Massachusetts LLC Operating Agreement for Two Partners

Description

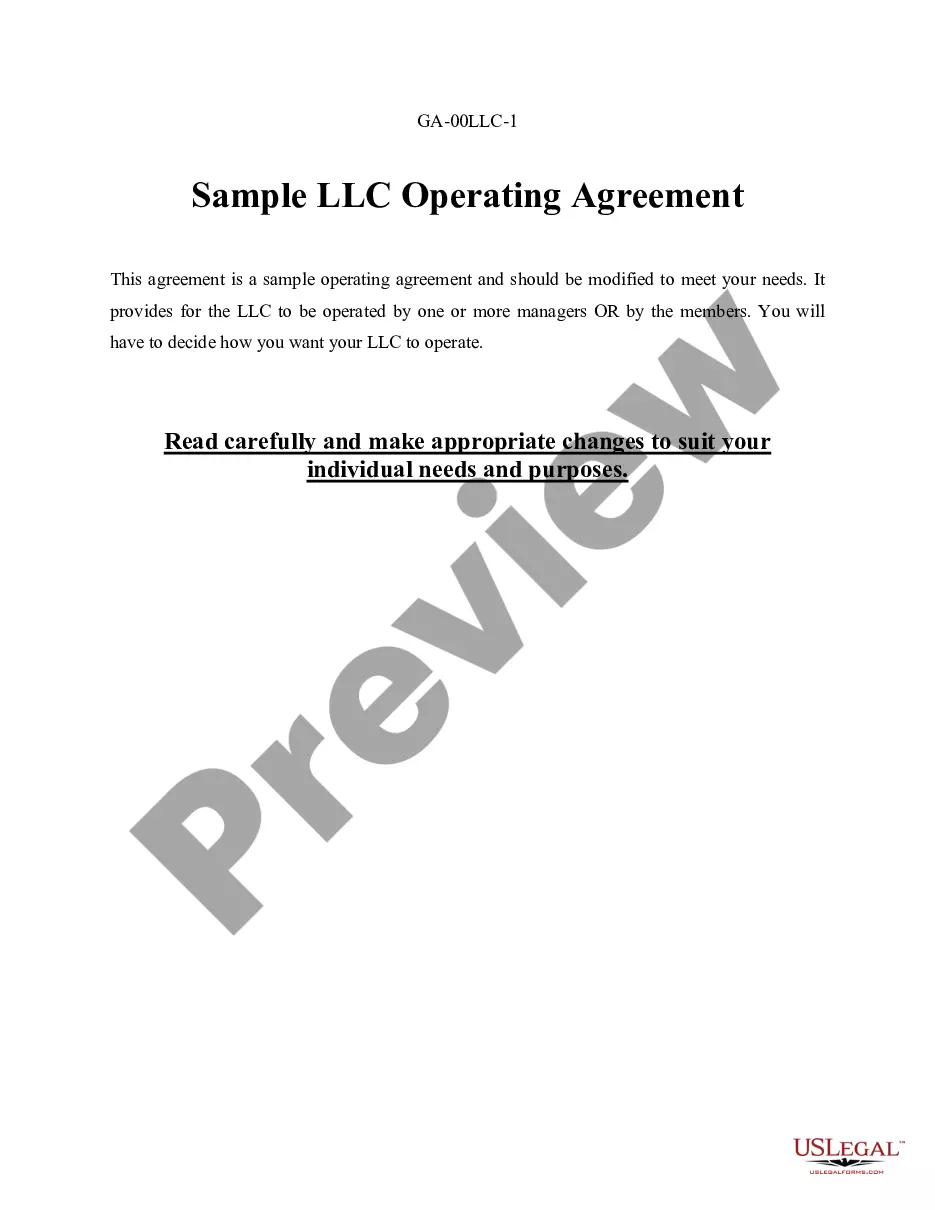

How to fill out LLC Operating Agreement For Two Partners?

US Legal Forms - one of the most notable compilations of legal documents in the United States - offers a variety of legal file templates you can download or print.

By using the website, you can access thousands of forms for business and individual needs, categorized by types, states, or keywords.

You can find the latest versions of documents similar to the Massachusetts LLC Operating Agreement for Two Partners in just minutes.

Read the form details to confirm that you have selected the correct form.

If the form does not fulfill your requirements, utilize the Search box at the top of the screen to find the one that does.

- If you already possess a membership, Log In and download the Massachusetts LLC Operating Agreement for Two Partners from the US Legal Forms collection.

- The Download button will appear on each form you view.

- You can access all previously obtained forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/region.

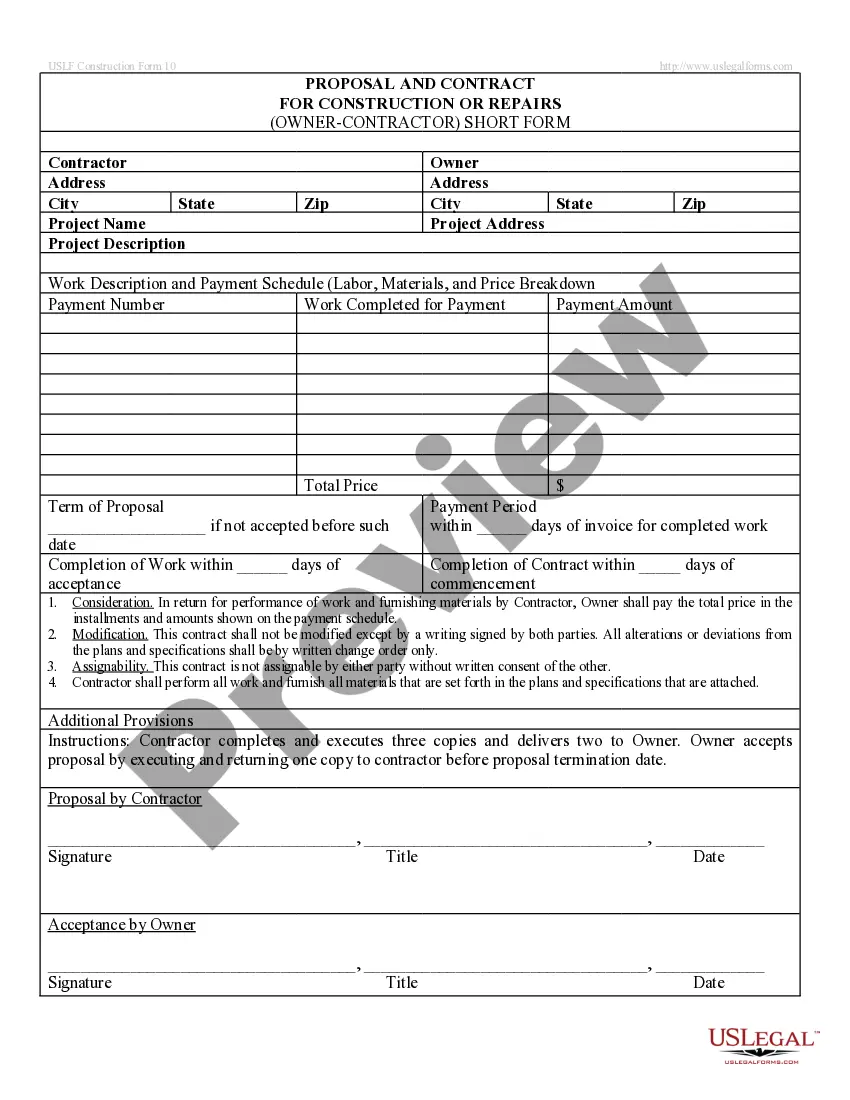

- Click the Review button to inspect the form’s content.

Form popularity

FAQ

Registering an LLC for Multiple Members State laws generally allow the registration of LLCs with several members. To create an LLC owned by many people, the intended owners of the LLC are required to file articles of organization with any state agency in charge of registering such business entities.

Basic Steps to Form a Multi-Member LLCChoose a business name.Apply for an EIN (Employer Identification Number).File your LLC's articles of organization.Create an operating agreement.Apply for the necessary business licenses and permits.Open a separate bank account for your business.

member LLC (also called a membermanaged LLC) is a limited liability company that has more than one owner but no managers. Instead, owners run the daytoday operations of the LLC.

member LLC is a limited liability company with two or more members. Like a singlemember LLC, a multimember LLC (MMLLC) is a lightweight business entity that combines the flexibility of a partnership with the limited liability of a corporation.

The most popular types of two-members LLCs are businesses run by a husband and wife or businesses with friends as partners. A multi-member LLC can be formed in all 50 states and can have as many owners as needed unless it chooses to form as an S corporation, which would limit the number of owners to 100.

Member LLC Operating Agreement is a document that establishes how an entity with two (2) or more members will be run. Without putting the contract into place, the entity is governed in accordance with the rules and standards established by the state, which may or may not align with the company's goals.

Importance of an Operating AgreementSometimes, only LLCs with more than one member are required to have an operating agreement.

An LLC operating agreement is not required in Massachusetts, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

member LLC operating agreement is a legal contract that outlines the agreedupon ownership structure and sets forth the governing terms for a multimember LLC. In addition, it sets clear expectations about each member's powers, roles, and responsibilities.