The Massachusetts Charity Subscription Agreement is a legal contract established between a charitable organization and its supporters or donors. It serves as a formal agreement that outlines the terms and conditions of regular donations made by individuals or entities towards the charitable cause in Massachusetts. This agreement is primarily designed to promote long-term commitments from donors, ensuring consistent and predictable funding for the organizations' philanthropic efforts. By subscribing to this agreement, donors affirm their commitment to contribute regularly, either on a monthly, quarterly, or annual basis, as specified in the agreement. The Massachusetts Charity Subscription Agreement includes various important elements to safeguard the interests of both the charitable organization and the donor. These elements include the duration of the agreement, the donation amount or frequency, the preferred method of payment, and any specific guidelines for the utilization of the funds. Additionally, the agreement might also outline the donor's entitlement to any benefits or recognition associated with their contributions, such as invitations to special events, acknowledgment in publications, or naming rights for specific initiatives or programs. There might be different types of Massachusetts Charity Subscription Agreements based on the specific nature and objectives of the charitable organization. Some common variations may include: 1. General Charity Subscription Agreement: This type of agreement is applicable to a wide range of charitable organizations, covering various causes such as education, healthcare, environmental conservation, poverty alleviation, arts and culture, or animal welfare. 2. Restricted-Use Charity Subscription Agreement: In certain cases, donors may wish to restrict the use of their donations to support specific projects, programs, or initiatives within the charity. This type of agreement ensures that the funds are utilized exclusively for the designated purpose. 3. Endowed Charity Subscription Agreement: Some donors may choose to create an endowment fund within the charitable organization. This agreement establishes a perpetual source of funding, where only a portion of the returns on the principal investment is utilized for ongoing charitable activities, ensuring the long-term sustainability of the organization. When entering into a Massachusetts Charity Subscription Agreement, both the charitable organization and the donor must carefully review and understand the terms and conditions to ensure a mutual understanding and compliance with legal obligations. It is recommended to seek legal advice or consult with professionals familiar with nonprofit law to ensure the validity and effectiveness of the agreement.

Massachusetts Charity Subscription Agreement

Description

How to fill out Massachusetts Charity Subscription Agreement?

If you wish to complete, acquire, or printing legal record themes, use US Legal Forms, the greatest collection of legal forms, that can be found on the Internet. Utilize the site`s simple and convenient look for to discover the documents you will need. Different themes for organization and specific purposes are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Massachusetts Charity Subscription Agreement within a couple of click throughs.

When you are already a US Legal Forms buyer, log in to the bank account and then click the Obtain option to obtain the Massachusetts Charity Subscription Agreement. You can also accessibility forms you earlier delivered electronically inside the My Forms tab of your bank account.

If you are using US Legal Forms initially, refer to the instructions beneath:

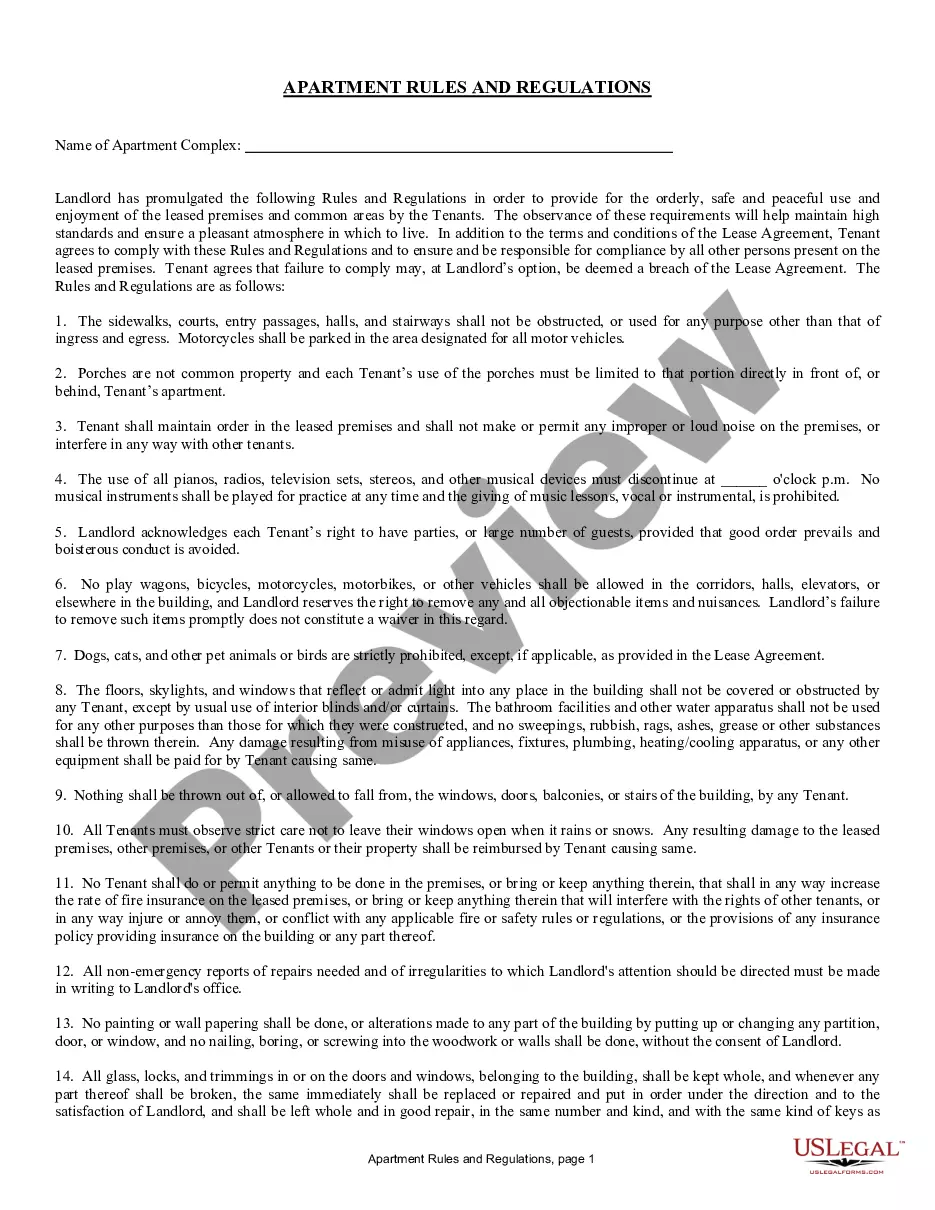

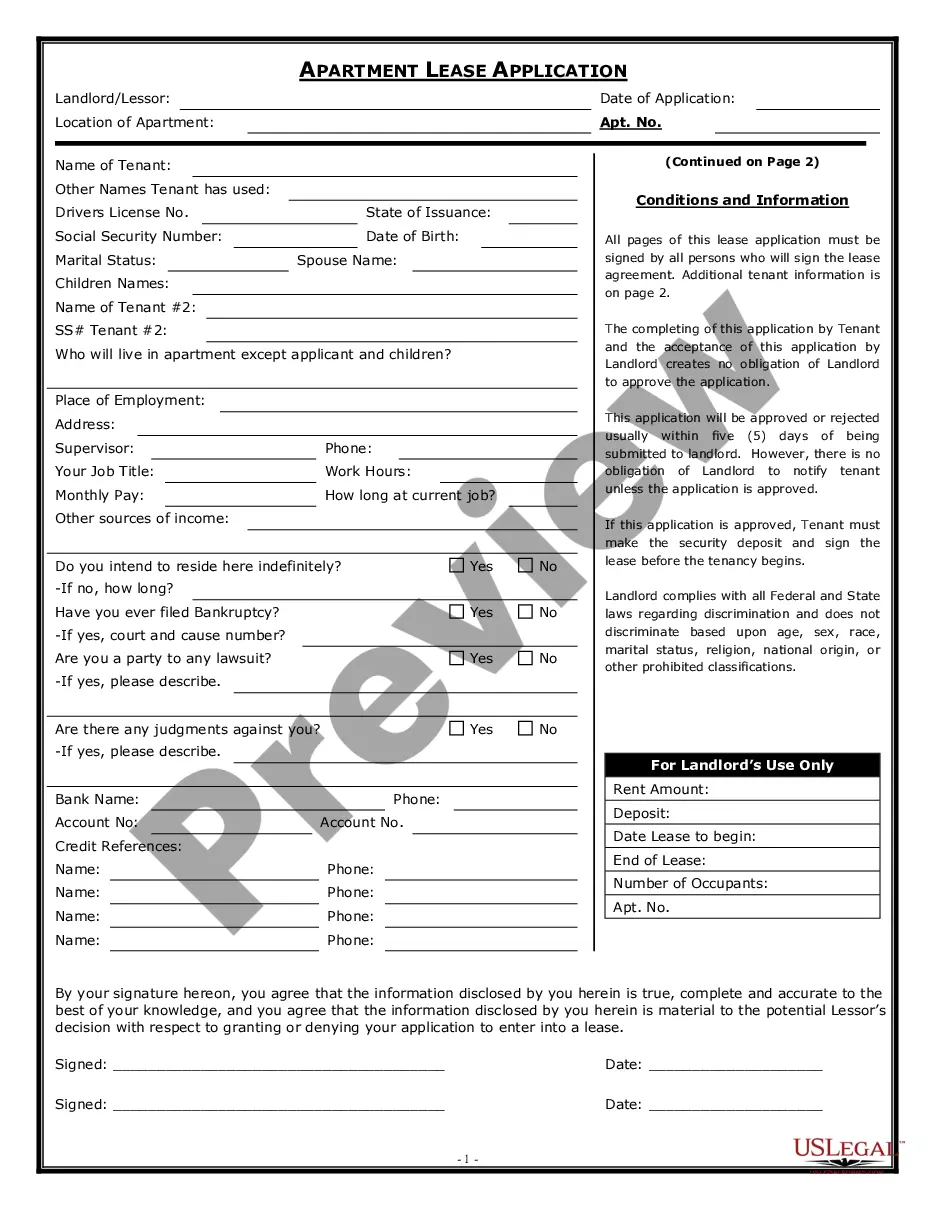

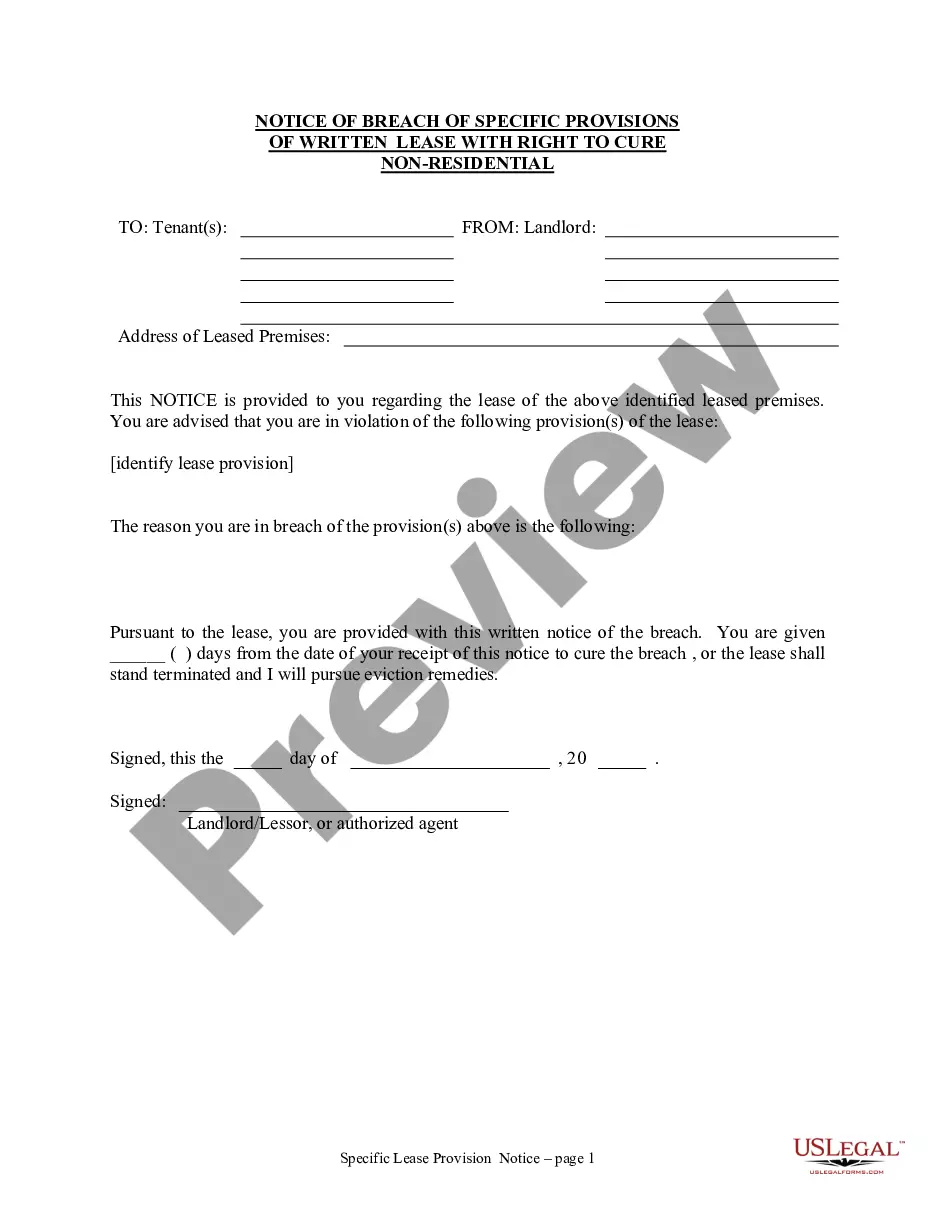

- Step 1. Ensure you have chosen the shape for that right area/nation.

- Step 2. Take advantage of the Review choice to check out the form`s information. Don`t overlook to read the explanation.

- Step 3. When you are unhappy with the develop, take advantage of the Search field on top of the display to locate other models from the legal develop format.

- Step 4. Upon having found the shape you will need, go through the Get now option. Opt for the prices prepare you like and add your references to sign up for an bank account.

- Step 5. Approach the purchase. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Choose the file format from the legal develop and acquire it on your own gadget.

- Step 7. Comprehensive, modify and printing or signal the Massachusetts Charity Subscription Agreement.

Each legal record format you purchase is your own property permanently. You may have acces to every develop you delivered electronically within your acccount. Click the My Forms segment and select a develop to printing or acquire yet again.

Contend and acquire, and printing the Massachusetts Charity Subscription Agreement with US Legal Forms. There are many specialist and status-distinct forms you can use for the organization or specific demands.

Form popularity

FAQ

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders.

Selling sponsorships at a special event can be a great way for a nonprofit organization to raise additional money. Sponsorships are also beneficial for donors as donors can receive tax deductions while receiving public acknowledgement of their sponsorship.

How to Start a Nonprofit in MassachusettsName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

The Form PC (Public Charity) is Massachusetts's version of the 990. It asks for financial informationmost of which you can take from your Form 990as well as information on your solicitation activities and related-party transactions.

As outlined in the AGO's Form PC Instructions, all charities with a Gross Support and Revenue of more than $5,000 must submit a federal form and/or probate account in order to meet their annual filing requirements. We accept IRS Forms 990, 990-EZ, 990-PF, 1120 and 1041. We do not accept IRS Form 990-N.

Nonprofits Can Join the Subscription World There aren't many nonprofits making use of all subscription boxes have to offer. Several subscription boxessuch as Mission Cute and Causeboxgive back to charity, but few subscription-commerce programs are launched and managed by nonprofits.

Can a Nonprofit Sell Goods or Merchandise? A nonprofit can sell goods and often this is completed through donations or grants. Nonprofits can also sell services or goods to raise money. Consider that educational institutions and hospitals are nonprofit organizations, but still sell services or goods.

What Criteria Must A Charity Meet To Be Star Rated?Tax Status: The organization must be registered as a 501(c) (3) public charity and file a Form 990.Revenue: The charity must have generated at least $1 million in revenue for two consecutive years.More items...

All public charities doing business in Massachusetts must register with the Non-Profit Organizations/Public Charities Division of the Attorney General's Office (AGO), and file annual financial reports with the AGO. Upon registration, the AGO will assign the public charity an Attorney General Account Number (AG Number).

Nonprofits can use fees for service and contracts to supplement their funding. Examples of this include charging for summer camp, child care, therapy, job training, etc. These services may charge an hourly or fixed rate.