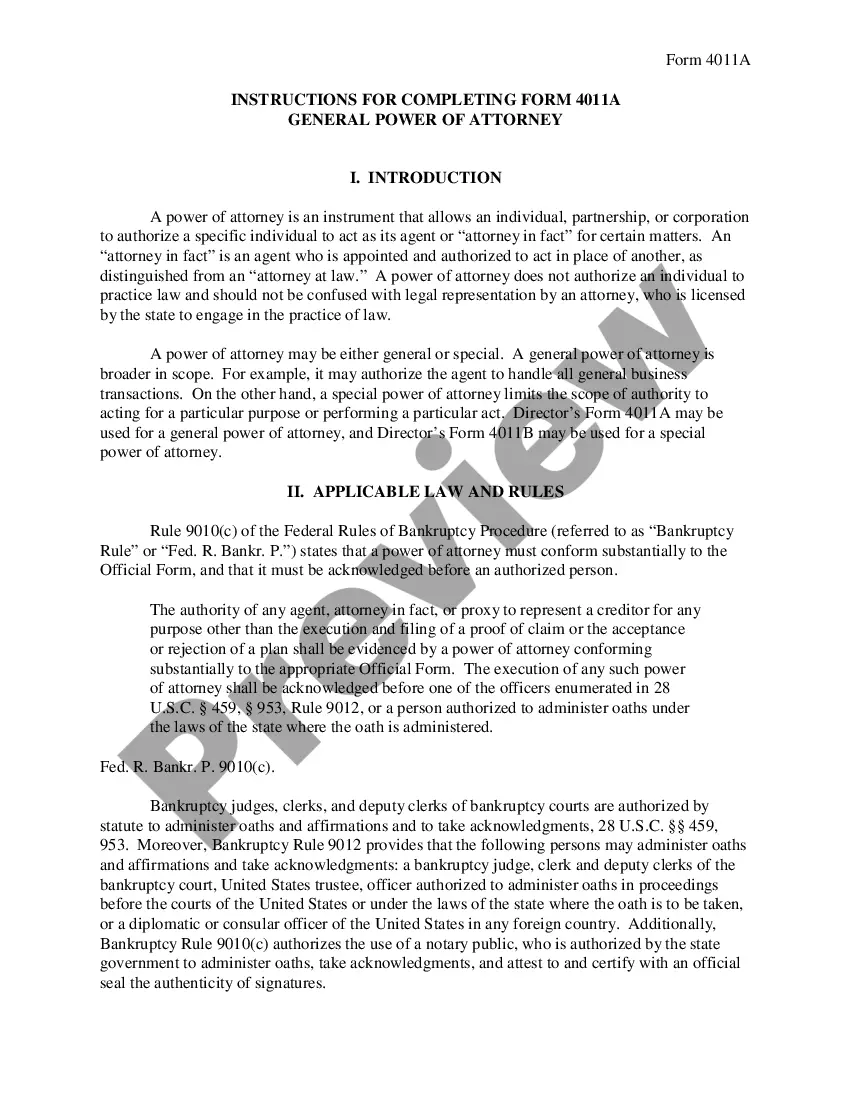

Massachusetts General Power of Attorney for Bank Account Operations

Description

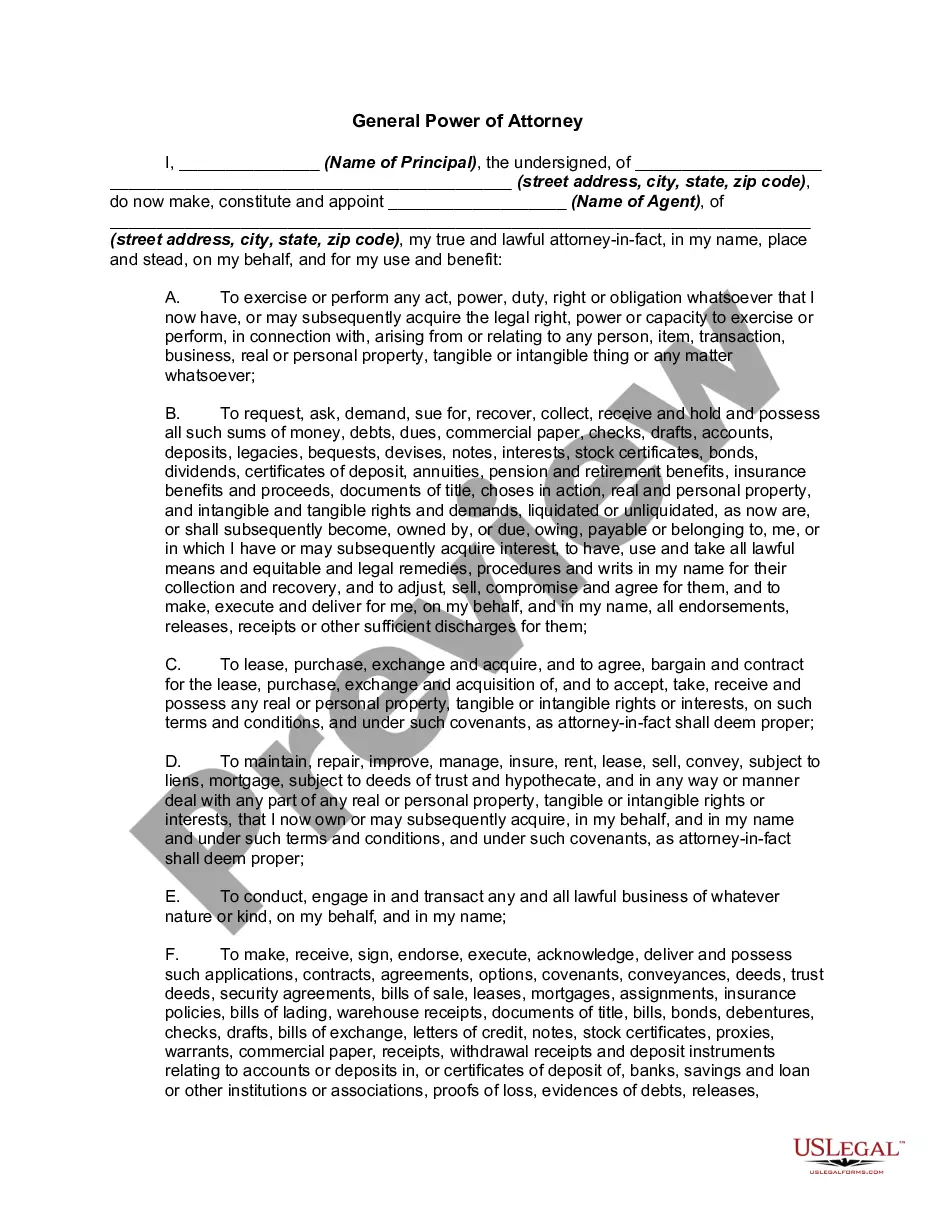

How to fill out General Power Of Attorney For Bank Account Operations?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous designs available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers a vast selection of templates, including the Massachusetts General Power of Attorney for Bank Account Management, which you can use for both business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to access the Massachusetts General Power of Attorney for Bank Account Management. Use your account to review the legal forms you may have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired Massachusetts General Power of Attorney for Bank Account Management. US Legal Forms is the largest repository of legal templates where you can find various document formats. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your locality/region.

- You can preview the form using the Review option and read the form summary to confirm it is suitable for you.

- If the form does not satisfy your requirements, utilize the Search feature to find the correct form.

- Once you are confident that the form is accurate, click the Purchase now option to obtain the form.

- Choose the pricing plan you prefer and input the necessary information.

- Create your account and complete the transaction using your PayPal account or a credit card.

Form popularity

FAQ

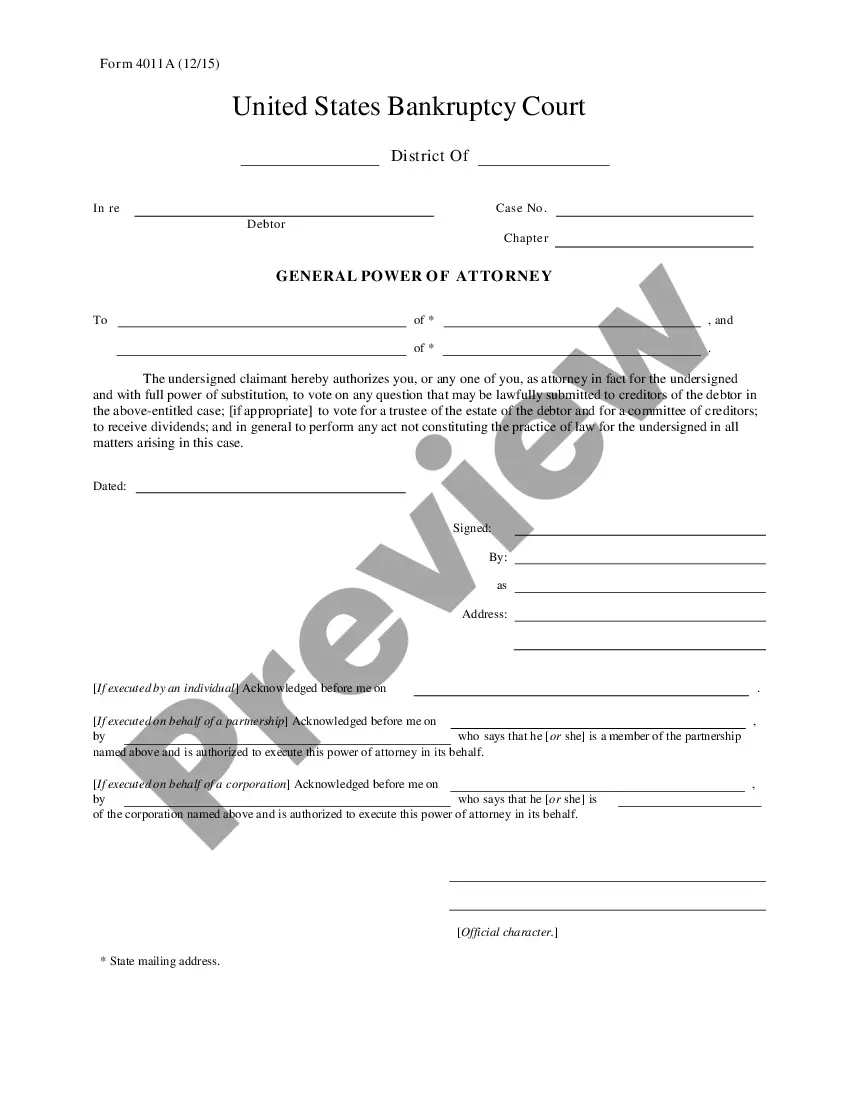

The POA authorizes the AIF to sign for and on behalf of the principal. A person with Power of Attorney for their parents can't actually add the POA to their bank accounts. However, they may change bank accounts to be jointly owned.

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

If you need help, contact our Client Service Center at (800) 392-5749 or submit your question by Secure Message on chase.com. Establish power of attorney on a brokerage account. Along with this form, you will also need to submit a durable Power of Attorney agreement.

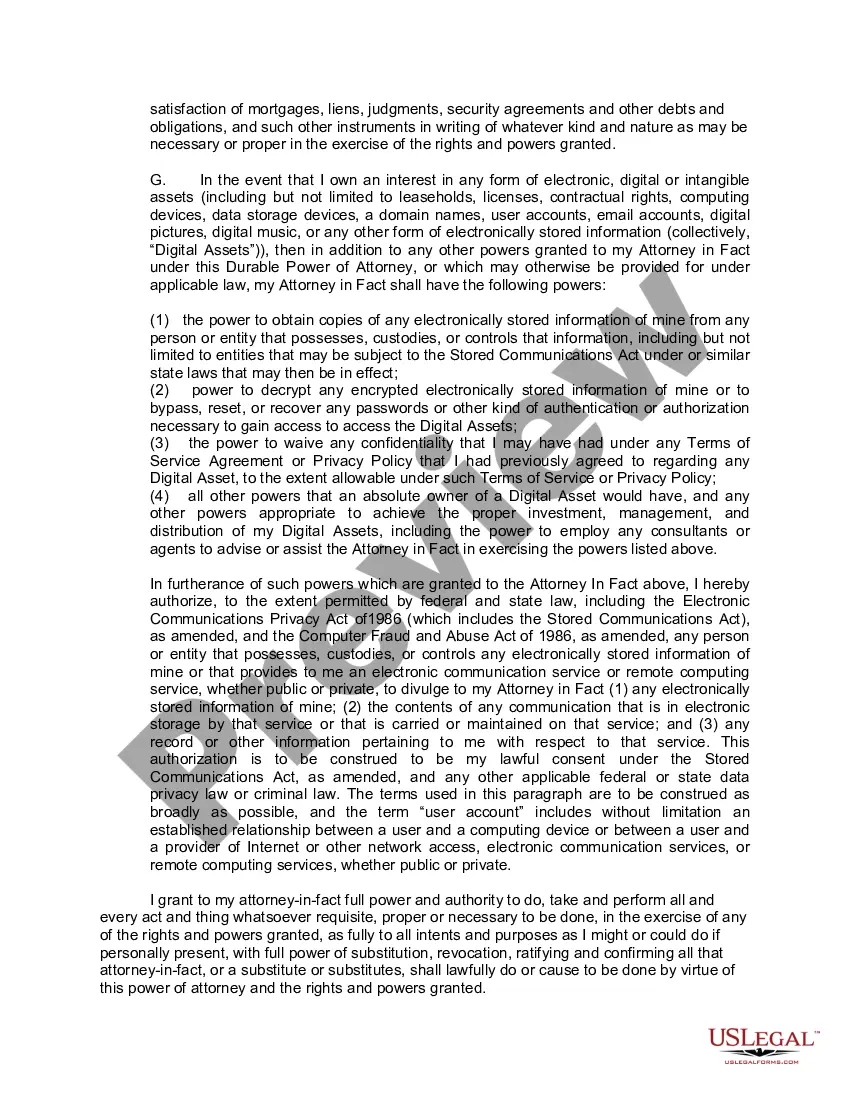

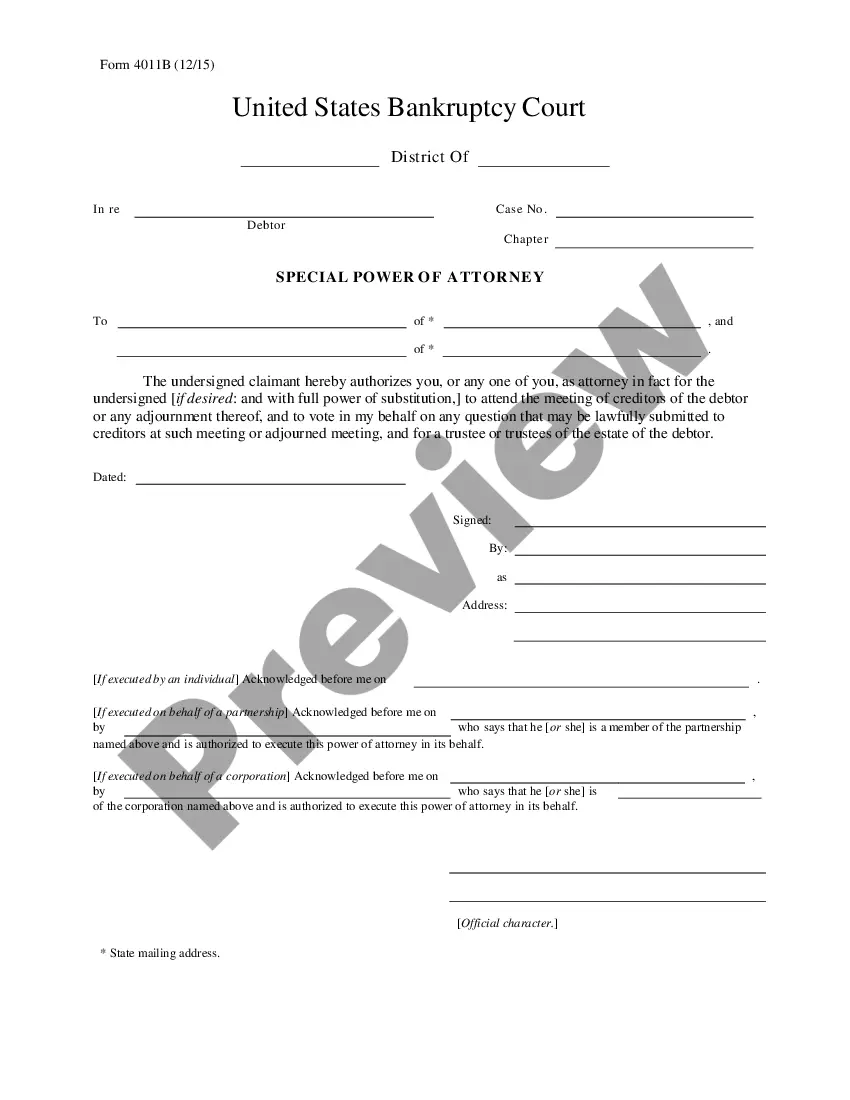

When you need someone to handle your finances on your behalf A power of attorney is a legal document giving a person (known as the agent) broad powers to manage matters on behalf of another person (known as the principal).

Contact the bank before having a financial power of attorney drafted by a lawyer.Send or deliver your previously drafted financial power of attorney document to the bank.Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.

When opening a bank account using a power of attorney, you will have to fill out forms with both your information as well as the information of the account holder. Provide the bank employee with the completed paperwork, your identification and the power of attorney. The bank will make a copy of the power of attorney.

A power of attorney for banking transactions is a POA that allows a trusted agent to deal with your bank account(s) on your behalf. If you want to set up a power of attorney in a way that allows someone to make bank transactions in your stead, your POA has to specifically state that.

While Massachusetts law does not technically require a POA to be notarized, signing your POA in the presence of a notary public is very strongly recommended. Many financial institutions will not want to rely on a POA unless it has been notarizeda process that helps to authenticate the document.

If one joint account holder loses capacity to operate their account and a registered enduring or lasting power of attorney is in place, then the bank will allow the attorney and the account holder (with capacity) to operate the account independently of each other, unless the account holder (with capacity) objects.

Give power of attorney to someone in India What is not covered: A POA holder cannot open bank accounts on your behalf. He can only operate bank accounts once they are opened.