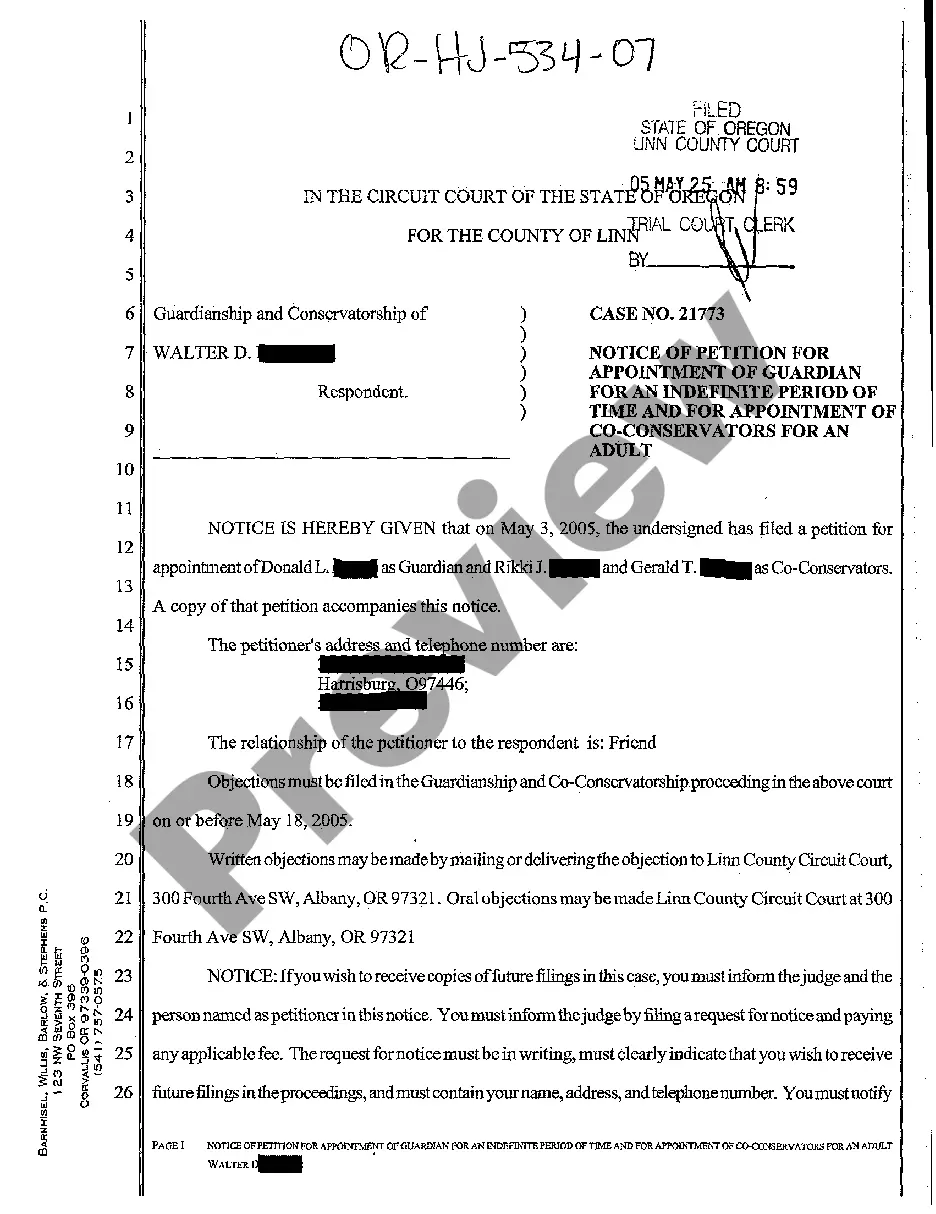

Title: Massachusetts Sample Letter for Notice of Credit Limit — Conversion to C.O.D. Status Keywords: Massachusetts, sample letter, notice, credit limit, conversion, C.O.D. status, types. 1. Introduction to Massachusetts Sample Letter for Notice of Credit Limit — Conversion to C.O.D. Status Dear [Business Name/Recipient], We hope this letter finds you well. As valued customers, we appreciate your continued support and partnership. However, this communication is to inform you of some changes in our credit payment policies. Due to recent developments, we regret to inform you that your credit limit will be converted to cash on delivery (C.O.D.) status, effective immediately. 2. Importance of providing notice for credit limit conversion At [Company Name], we understand that changes like these can affect your purchasing process and cash flow management. Therefore, we aim to provide ample prior notice, allowing our valued customers to make necessary adjustments. 3. Reasons for the credit limit conversion Unfortunately, due to recent market fluctuations and economic uncertainties, we find it necessary to implement this change. To maintain financial stability, we have reevaluated our credit policies. We are confident that this conversion will help in ensuring smooth operations for both parties involved. 4. Impact on credit terms and account status With the conversion of your credit limit to C.O.D. status, future purchases made from [Company Name] will require immediate cash payment upon delivery or prior to shipment. This update means a shift from our previous credit terms and account status. 5. Payment procedure and expectations We kindly request that you follow the following procedure to facilitate the C.O.D. payment: a. Upon receipt of an order, our sales representative will contact you to confirm the order details and arrange the payment. b. Payments can be made through cash, certified checks, or electronic funds transfer (EFT) before delivery or shipment. c. Our delivery personnel or shipment agent will collect the payment at the designated time and location. 6. Assurances of seamless transaction processes To ensure a seamless transition, we assure you that our team will be available to answer any questions or concerns you may have regarding this change. Our goal is to maintain a positive business relationship and address any potential disruptions caused by this credit limit conversion. 7. Seeking alternative arrangements or credit reconsideration If you feel that the conversion to C.O.D. status may not be suitable for your business needs or would like to discuss alternative arrangements, please feel free to contact our accounts department. We understand that every customer's situation is unique, and we are open to reevaluating credit limits on a case-by-case basis, subject to further discussions. We value our partnership with your business and are hopeful that this temporary change will not only benefit both parties but also help strengthen our working relationship. Furthermore, we appreciate your understanding and cooperation during this transition period. Thank you for your prompt attention to this matter. Yours sincerely, [Your Name] [Your Position/Title] [Company Name] [Contact Information] Keywords: Massachusetts, sample letter, notice, credit limit, conversion, C.O.D. status, types.

Massachusetts Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

How to fill out Massachusetts Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

Are you within a placement the place you need to have files for both organization or individual reasons nearly every day time? There are a lot of legal document templates available on the Internet, but getting kinds you can rely is not easy. US Legal Forms delivers 1000s of type templates, such as the Massachusetts Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status, which can be written to meet state and federal specifications.

In case you are currently informed about US Legal Forms website and possess your account, merely log in. Following that, you are able to obtain the Massachusetts Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status web template.

Unless you have an bank account and wish to begin to use US Legal Forms, follow these steps:

- Get the type you want and make sure it is to the proper town/state.

- Utilize the Preview key to examine the form.

- Look at the description to actually have selected the appropriate type.

- In case the type is not what you`re seeking, use the Search discipline to discover the type that meets your needs and specifications.

- If you find the proper type, simply click Get now.

- Opt for the rates strategy you would like, submit the required info to produce your account, and pay for an order using your PayPal or charge card.

- Pick a handy data file formatting and obtain your copy.

Get every one of the document templates you may have purchased in the My Forms menus. You can aquire a more copy of Massachusetts Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status whenever, if necessary. Just go through the required type to obtain or produce the document web template.

Use US Legal Forms, by far the most extensive collection of legal types, in order to save some time and prevent errors. The support delivers appropriately produced legal document templates that can be used for a variety of reasons. Create your account on US Legal Forms and initiate generating your way of life a little easier.