Massachusetts Authority of Partnership to Open Deposit Account and to Procure Loans

Description

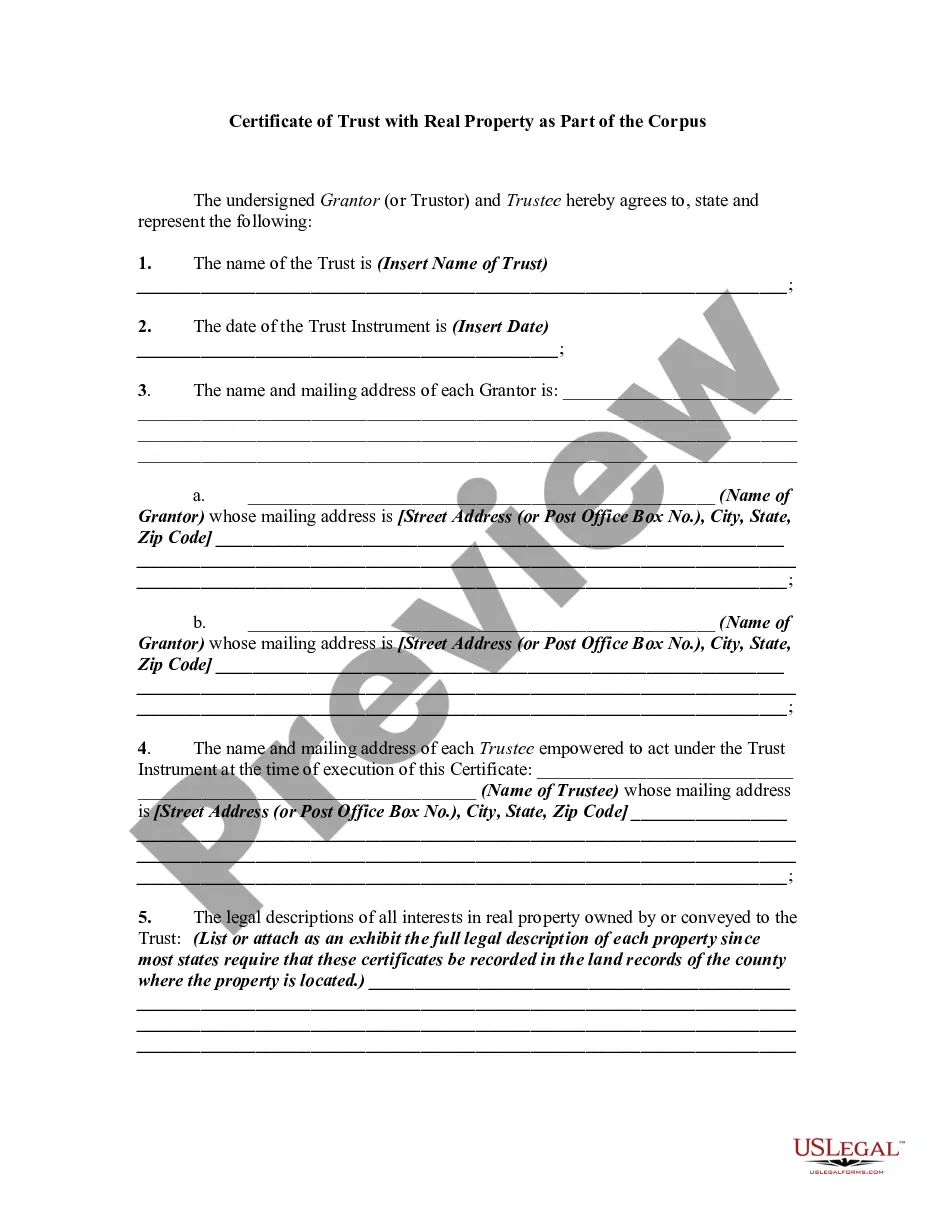

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

You can dedicate time online finding the valid document template that satisfies the local and national requirements you will need.

US Legal Forms offers a vast collection of lawful documents that can be examined by professionals.

You can obtain or print the Massachusetts Authority of Partnership to Open Deposit Account and to Procure Loans from the service.

First, ensure that you have selected the correct document template for the area/town of your choice. Review the form description to confirm you have chosen the right document. If available, make use of the Preview option to view the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and select the Download option.

- Then, you can fill out, modify, print, or sign the Massachusetts Authority of Partnership to Open Deposit Account and to Procure Loans.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

The Fed is the central bank of the United States, responsible for regulating the financial system and managing monetary policy. Its primary monetary policy tool is open market operations that control the buying and selling of U.S. Treasury and federal agency securities.

Collect the required Know Your Customer (KYC) documents that are required for opening the account. The bank will process the account opening formalities and open the start-up Business Account. Once the Business Account is opened, the start-up can take benefit of the other facilities offered by the bank.

Details you'll need to apply online:Name and address of business.Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in the following 9-digit format XX-XXXXXXX, or, if the LLC is a single member LLC, the EIN of the company or the Social Security Number (SSN) of the single member.More items...

These are some of the most common requirements to open a business bank account.Employer Identification Number (EIN) or Social Security Number (SSN)Personal identification.Business formation documents.Ownership agreements.Business license.Certificate of assumed name.Monthly credit card revenue.31-Jan-2021

Banks as Financial Intermediaries. An intermediary is one who stands between two other parties. Banks are a financial intermediarythat is, an institution that operates between a saver who deposits money in a bank and a borrower who receives a loan from that bank.

Most of the money in our economy is created by banks, in the form of bank deposits the numbers that appear in your account. Banks create new money whenever they make loans. 97% of the money in the economy today exists as bank deposits, whilst just 3% is physical cash.

Documents Required for Opening Company Current AccountPAN card of Director.Passport.Voter Identity Card.Driving License.Aadhaar card issued by Unique Identification Authority of India (UIDAI)Senior Citizen Card issued by State/Central Govt.Fisherman Identity card issued by State/Central Government.Arms License.

Like banks, credit unions accept deposits, make loans and provide a wide array of other financial services. But as member-owned and cooperative institutions, credit unions provide a safe place to save and borrow at reasonable rates.

A commercial bank is a type of financial institution that accepts deposits, offers checking account services, makes business, personal, and mortgage loans, and offers basic financial products like certificates of deposit (CDs) and savings accounts to individuals and small businesses.

If you are a single-member LLC or sole proprietorship, an EIN is not required to open a business bank account because you are technically still classed as an individual in the eyes of the IRS.