Massachusetts Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

Are you currently in a circumstance where you require documents for either business or personal reasons on a daily basis.

There are numerous legitimate document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Massachusetts Receipt and Withdrawal from Partnership, designed to meet state and federal regulations.

When you find the appropriate form, simply click Get now.

Choose a convenient document format and download your version. You can access all the form templates you have purchased in the My documents menu. You can obtain an additional copy of the Massachusetts Receipt and Withdrawal from Partnership at any time if needed. Click the necessary form to download or print the template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Massachusetts Receipt and Withdrawal from Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/county.

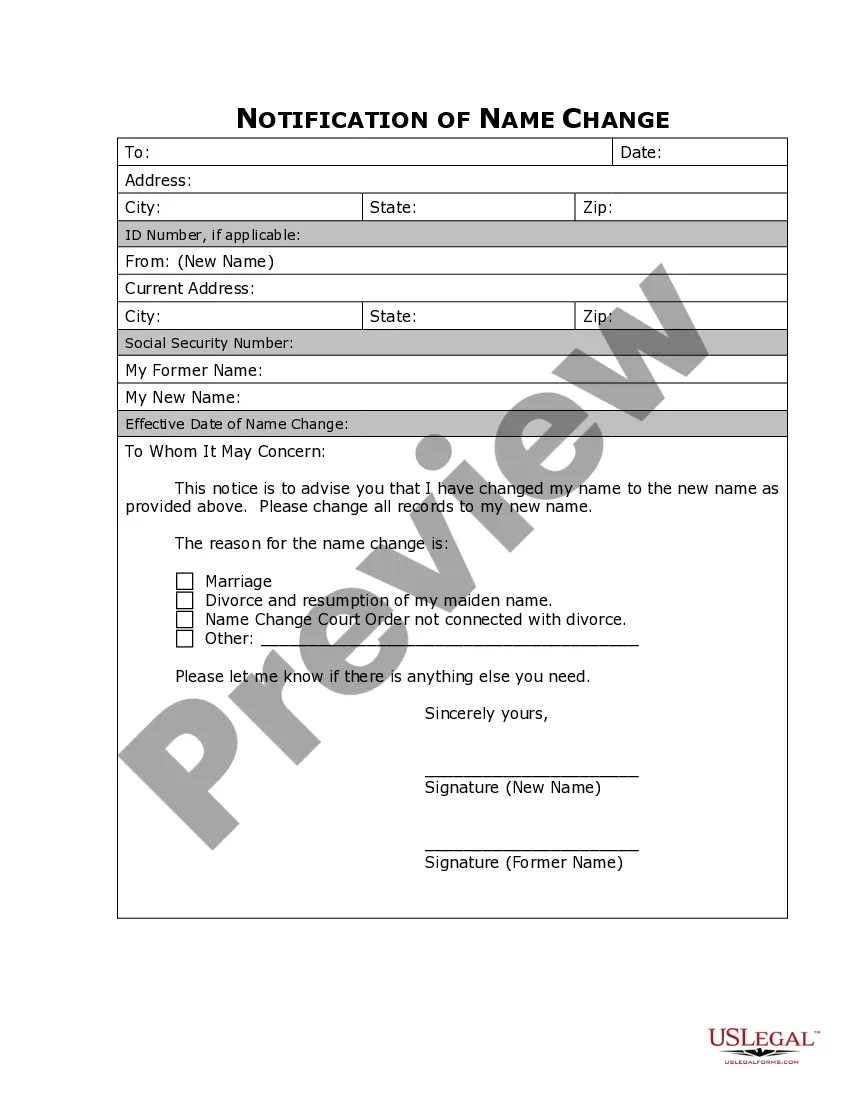

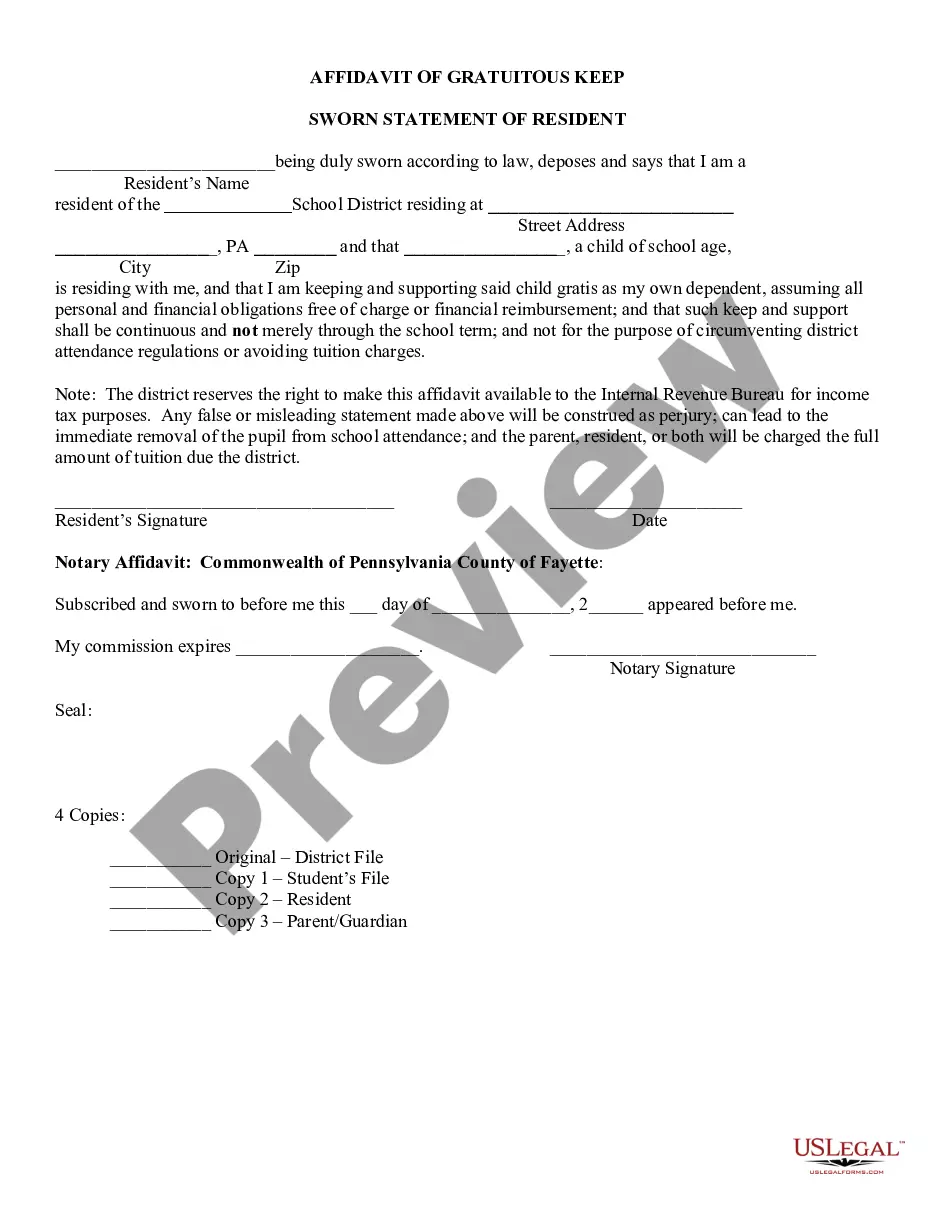

- Use the Review option to examine the form.

- Review the summary to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

No, you typically do not report your partner's income on your personal tax return. Each partner is responsible for reporting their income individually based on the Schedule K-1 received from the partnership. This allocation is important for maintaining clear records and responsibilities regarding Massachusetts Receipt and Withdrawal from Partnership compliance.