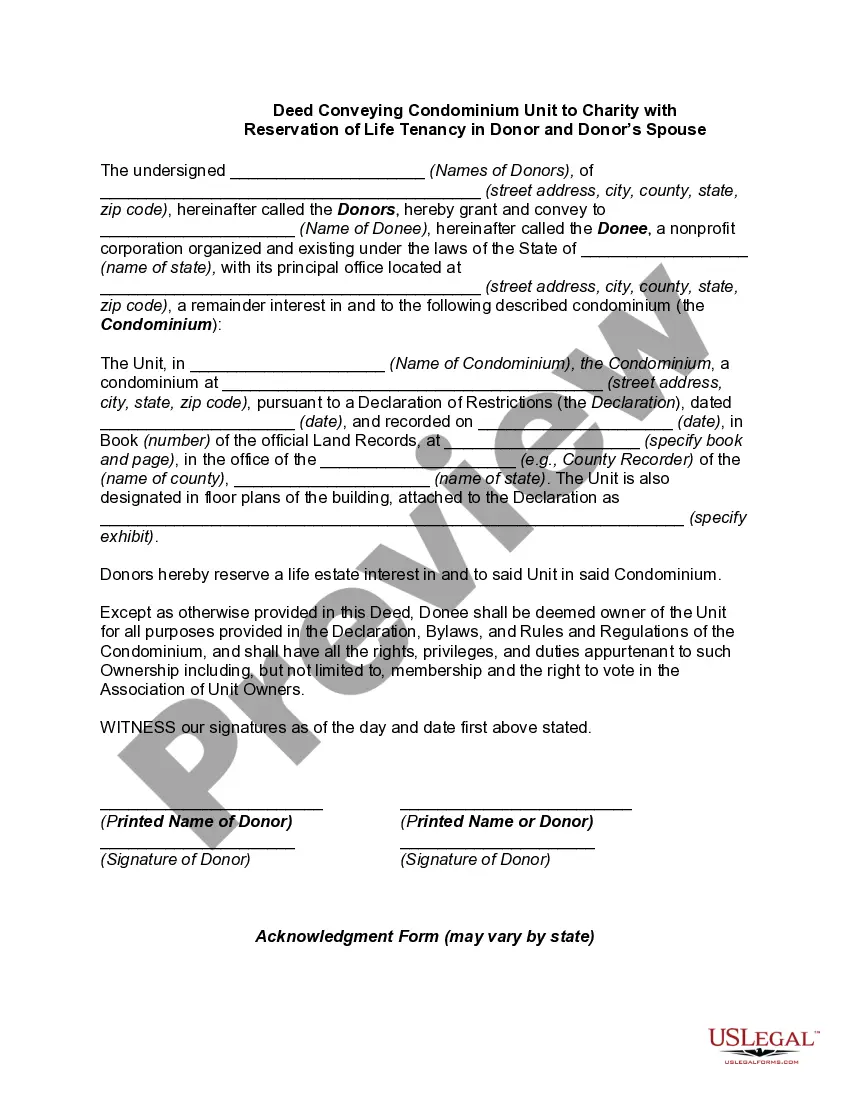

A Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legal document that transfers ownership of a condominium unit to a charitable organization while also granting the donor and their spouse the right to live in the unit for the remainder of their lives. This type of deed provides a unique way for individuals to donate a property to charity while still enjoying the benefits of living in it during their lifetime. Keywords: Massachusetts, deed, conveying, condominium unit, charity, reservation of life tenancy, donor, donor's spouse. There are different variations of this type of deed that may arise depending on specific circumstances or preferences. Some variations include: 1. Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor Only: In this type of deed, only the donor retains the right to live in the condominium unit for the remainder of their life. The spouse does not have any life tenancy rights. 2. Massachusetts Deed Conveying Condominium Unit to Charity with Conditional Reservation of Life Tenancy: This type of deed includes specific conditions or restrictions on the life tenancy rights. For example, it may state that the donor and their spouse can live in the unit until they decide to move out or until they require an assisted living facility or nursing home. 3. Massachusetts Deed Conveying Condominium Unit to Charity with Right of Occupancy: This variation grants the donor and their spouse the right to occupy the condominium unit rather than a life tenancy right. This means they can live in the unit but do not have a legal right to continue living there for their entire lives. The charity has more flexibility if they wish to take possession of the unit at a certain point in the future. These are just a few examples of the potential variations of a Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. The specific terms and conditions of each deed can vary depending on the preferences and intentions of the donor, as well as any legal requirements or regulations in Massachusetts. It is essential to consult with a qualified attorney to draft and execute the deed properly and ensure it aligns with the donor's intentions and the applicable laws.

Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Massachusetts Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

US Legal Forms - among the most significant libraries of authorized types in America - gives an array of authorized file layouts you may acquire or produce. While using site, you will get a huge number of types for organization and individual purposes, sorted by groups, claims, or keywords and phrases.You will find the most up-to-date types of types such as the Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse within minutes.

If you have a registration, log in and acquire Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse in the US Legal Forms collection. The Obtain button can look on every single type you perspective. You get access to all earlier delivered electronically types in the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, here are easy recommendations to obtain started:

- Be sure to have chosen the best type for the city/county. Select the Review button to analyze the form`s content. See the type information to ensure that you have chosen the appropriate type.

- In case the type does not match your demands, take advantage of the Lookup area on top of the screen to find the the one that does.

- If you are content with the shape, validate your selection by clicking the Get now button. Then, choose the pricing plan you favor and supply your qualifications to register on an bank account.

- Approach the financial transaction. Utilize your charge card or PayPal bank account to complete the financial transaction.

- Select the file format and acquire the shape on your gadget.

- Make modifications. Fill up, modify and produce and indication the delivered electronically Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

Every single template you put into your account lacks an expiry time which is your own for a long time. So, if you wish to acquire or produce another version, just check out the My Forms segment and then click about the type you will need.

Get access to the Massachusetts Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse with US Legal Forms, one of the most considerable collection of authorized file layouts. Use a huge number of expert and express-particular layouts that satisfy your small business or individual requirements and demands.

Form popularity

FAQ

In legal terms, it is an estate in real property that ends at death, when the property rights may revert to the original owner or to another person. The owner of a life estate is called a "life tenant".

You cannot simply remove or change a name once it is on a deed to real estate like you can change the beneficiary on a life insurance policy or bank account. Once a remainderman is named on the deed to your house, he or she has an interest in the home and his or her legal problems could become yours.

Master deed. This is a deed filed by a condominium owner to record the property and allow sales of the individual condos and use of communal areas by owners.

This is a deed in which you transfer your home (or other real estate) to the persons whom you want to have it after you pass away (remaindermen), but reserve unto yourself the right to live in your home until you pass away. Typically, the remaindermen are your children.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner. Life estates can be used to avoid probate and to give a house to children without giving up the ability to live in it.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.