Massachusetts Sample Letter for Payroll Dispute: A Comprehensive Guide Introduction: A Massachusetts Sample Letter for Payroll Dispute is a written communication to address and resolve issues related to wage disputes, incorrect deductions, unpaid wages, or any other discrepancies in an employee's payroll. This type of letter serves as a tool for both employees and employers to initiate a formal discussion and find a mutually agreeable resolution. Below, you will find detailed descriptions of different types of Massachusetts Sample Letters for Payroll Dispute. 1. Massachusetts Sample Letter for Unpaid Wages: In cases where an employee has not received the full or correct amount of compensation for their work hours, an employee can use this sample letter to dispute unpaid wages. This letter should include details such as the amount owed, any evidence of the agreed-upon wages, and a clear request for payment, in alignment with the Massachusetts Wage Act. 2. Massachusetts Sample Letter for Unlawful Deductions: Employees who suspect that their employer has made unauthorized or excessive deductions from their wages can utilize this sample letter to address the issue. The letter should outline the deductions made, explain why they are unlawful or inappropriate, and request a correction, as per the Massachusetts Wage and Hour Laws. 3. Massachusetts Sample Letter for Overtime Dispute: If an employee believes they have been wrongfully denied overtime pay or were not paid at the correct overtime rate, they can utilize this sample letter to dispute the issue. It should express their concerns with specific details about the unpaid or incorrectly calculated overtime, reference applicable overtime laws in Massachusetts, and request proper compensation. 4. Massachusetts Sample Letter for Payroll Error Correction: When employees identify errors or mistakes in their payroll, such as incorrect tax withholding, erroneous deductions, or inaccurate hours worked, they can use this sample letter to request a correction. The letter should clearly outline the error, provide supporting documentation, and request a prompt resolution to rectify the payroll mistake. 5. Massachusetts Sample Letter for Late Payroll: If an employee has experienced delays in receiving their wages or salaries, they can draft this sample letter to address the issue. It should state the reasons for concern about the late payment, reference the Massachusetts Wage and Hour Laws regarding timely payment, and request immediate action to resolve the matter. Conclusion: Utilizing a Massachusetts Sample Letter for Payroll Dispute can help employees communicate their concerns effectively, ensuring their rights are protected and potentially leading to a fair resolution. It is important for employees to tailor these sample letters to their specific circumstances, providing all necessary details and adhering to relevant Massachusetts wage and labor laws. Keyword suggestions: Massachusetts, sample letter, payroll dispute, unpaid wages, unlawful deductions, overtime dispute, payroll error correction, late payroll, Massachusetts Wage Act, Massachusetts Wage and Hour Laws.

Massachusetts Sample Letter for Payroll Dispute

Description

How to fill out Massachusetts Sample Letter For Payroll Dispute?

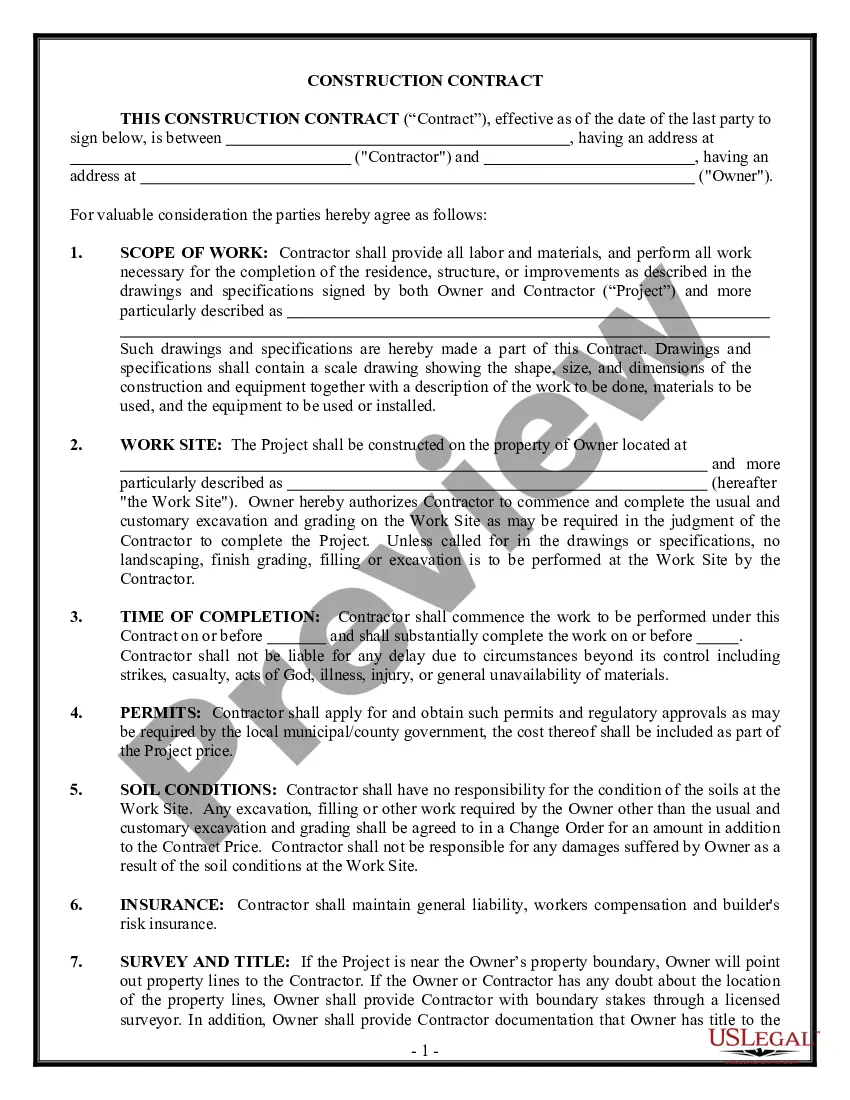

Discovering the right legitimate record format could be a battle. Needless to say, there are a lot of themes available on the net, but how will you find the legitimate kind you need? Take advantage of the US Legal Forms site. The assistance offers thousands of themes, like the Massachusetts Sample Letter for Payroll Dispute, which you can use for organization and personal needs. Each of the forms are examined by professionals and meet up with federal and state demands.

When you are currently listed, log in in your account and click on the Obtain key to obtain the Massachusetts Sample Letter for Payroll Dispute. Utilize your account to search through the legitimate forms you have bought previously. Go to the My Forms tab of your respective account and acquire another duplicate from the record you need.

When you are a new customer of US Legal Forms, listed here are straightforward directions that you should stick to:

- Initially, be sure you have chosen the correct kind for your city/state. You can check out the shape making use of the Preview key and read the shape description to guarantee it is the right one for you.

- If the kind will not meet up with your needs, take advantage of the Seach industry to get the right kind.

- When you are certain the shape is proper, select the Acquire now key to obtain the kind.

- Opt for the costs prepare you want and type in the required info. Design your account and buy the order using your PayPal account or charge card.

- Pick the document structure and acquire the legitimate record format in your gadget.

- Complete, modify and print out and signal the acquired Massachusetts Sample Letter for Payroll Dispute.

US Legal Forms may be the biggest collection of legitimate forms in which you can find a variety of record themes. Take advantage of the company to acquire professionally-produced paperwork that stick to express demands.

Form popularity

FAQ

Report it right away to your boss or human resources: Assume it's an honest mistake and ask for an immediate correction. You should get your unpaid wages in your next check, if not sooner. Otherwise, you're lending your boss money at no interest.

What To Do When You Realize You're Underpaid Stay calm and professional. The realization that your coworkers have a higher salary won't come without a slew of negative emotions. ... Reflect on your performance. ... Prepare for a conversation with your boss. ... Highlight your desire to grow with the company. ... Consider looking elsewhere.

Workers in California have the right to file a wage claim when their employers do not pay them the wages or benefits they are owed. A wage claim starts the process to collect on those unpaid wages or benefits. Wage claims can be filed online, by email, mail or in person.

To write a payroll processing error letter, follow these steps below: Define the error. Explain what led to the error and what you're doing to correct it. Follow up with a formal letter that documents your communication and process for handling the error.

How to Handle Payroll Errors Step 1: Briefly state the error and apologize. ... Step 2: Describe what caused the error and show the employee exactly how the correct pay should have been calculated. ... Step 3: Explain what steps are being taken to fix the error and to ensure it is not repeated.

Employers should fix any payroll errors right away. For most employers, that means by the next paycheck. That said, you might not find the error or the employee might not report it quickly.

Step 1: Define the error. Shed light on payroll errors by letting employees know what occurred. ... Step 2: Explain what led to the error and what you're doing to correct it. ... Step 3: Follow up with a payroll processing error letter. ... Example #1. ... Example #2.

Schedule an in-person meeting with your employer. Bring relevant evidence along with you such as pay stubs, your own records of hours worked, and even documents that detail your payment agreement. You can explain why you believe your paycheck is incorrect.