Massachusetts Covenant Not to Sue by Widow of Deceased Stockholder

Category:

State:

Multi-State

Control #:

US-0624BG

Format:

Word;

Rich Text

Instant download

Description

A covenant not to sue is an agreement entered into by a person who has a legal claim against another but agrees not to pursue the claim. Such a covenant does not extinguish a cause of action and does not release other joint tortfeasors even if it does not

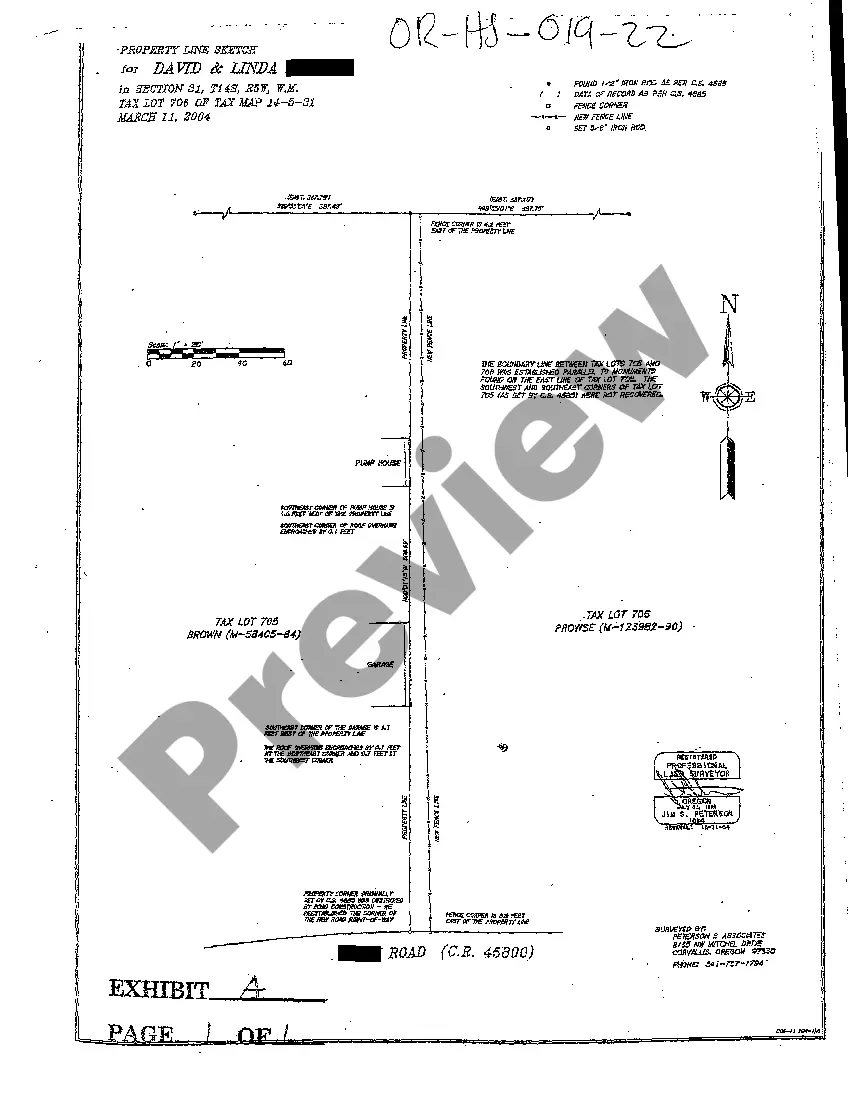

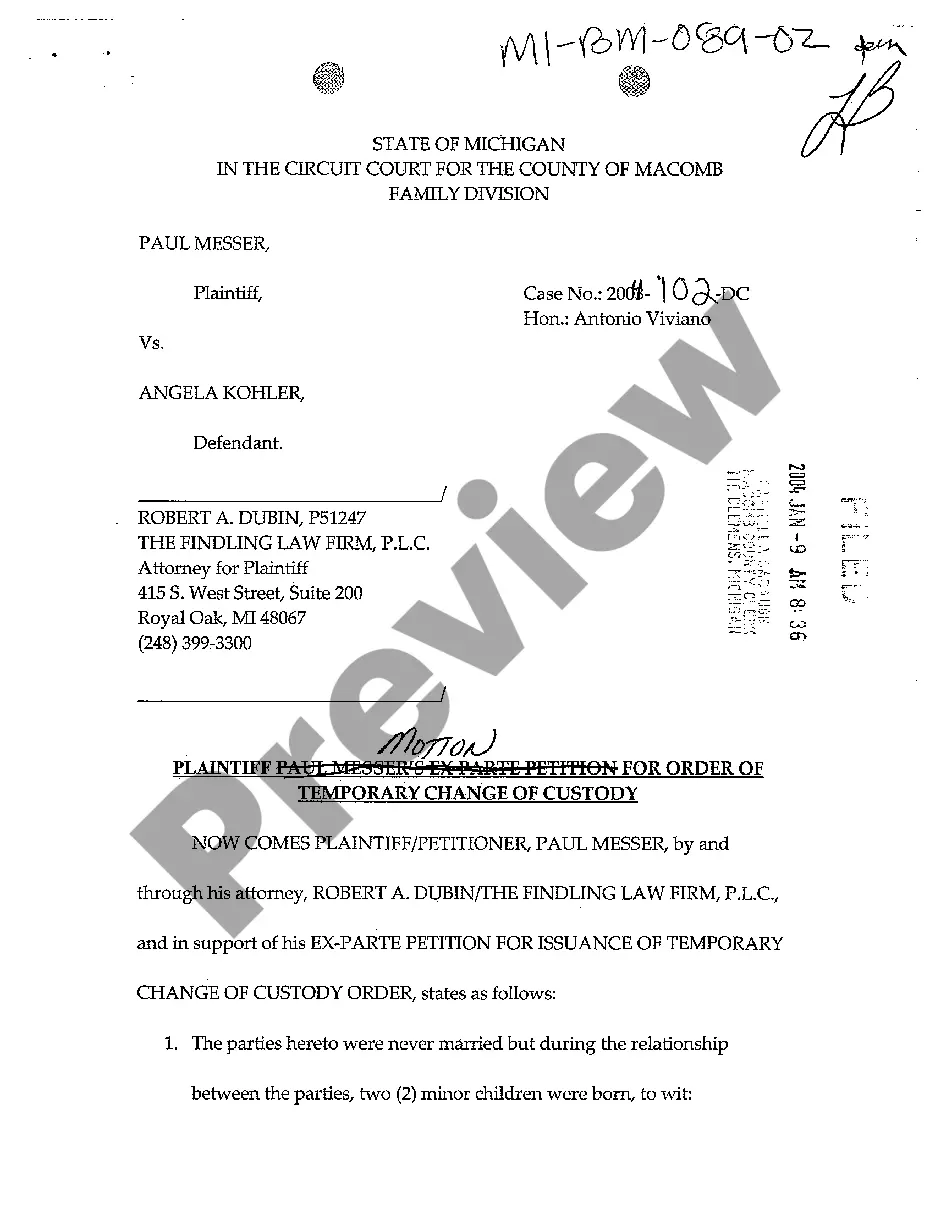

Free preview

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

Have you been in a position that requires documents for occasional organizational or personal needs almost daily.

There is an abundance of legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Massachusetts Covenant Not to Sue by Widow of Deceased Stockholder, which are crafted to comply with both state and federal regulations.

If you find the correct form, click Acquire now.

Select the pricing option you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Covenant Not to Sue by Widow of Deceased Stockholder template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/county.

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the appropriate form.

- If the form isn’t what you’re seeking, use the Search area to find the form that meets your needs and requirements.