Massachusetts Debt Settlement Offer in Response to Creditor's Proposal: A Comprehensive Guide to Resolving Debts Keywords: Massachusetts, debt settlement offer, creditor's proposal, debt settlement options, negotiating debt repayment, debt relief programs, credit counseling, debt management, debt settlement agreement, collection agency, bankruptcy alternatives. Description: When faced with overwhelming debts, individuals in Massachusetts may consider a debt settlement offer in response to a creditor's proposal. This process involves negotiating with creditors to reach a mutually agreed-upon resolution, allowing individuals to reduce their debt burden and regain financial stability. Understanding the various types of debt settlement offers available in Massachusetts is crucial for making informed decisions about debt management. 1. Debt Settlement Options: Massachusetts offers different debt settlement options, such as debt negotiation and debt relief programs. These options aim to help individuals settle their debts for less than the full amount owed, providing an opportunity to reduce the financial strain. 2. Negotiating Debt Repayment: Massachusetts debtors can negotiate directly with creditors or rely on third-party negotiators, such as credit counseling agencies, to represent them. Negotiating a debt repayment plan involves analyzing the debtor's financial situation, determining their ability to repay, and proposing a reasonable settlement amount. 3. Credit Counseling: Credit counseling agencies in Massachusetts offer guidance and assistance to individuals struggling with debts. These agencies assess a debtor's financial situation, devise customized debt management plans, and negotiate with creditors to establish reduced interest rates or monthly payments. 4. Debt Management: Massachusetts residents may opt for debt management programs offered by reputable credit counseling agencies. These programs consolidate multiple debts into one monthly payment, simplifying the repayment process. They also negotiate with creditors on behalf of the debtor, aiming to lower interest rates and waive certain fees. 5. Debt Settlement Agreement: If negotiations are successful, a debt settlement agreement is drafted, outlining the terms and conditions of the settlement. This legal document states the reduced amount to be repaid, often a percentage of the initial debt, along with a repayment schedule. Once signed by both parties, this agreement is legally binding and enforceable. 6. Dealing with Collection Agencies: In cases where debts have been sold to collection agencies, Massachusetts residents should be aware of their rights under state and federal laws. Debt settlement offers can still be negotiated with collection agencies, and it's important to ensure the agreed-upon terms align with the debtor's financial capabilities. 7. Bankruptcy Alternatives: Debt settlement offers serve as viable alternatives to bankruptcy for Massachusetts residents struggling to repay their debts. By avoiding bankruptcy, individuals can protect their credit scores and avoid the negative consequences associated with filing for bankruptcy. In Massachusetts, debt settlement offers in response to creditor's proposals provide a valuable opportunity for individuals burdened with excessive debt to find a path towards financial stability. Whether through direct negotiations or seeking assistance from credit counseling agencies, exploring these debt settlement options can help individuals regain control of their finances and pave the way for a debt-free future.

Massachusetts Debt Settlement Offer in Response to Creditor's Proposal

Description

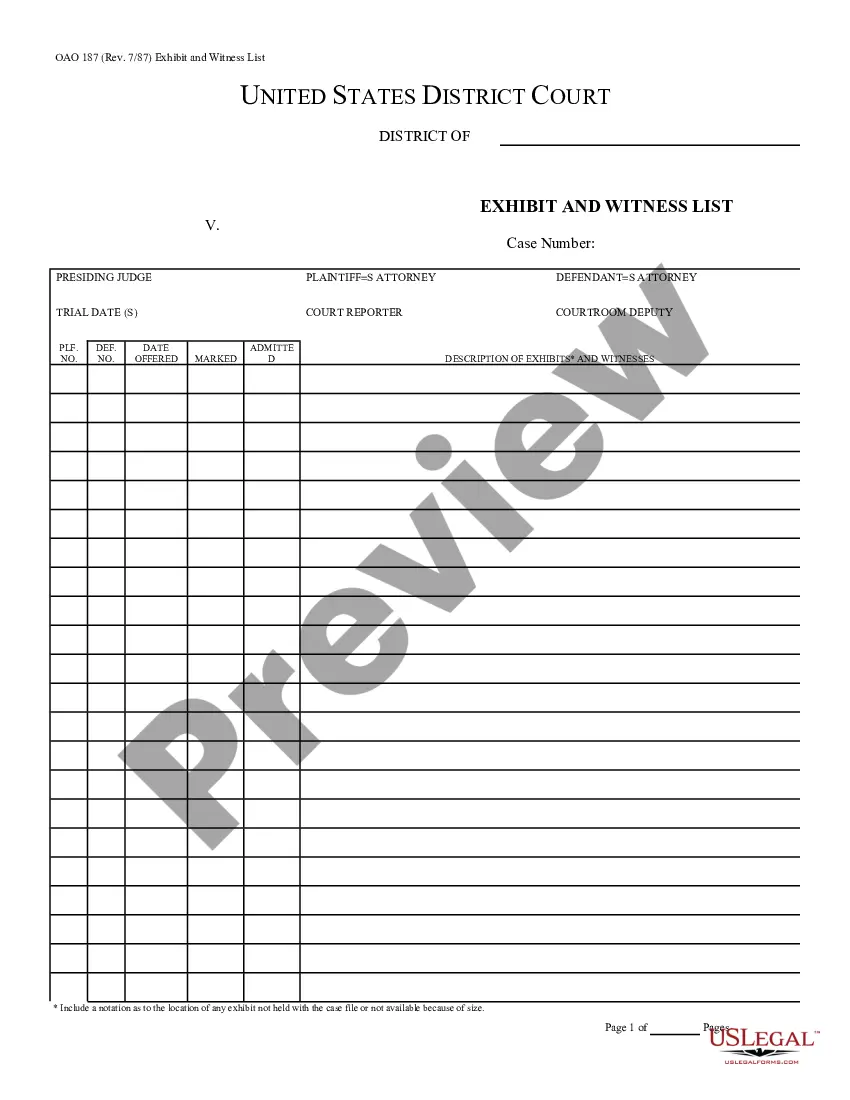

How to fill out Debt Settlement Offer In Response To Creditor's Proposal?

US Legal Forms - among the largest libraries of legal forms in the United States - offers a wide array of legal record themes you are able to obtain or print. While using internet site, you can find a huge number of forms for business and person functions, sorted by categories, states, or search phrases.You can find the most recent versions of forms like the Massachusetts Debt Settlement Offer in Response to Creditor's Proposal in seconds.

If you have a subscription, log in and obtain Massachusetts Debt Settlement Offer in Response to Creditor's Proposal from your US Legal Forms catalogue. The Obtain switch will show up on every type you look at. You gain access to all in the past acquired forms from the My Forms tab of the profile.

If you wish to use US Legal Forms initially, here are simple recommendations to get you began:

- Be sure to have selected the right type for your area/area. Click the Preview switch to analyze the form`s content material. Read the type outline to ensure that you have chosen the proper type.

- If the type does not fit your demands, use the Research field at the top of the display to discover the one which does.

- Should you be satisfied with the shape, verify your option by visiting the Buy now switch. Then, pick the costs program you prefer and give your accreditations to sign up on an profile.

- Process the financial transaction. Use your credit card or PayPal profile to perform the financial transaction.

- Pick the file format and obtain the shape in your system.

- Make adjustments. Load, modify and print and signal the acquired Massachusetts Debt Settlement Offer in Response to Creditor's Proposal.

Every format you added to your bank account lacks an expiry date and it is your own eternally. So, if you want to obtain or print yet another copy, just go to the My Forms section and click in the type you need.

Obtain access to the Massachusetts Debt Settlement Offer in Response to Creditor's Proposal with US Legal Forms, the most extensive catalogue of legal record themes. Use a huge number of specialist and condition-certain themes that meet your organization or person requires and demands.

Form popularity

FAQ

"If you're happy with their offer, and you should be because it's less than what you actually owe them, then you should at least consider it," he says. The alternative, according to Ulzheimer, is the creditor either outsourcing the debt to a collector or even suing you.

Two Options for Taking the Settlement OfferRead the settlement offer carefully or have an attorney review the offer to be sure it's legally binding that the creditor or collector can't come after you for the remaining balance at some point in the future. Or, you can even try to negotiate a lower settlement.

Once you've done your research and put aside some cash, it's time to determine what your settlement offer will be. Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor.

Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report. Ask for a written confirmation after settling on an agreement.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Debt settlement is an offer you make to your creditors to have your debt considered paid in full for payment of less than you owe. Your creditors agree to settle for pennies on the dollar because otherwise, they may see nothing or far less than that.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.