Massachusetts Commercial Partnership Agreement between an Investor and Worker

Description

How to fill out Commercial Partnership Agreement Between An Investor And Worker?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a wide array of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by category, state, or keywords. You can find the latest versions of forms like the Massachusetts Commercial Partnership Agreement between an Investor and Employee in just minutes.

If you are already registered, Log In to obtain the Massachusetts Commercial Partnership Agreement between an Investor and Employee from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Choose the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Massachusetts Commercial Partnership Agreement between an Investor and Employee. Every template you save in your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you would like. Access the Massachusetts Commercial Partnership Agreement between an Investor and Employee with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

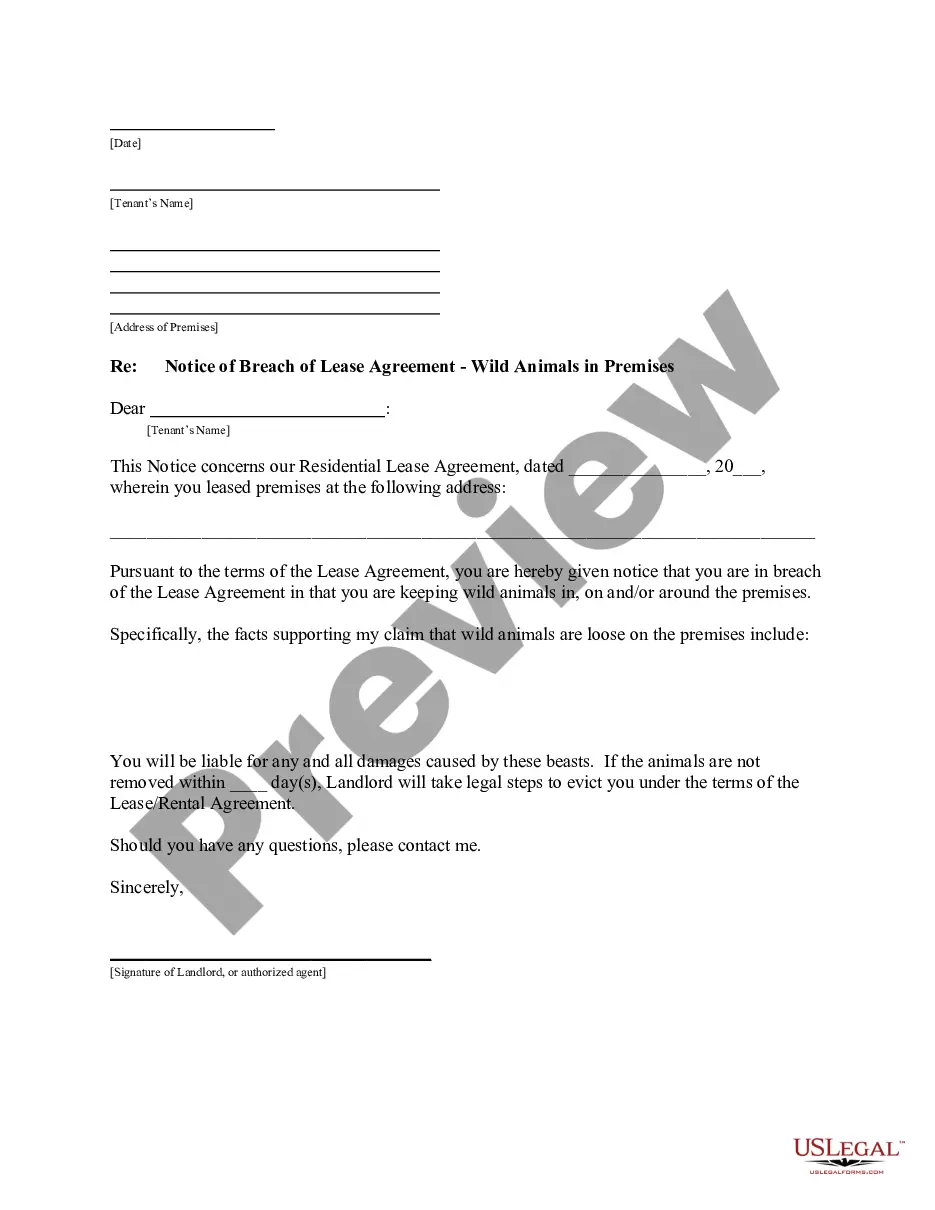

- Ensure you have selected the correct form for your city/area. Click the Preview button to examine the form’s content.

- Review the form summary to confirm you have chosen the correct document.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- If you are content with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you desire and provide your information to register for an account.

Form popularity

FAQ

What to include in your partnership agreementName of the partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision-making.Management duties.Admitting new partners.Withdrawal or death of a partner.More items...

The Top 10 Issues Every Partnership Agreement Should CoverContributions. Money, money, money, and where is it coming from?Management.Decision-making.Authority of each partner.Division of profits.Admission of new partners.What if a partner wants to leave the business, or dies?Role of a spouse?More items...?

7 Things Every Partnership Agreement Needs To AddressContributions. Make sure you clearly lay out each partner's stake in the formation and ongoing finances of the business.Distributions.Ownership.Decision Making.Dispute Resolution.Critical Developments.Dissolution.

A partnership deed normally contains the following clauses:Name of the firm.Nature of the firm's business.The principal place of business.Duration of partnership, if any.Amount of capital to be contributed by each partner.The amount which can be withdrawn by each partner.The profit-sharing ratio.More items...?

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

6 Things Every Partnership Agreement NeedsPercentage of ownership. You should have a record of how much each partner is contributing to the partnership prior to its opening.Allocation of profits and losses.Who can bind the partnership?Making decisions.The death of a partner.Resolving disputes.

How do I create a Partnership Agreement?Specify the type of business you're running.State your place of business.Provide partnership details.State the partnership's duration.Provide each partner's details.State each partner's capital contributions.Outline the admission of new partners.More items...?