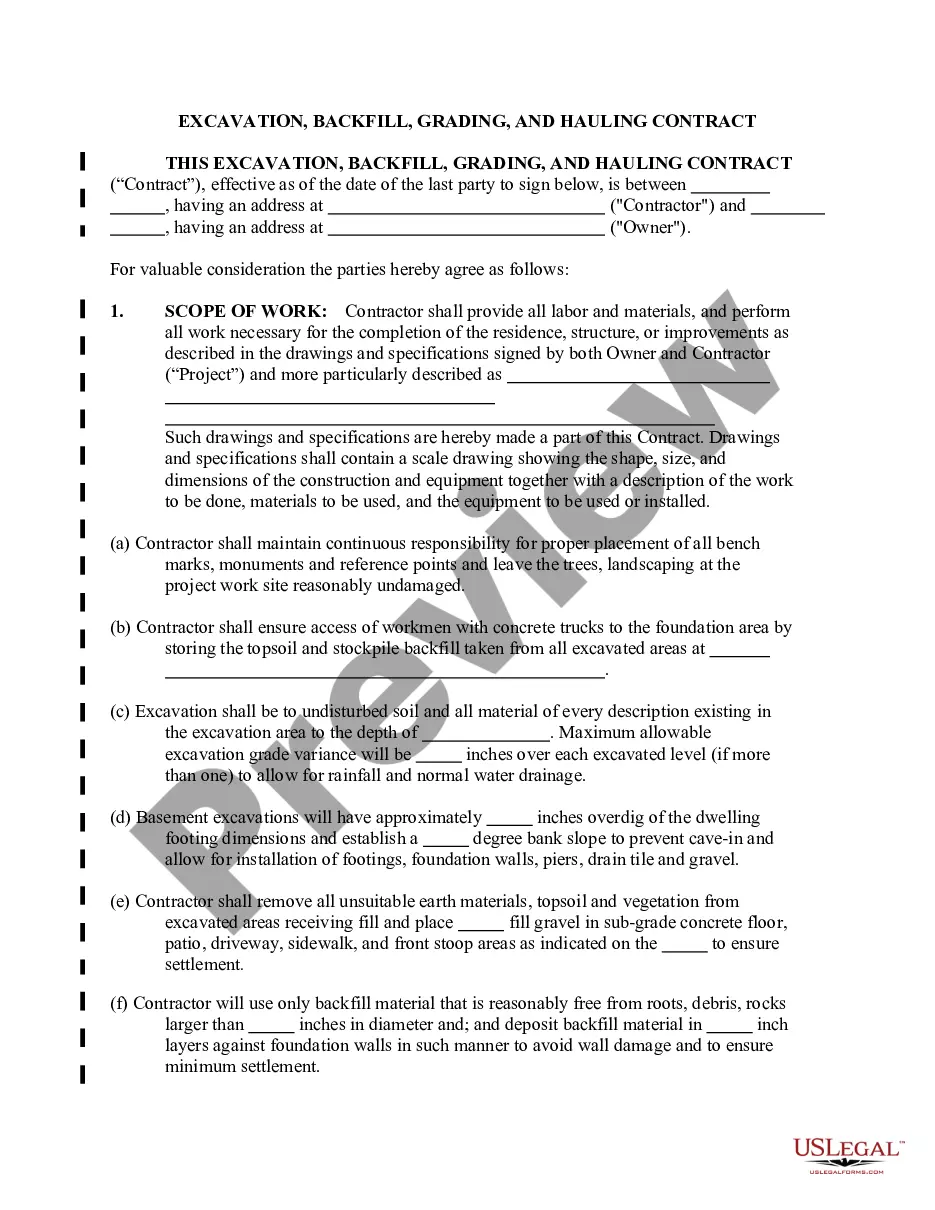

- Take advantage of the Review option to examine the form.

- Read the explanation to actually have selected the correct form.

- When the form isn`t what you`re looking for, utilize the Research field to find the form that meets your requirements and requirements.

- Once you obtain the right form, simply click Buy now.

- Pick the pricing plan you need, fill in the necessary info to create your account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Choose a handy file format and acquire your copy.

Get all of the file web templates you possess bought in the My Forms food list. You can aquire a more copy of Massachusetts Two Person Member Managed Limited Liability Company Operating Agreement any time, if possible. Just click the required form to acquire or produce the file design.

Use US Legal Forms, probably the most extensive selection of legal forms, to save lots of some time and prevent blunders. The support provides skillfully made legal file web templates that can be used for a variety of uses. Produce your account on US Legal Forms and initiate generating your life a little easier.