Massachusetts Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out Promissory Note For Commercial Loan Secured By Real Property?

US Legal Forms - one of the largest collections of legal templates in the United States - offers an extensive variety of legal document categories that you can acquire or print.

Through the website, you can discover thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can retrieve the most recent versions of forms such as the Massachusetts Promissory Note for Commercial Loan Secured by Real Estate within minutes.

If you currently have a subscription, Log In and source the Massachusetts Promissory Note for Commercial Loan Secured by Real Estate from the US Legal Forms library. The Download button will appear on every form you access. You have access to all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, adjust, and print and sign the downloaded Massachusetts Promissory Note for Commercial Loan Secured by Real Estate. Every document you added to your account does not expire and is yours indefinitely. Therefore, if you wish to acquire or print another copy, just visit the My documents section and click on the form you need. Access the Massachusetts Promissory Note for Commercial Loan Secured by Real Estate with US Legal Forms, one of the most extensive libraries of legal document categories. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

- If you are utilizing US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have picked the correct form for your city/county. Click the Preview button to review the form's details.

- Check the form description to confirm you have selected the right form.

- If the form doesn’t meet your needs, use the Lookup field at the top of the screen to find the one that fits.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

A. The Commonwealth of Massachusetts has a 6- year statute of limitations on all written contracts, promissory notes and credit card claims. The statute begins calculating the dates, generally, from the date the contract was breached.

When a borrower takes out a loan, promissory notes legally bind them to repay it. Promissory notes also help private parties in owner financing safeguard the lending process. When a borrower pays the seller directly, mortgage lenders or banks are not involved.

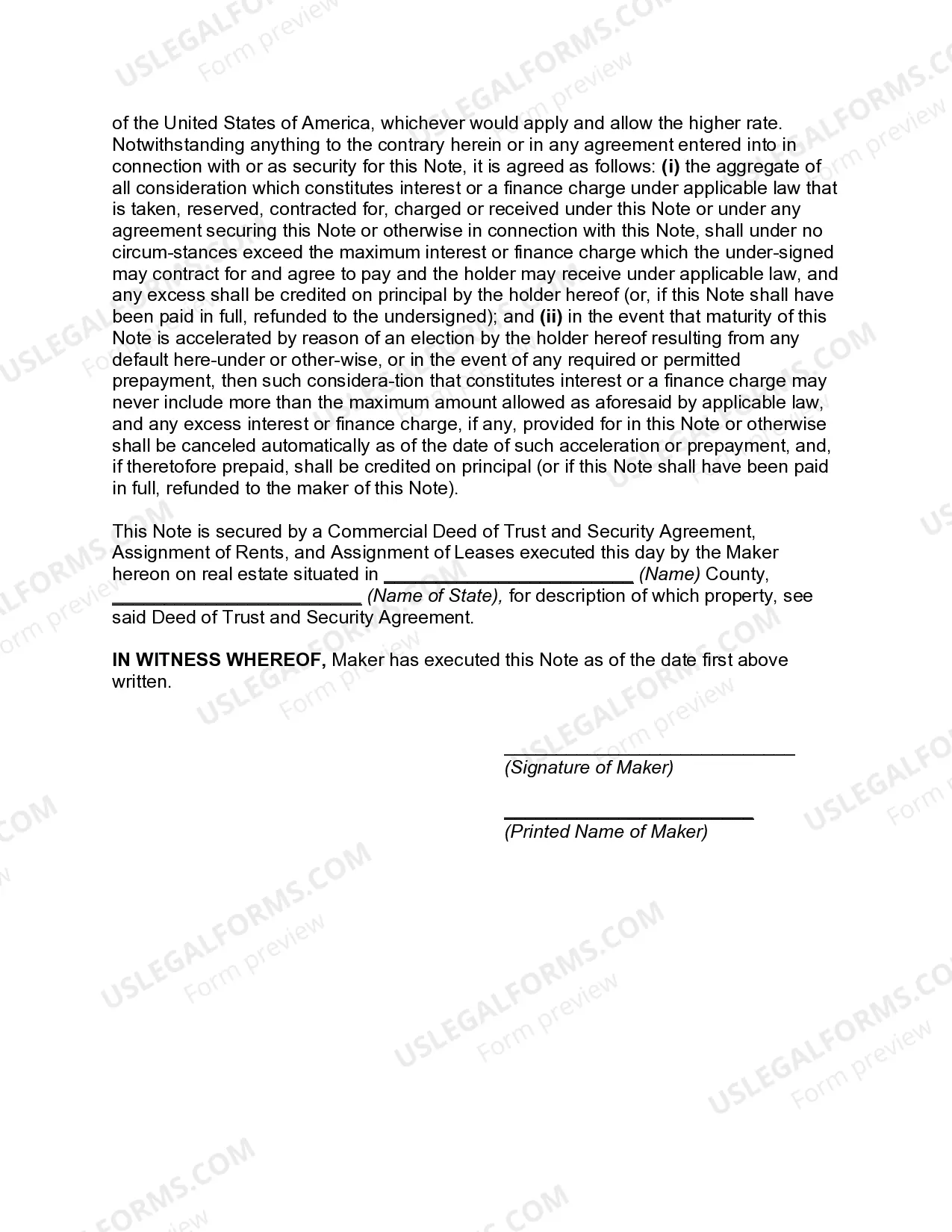

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

Q. What are Real Estate Secured loans? A. Often referred to as private money, hard money, or bridge financing, these short-term loans offer greater flexibility than traditional bank financing.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.