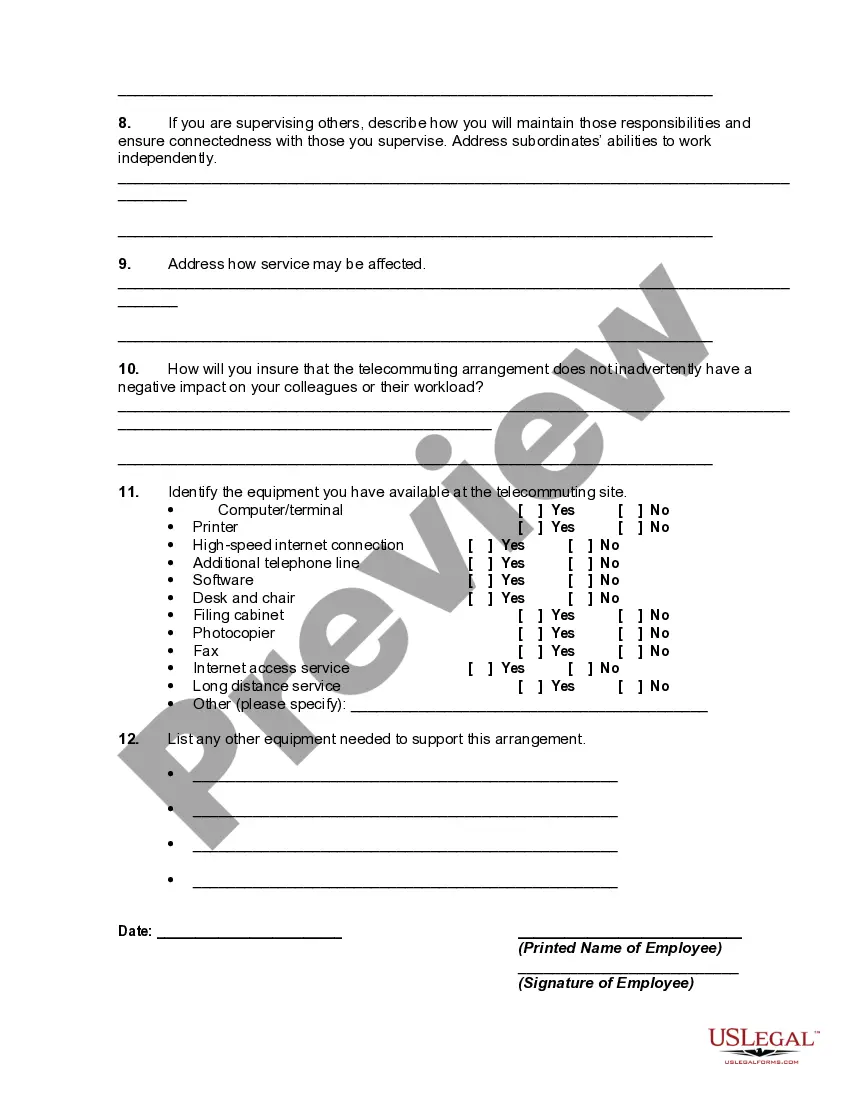

Massachusetts Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

Selecting the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service offers a plethora of templates, including the Massachusetts Telecommuting Worksheet, which can be utilized for both business and personal purposes. All the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Massachusetts Telecommuting Worksheet. Use your account to access the legal forms you have ordered previously. Navigate to the My documents tab in your account to download another copy of the form you need.

If you are a new user of US Legal Forms, here are straightforward instructions to follow: First, ensure you have selected the correct form for your city/state. You can preview the form by using the Review button and check the form details to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are confident that the form is appropriate, click the Get Now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Finally, complete, edit, print, and sign the obtained Massachusetts Telecommuting Worksheet.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Take advantage of the service to obtain professionally crafted documents that comply with state requirements.

- Selecting the proper legal document template can be a challenge.

- There are numerous templates available online.

- Utilize the US Legal Forms website.

- The service offers a plethora of templates.

- All forms comply with state and federal regulations.

Form popularity

FAQ

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

If you're a nonresident of Massachusetts, you must file a Massachusetts Income Tax Return if you received Massachusetts source income in excess of your personal exemption multiplied by the ratio of your Massachusetts source income to your total income, or your gross income was more than $8,000 whether received from

Nonresidents. If you're a nonresident with an annual Massachusetts gross income of more than either $8,000 or the prorated personal exemption, whichever is less, you must file a Massachusetts tax return.

KPMG NOTE. Beginning September 15, 2021, employees working remotely outside of Massachusetts should have wages reported and taxes withheld to the state where they are physically performing services.

If you live in Massachusetts and have dividend income, it'll be taxable to MA instead of NH, even if you work in New Hampshire. If you've lived in NH all your life, you may not have known about this tax because it does not apply to everyone.

Filing RequirementsIf you're a full-year resident with an annual Massachusetts gross income of more than $8,000, you must file a Massachusetts tax return.

If you're a nonresident of Massachusetts, you must file a Massachusetts Income Tax Return if you received Massachusetts source income in excess of your personal exemption multiplied by the ratio of your Massachusetts source income to your total income, or your gross income was more than $8,000 whether received from