A Massachusetts Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan, where the borrower promises to repay a specific amount of money to the lender on a predetermined date. This type of promissory note is often used in various financial transactions, such as personal loans, business loans, or real estate transactions. The Massachusetts Promissory Note Payable on a Specific Date contains specific information, including the names and contact details of both the lender and the borrower, the loan amount, the interest rate (if any), the repayment terms, and the maturity date. The note also clearly states the consequences of defaulting on the loan, which may include late fees, penalties, or legal action. In Massachusetts, there are different types of promissory notes payable on a specific date that are commonly used. These include: 1. Demand Promissory Note: This note stipulates that the lender can demand full repayment of the loan at any given time, allowing flexibility for both parties. 2. Installment Promissory Note: This note divides the loan amount into regular installments, typically monthly or quarterly, making it more manageable for the borrower to repay the loan over a predetermined period. 3. Balloon Promissory Note: This note requires the borrower to make smaller periodic payments throughout the loan term, with a large lump-sum payment (balloon payment) due at the end of the loan term. 4. Secured Promissory Note: This note includes collateral, such as real estate or personal assets, that the lender can claim in case of default. This provides additional security for the lender. 5. Unsecured Promissory Note: This note does not require any collateral and relies solely on the borrower's creditworthiness. It is commonly used among family members or close friends. It's important to note that drafting a Massachusetts Promissory Note Payable on a Specific Date should be done in consultation with a legal professional to ensure compliance with state laws and to address specific circumstances or requirements.

Massachusetts Promissory Note Payable on a Specific Date

Description

How to fill out Massachusetts Promissory Note Payable On A Specific Date?

Finding the right authorized file format can be a struggle. Needless to say, there are a variety of layouts available online, but how would you obtain the authorized form you require? Take advantage of the US Legal Forms web site. The support delivers a large number of layouts, like the Massachusetts Promissory Note Payable on a Specific Date, which you can use for enterprise and personal requires. All the varieties are checked out by specialists and satisfy federal and state requirements.

When you are already listed, log in for your bank account and click on the Acquire button to have the Massachusetts Promissory Note Payable on a Specific Date. Utilize your bank account to check through the authorized varieties you might have acquired previously. Proceed to the My Forms tab of your own bank account and get an additional version of your file you require.

When you are a brand new customer of US Legal Forms, here are straightforward guidelines that you should comply with:

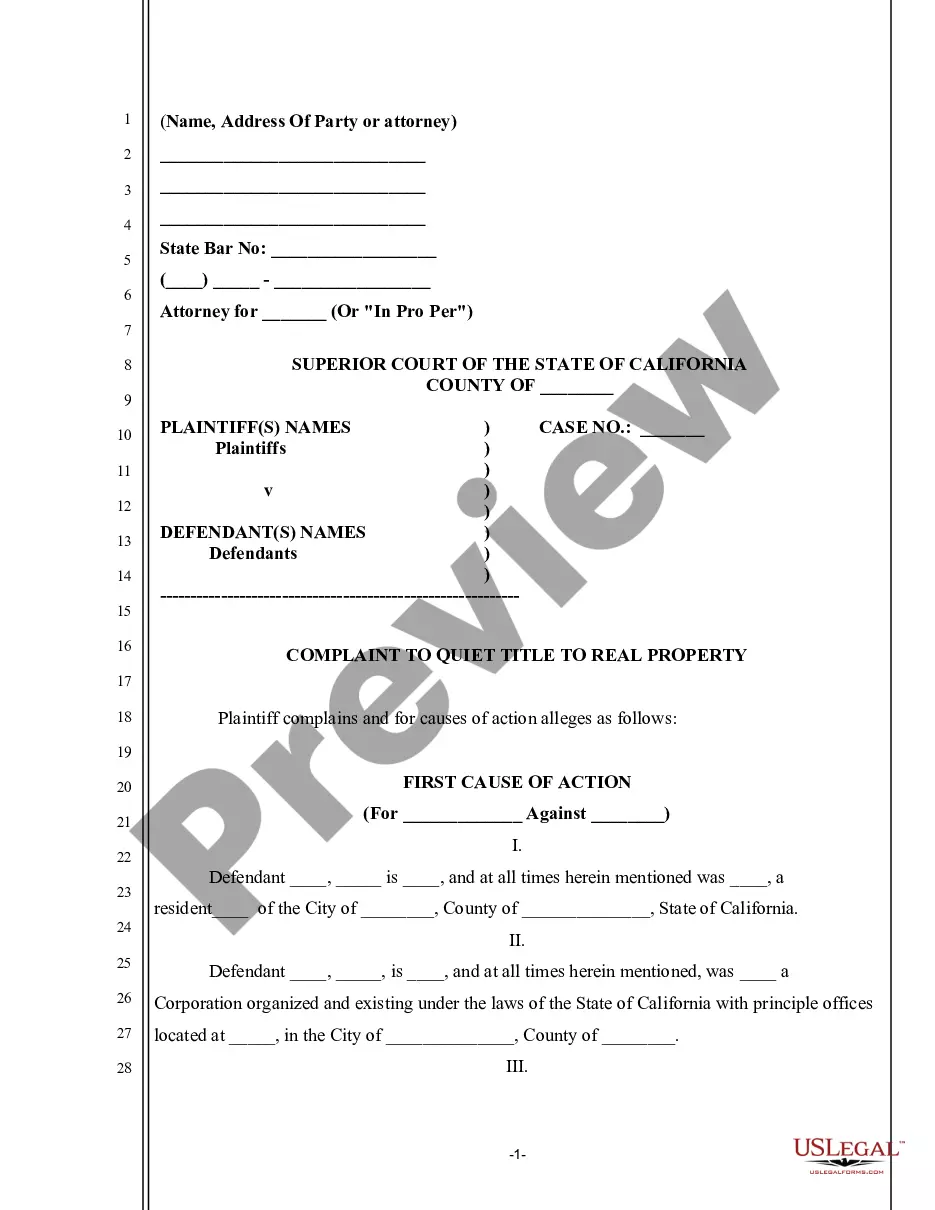

- Very first, be sure you have chosen the appropriate form for your metropolis/area. You are able to look over the form using the Review button and read the form information to make sure it will be the right one for you.

- In the event the form is not going to satisfy your requirements, utilize the Seach field to get the proper form.

- When you are sure that the form would work, click on the Get now button to have the form.

- Select the rates prepare you want and type in the essential details. Build your bank account and pay for the transaction with your PayPal bank account or Visa or Mastercard.

- Pick the document file format and obtain the authorized file format for your product.

- Complete, edit and print out and sign the attained Massachusetts Promissory Note Payable on a Specific Date.

US Legal Forms is the greatest library of authorized varieties where you will find numerous file layouts. Take advantage of the company to obtain professionally-made files that comply with condition requirements.

Form popularity

FAQ

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Short answer: A promissory note must be signed by the borrower. However, an undated but signed promissory note is valid and effective because the signature date is not an essential element of a promissory note.

A prepayment may be allowed by a promissory note. A prepayment provision would allow you, as a borrower, to pay a debt early without paying an extra premium payment or penalty. It can consist of the unpaid accrued interest and the unpaid principal sum as of the date of prepayment.

Generally, a note cannot be prepaid before the date established in the note for payment. A state statute that establishes a ceiling or maximum rate of interest to be charged on the loan is called a usury statute.

Many differences among promissory notes relate to when and how the borrowed amount will be repaid. Although you are free to negotiate terms that work for your arrangement, your note must either have an end date or be payable when the lender demands it. Unconditional .

A Promissory Note Due on a Specific Date is a loan contract that enables a lender and borrower to agree on a set date for repayment. By giving a clear deadline to the borrower, this lending document can help to ensure that the loan will be repaid in full and on time.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Definition: The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. A note or promissory note is a written promise to a pay specific amount of money at a future date. The future date is called the maturity date.