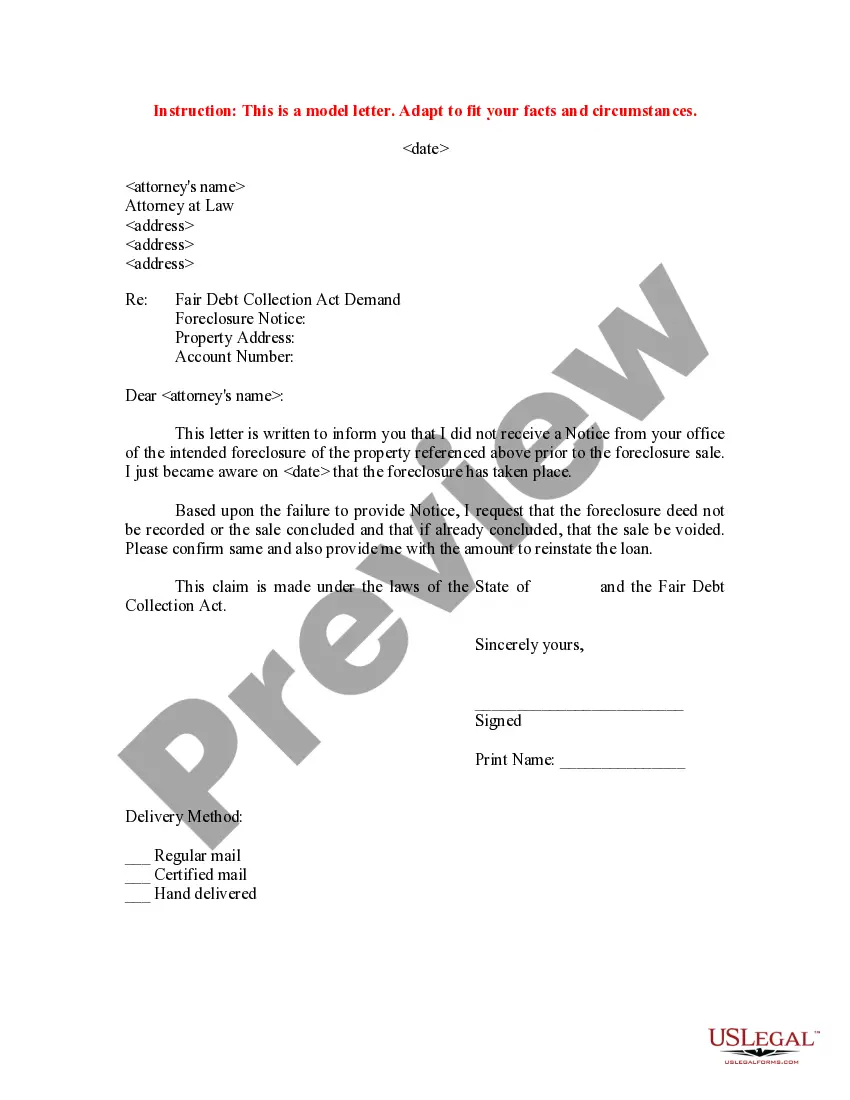

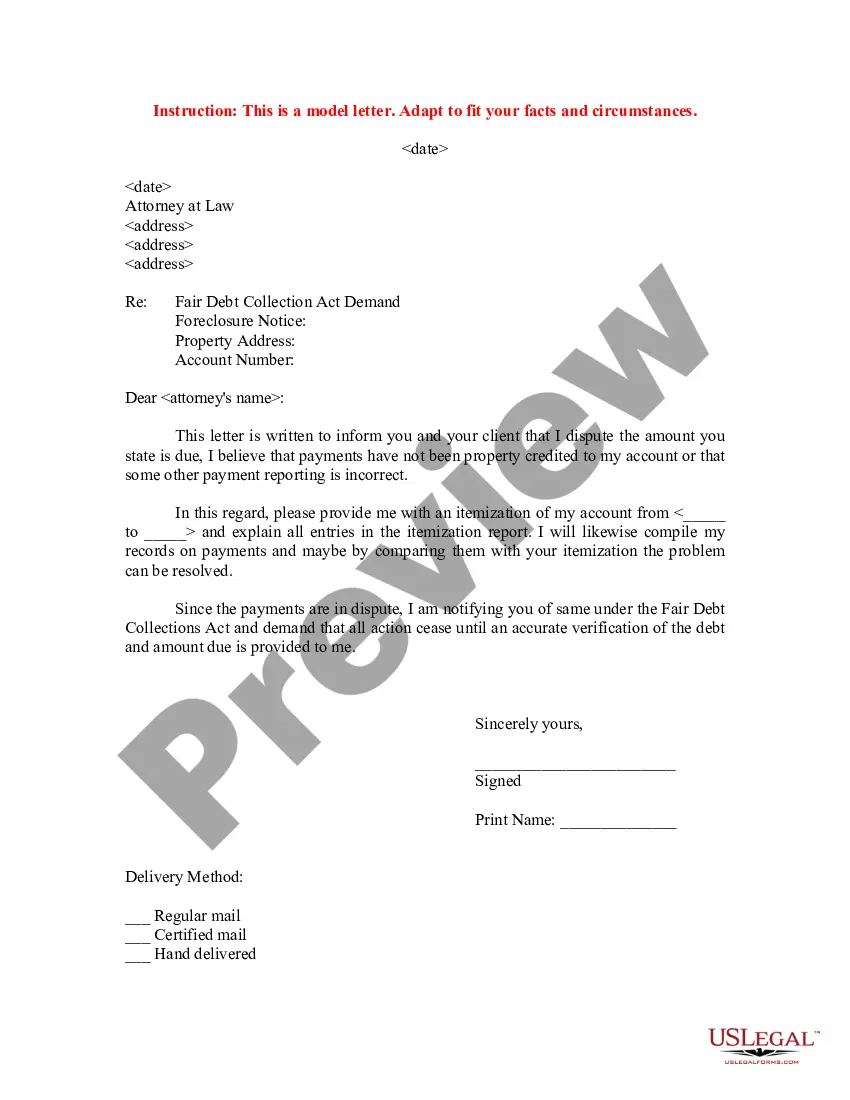

Massachusetts Sample Letter to Foreclosure Attorney - Payment Dispute

Description

How to fill out Sample Letter To Foreclosure Attorney - Payment Dispute?

US Legal Forms - one of the biggest libraries of legitimate forms in the USA - provides a wide array of legitimate papers web templates you can acquire or printing. While using web site, you can find a huge number of forms for company and person uses, categorized by groups, claims, or search phrases.You can find the latest versions of forms much like the Massachusetts Sample Letter to Foreclosure Attorney - Payment Dispute in seconds.

If you currently have a subscription, log in and acquire Massachusetts Sample Letter to Foreclosure Attorney - Payment Dispute in the US Legal Forms collection. The Obtain switch can look on every single type you look at. You have accessibility to all in the past delivered electronically forms inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, allow me to share easy instructions to obtain started off:

- Make sure you have picked out the best type for the town/region. Go through the Preview switch to analyze the form`s content material. See the type explanation to ensure that you have chosen the correct type.

- If the type doesn`t match your needs, take advantage of the Research discipline towards the top of the display to find the one that does.

- When you are happy with the form, verify your choice by clicking on the Buy now switch. Then, opt for the prices plan you prefer and supply your accreditations to register to have an accounts.

- Method the transaction. Make use of your credit card or PayPal accounts to perform the transaction.

- Choose the formatting and acquire the form in your system.

- Make modifications. Load, revise and printing and indicator the delivered electronically Massachusetts Sample Letter to Foreclosure Attorney - Payment Dispute.

Each design you included with your account does not have an expiry date which is your own property for a long time. So, if you would like acquire or printing one more backup, just check out the My Forms section and click on the type you require.

Get access to the Massachusetts Sample Letter to Foreclosure Attorney - Payment Dispute with US Legal Forms, probably the most extensive collection of legitimate papers web templates. Use a huge number of skilled and express-particular web templates that meet your organization or person needs and needs.

Form popularity

FAQ

The lender - the ?mortgagee? must give you a Right to Cure Notice once every 3 years. Usually this notice says that you have 150 days to pay your missed payments or the bank can begin to foreclose.

Under Massachusetts Law, a homeowner is given 150 days to bring the loan current, however if the borrower fails to respond to the foreclosing entity, this time frame can be reduced to 90 days.

When Can a Massachusetts Foreclosure Start? Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a couple of exceptions.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Which Type of Foreclosure Is Permitted in Massachusetts? If you default on your mortgage payments in Massachusetts, the lender may foreclose using a judicial or nonjudicial method.

The bank is allowed to bid at the auction. The bank often wins the property. The buyer usually has thirty days to pay the full amount that they bid, and sign the paperwork. Once all the paperwork is signed, the bank signs the deed and gives it to the new owner.

The law now requires that lenders send a 150-day right-to-cure notice rather than a 90-day notice in any case where the property sought to be foreclosed is the borrower's principal residence and is collateral for a residential loan.

To cure, you will need to make all your missed payments to the lender before the cure period ends. If you can't cure, you can use this period to apply for a loan modification. You may also receive a Right to Request a Modified Mortgage Loan notice.