Unless limited or prohibited by the articles or bylaws, action required or permitted by the RNPCA to be approved by the members may be approved without a meeting of members if the action is approved by members holding at least eighty percent (80%) of the voting power. The action must be evidenced by one or more consents in the form of a record bearing the date of signature and describing the action taken, signed by those members representing at least eighty percent (80%) of the voting power, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting

Description

How to fill out Consent To Action By The Board Of Trustees Of A Non-Profit Church Corporation In Lieu Of Meeting?

If you require thorough, acquire, or generate approved document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Capitalize on the site’s straightforward and convenient search to locate the documents you need.

Many templates for commercial and personal purposes are categorized by types and jurisdictions, or keywords.

Every legal document format you acquire is yours indefinitely. You will have access to each form you've obtained in your account. Visit the My documents section to select a form to print or download again.

Complete and obtain, and print the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to locate the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and select the Obtain option to retrieve the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct region/state.

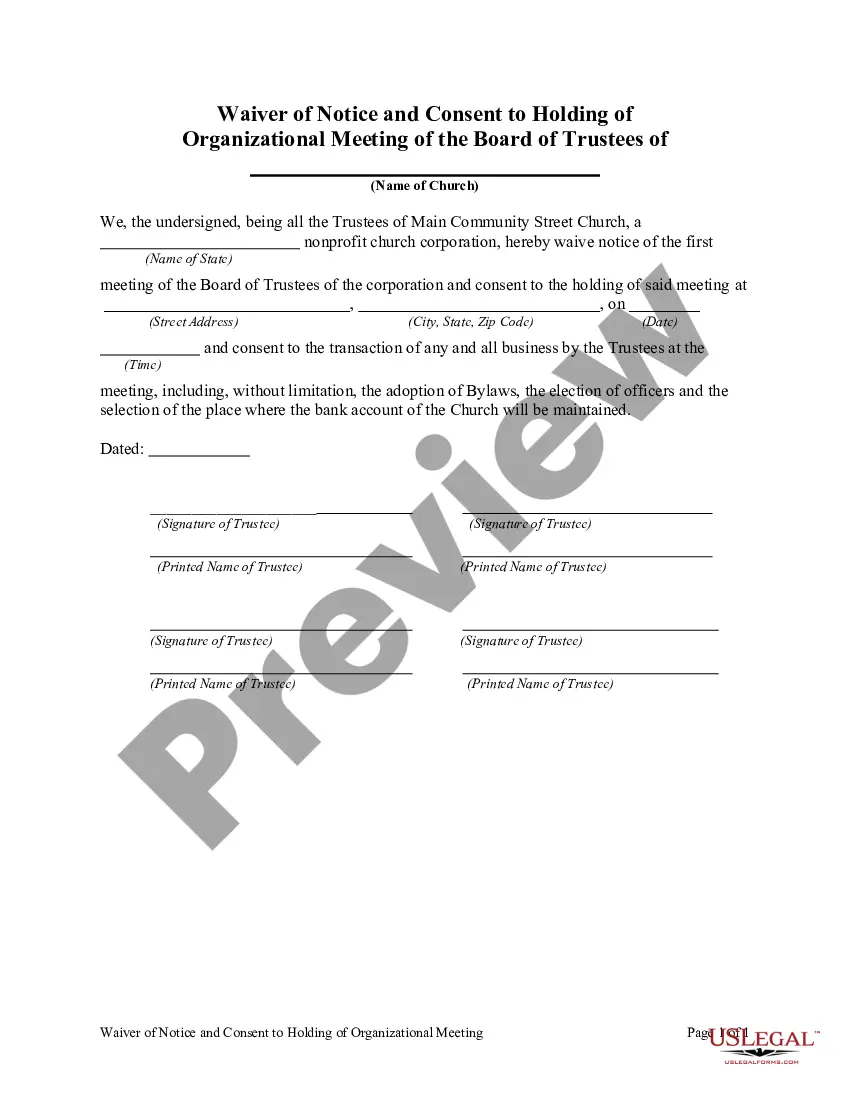

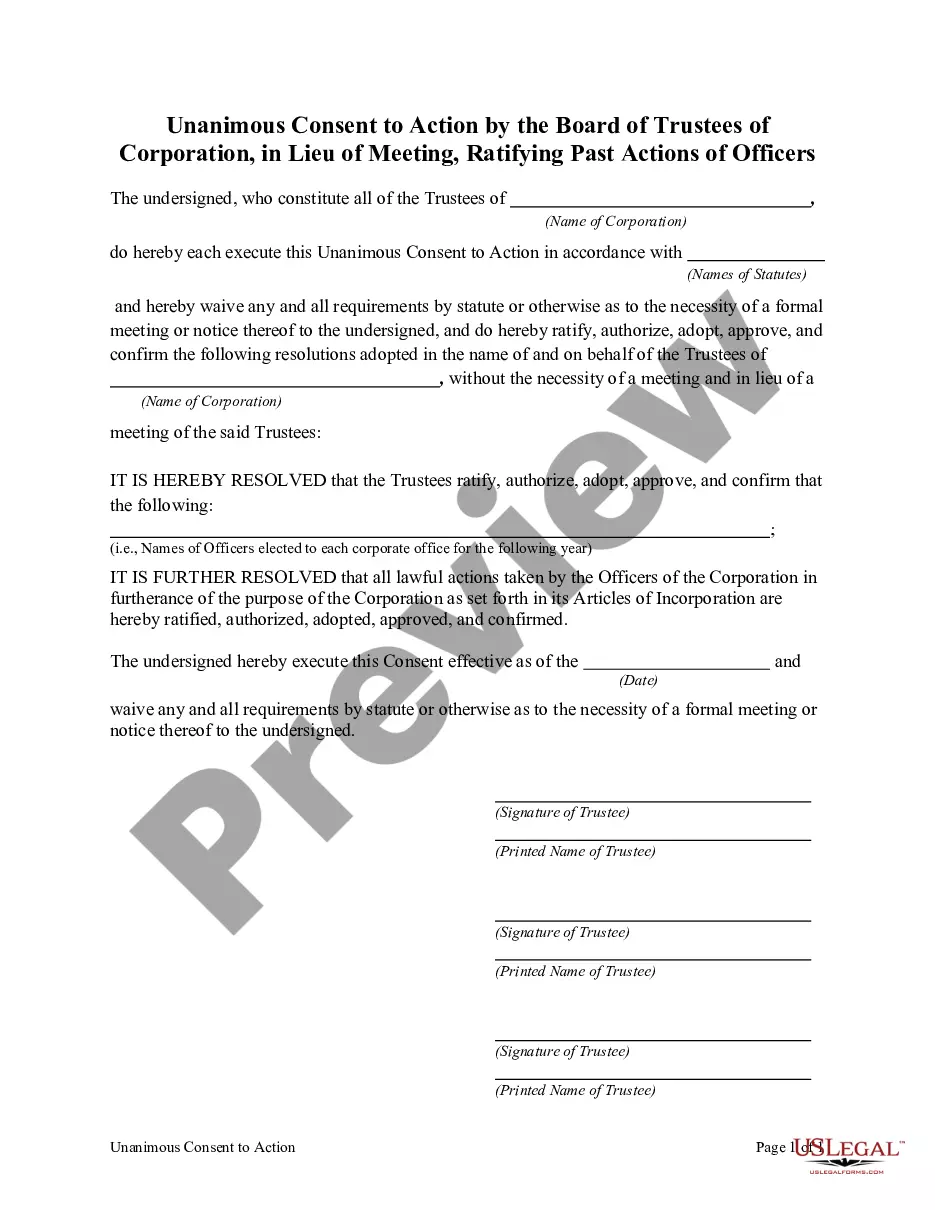

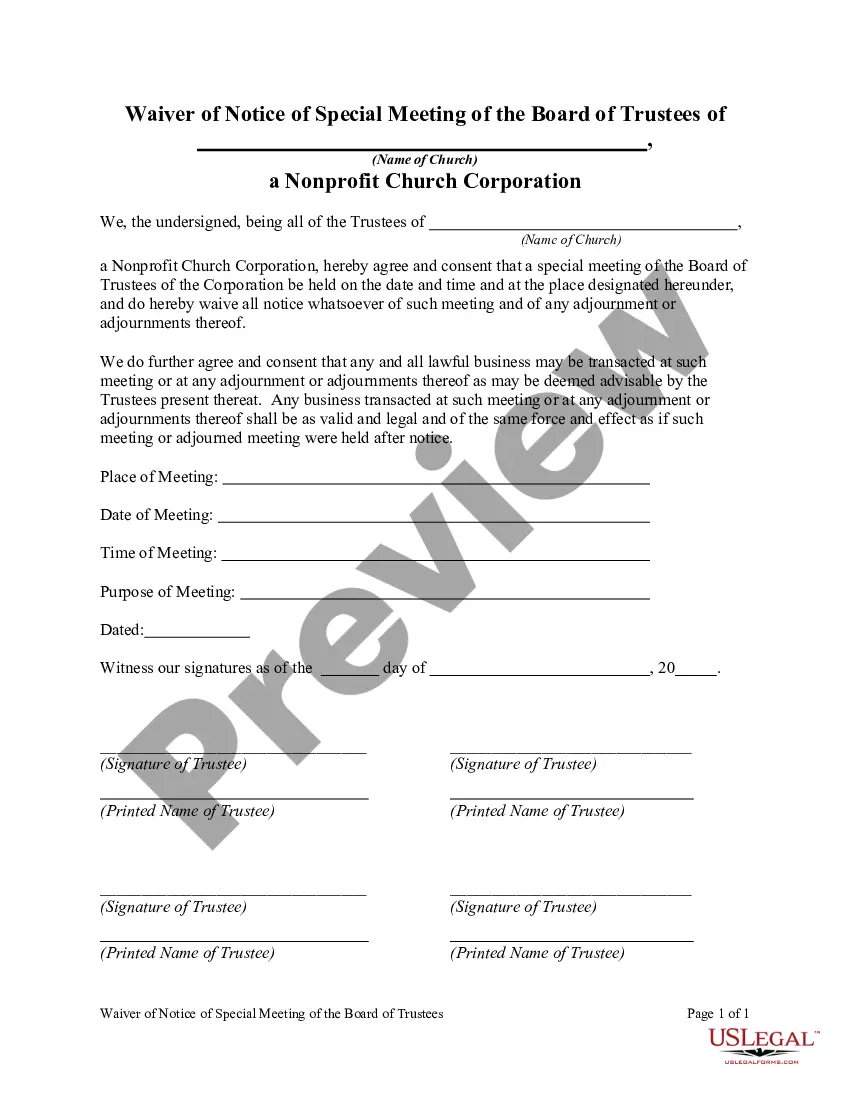

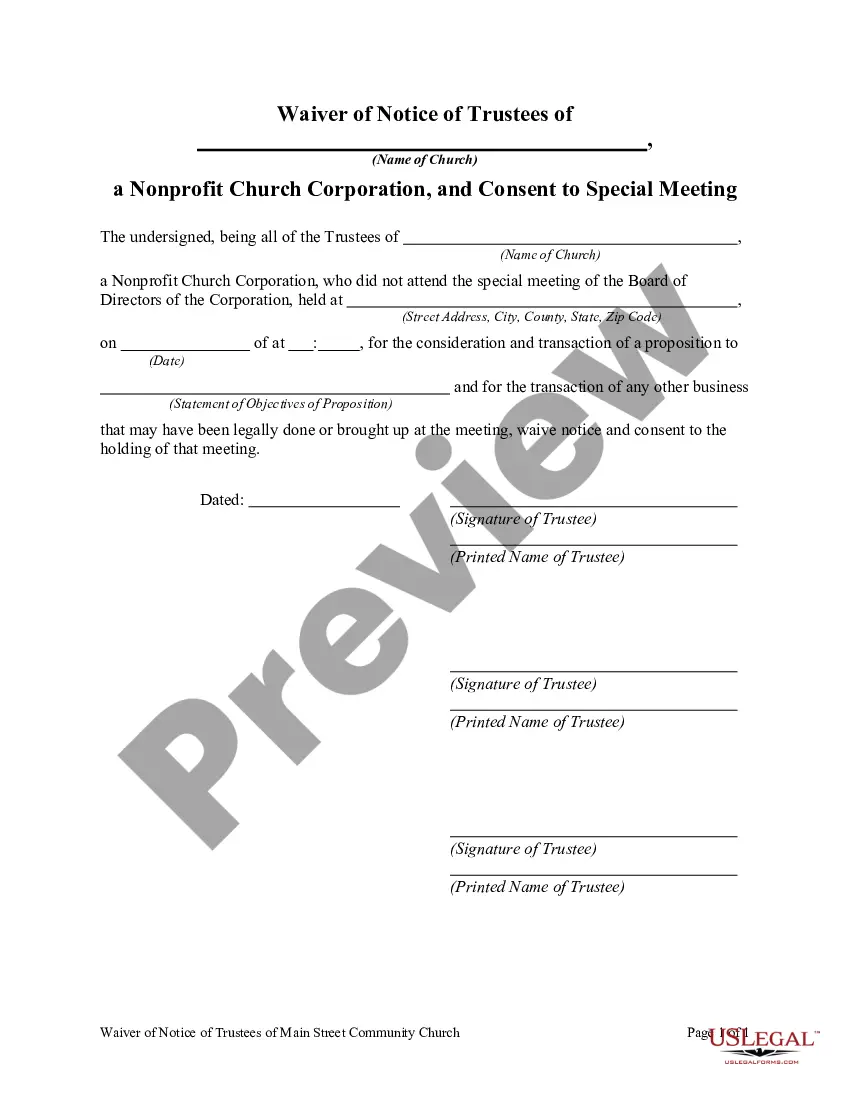

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form.

- Step 4. Once you find the form you need, click the Get now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting.

Form popularity

FAQ

Starting a nonprofit in Massachusetts involves several key steps: defining your mission, forming a board of directors, and drafting bylaws. You also need to file your organization’s articles of incorporation with the state and apply for federal tax exemption. When you're ready to manage decisions effectively, consider using the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting to streamline governance.

A written consent to action without a meeting is a formal method for board members to approve decisions through signatures on a document rather than in a physical gathering. This practice is efficient and convenient for busy board members. It fits perfectly within the framework of the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting, allowing for timely resolutions.

To remove someone from a non-profit board, you typically need to follow the procedures outlined in your organization’s bylaws. This often involves a vote by the remaining board members or the governing body of the non-profit. If necessary, you may also want to file a Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting to formalize the decision without a meeting. Using clear documentation is essential to ensure compliance and avoid future disputes.

There is no legally mandated number of directors needed for a 501(c)(3) board. Based on rulings made by the IRS, it seems that the IRS very strongly suggests that a 501(c)(3) board consist of at least three directors.

Request a meeting of the board of directors via postal mail or email (again, you will have to refer to your bylaws). The purpose of the meeting, date and time should be listed on the request. The notice must be sent to all directors/shareholders entitled to vote on the change.

Under California law, a nonprofit board may be composed of as few as one director, but the IRS may take issue with granting recognition of 501(c)(3) status to a nonprofit with only one director. It is commonly recommended that nonprofits have between three and 25 directors.

According to Leading with Intent: 2017 National Index of Nonprofit Board Practices, the average size of a nonprofit board is 15 members; the median board size is 13 members.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

A 501(c)(3) eligible nonprofit board of directors in Massachusetts MUST: Have a minimum of three unrelated board members. Elect the following members: president (that must serve as a director as well), treasurer, and clerk.

The Top 10 Legal Risks Facing Nonprofit BoardsExposures from social media use, misuse and naivete.Unhappy staff and volunteers.IRS Form 990 and federal tax-exempt status.Copyrights and trademarks.Lobbying and political activity compliance.Third-party sexual harassment.More items...