Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance In Massachusetts, an Employment Agreement with a Nonqualified Retirement Plan Funded with Life Insurance is a legally binding document that outlines the terms and conditions of an employee's retirement benefits. This type of plan is designed to provide additional financial security to employees beyond their qualified retirement plans. The Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance serves as a supplemental retirement benefit that allows employers to offer attractive compensation packages and attract top talent. The plan is typically funded through life insurance policies owned by the employer, which also provide a death benefit to the employee's beneficiaries. This type of employment agreement ensures that employees receive additional retirement benefits even if they do not meet the eligibility criteria for qualified retirement plans, such as 401(k) or pension plans. The terms of the plan are determined by the employer, and it can be customized to suit the specific needs and goals of the organization and its employees. There are several types of Massachusetts Employment Agreements with Nonqualified Retirement Plans Funded with Life Insurance, including: 1. Deferred Compensation Plans: These plans allow employees to defer a portion of their current compensation to be paid out at a future date, typically upon retirement. The deferred amounts are invested in a life insurance policy, which accumulates cash value over time. 2. Supplemental Executive Retirement Plans (SERP): SERPs are specifically designed for top-level executives and provide enhanced retirement benefits beyond what is available through qualified plans. These plans are often used as a retention tool to incentivize executives to stay with the company for the long term. 3. Split Dollar Life Insurance Plans: Split dollar plans involve a cost-sharing arrangement between the employer and the employee. The premium payments for the life insurance policy are split between both parties. Upon retirement, the cash value of the policy can be accessed by the employee. 4. Executive Bonus Plans: Under an executive bonus plan, the employer pays premiums for a life insurance policy owned by the employee. The employee receives the death benefit upon passing, and the cash value can be accessed for retirement purposes. It is important for both employers and employees to carefully review and understand the terms and conditions outlined in the Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Consulting with legal and financial professionals is highly recommended ensuring compliance with state laws and to maximize the benefits of these plans for both parties involved.

Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

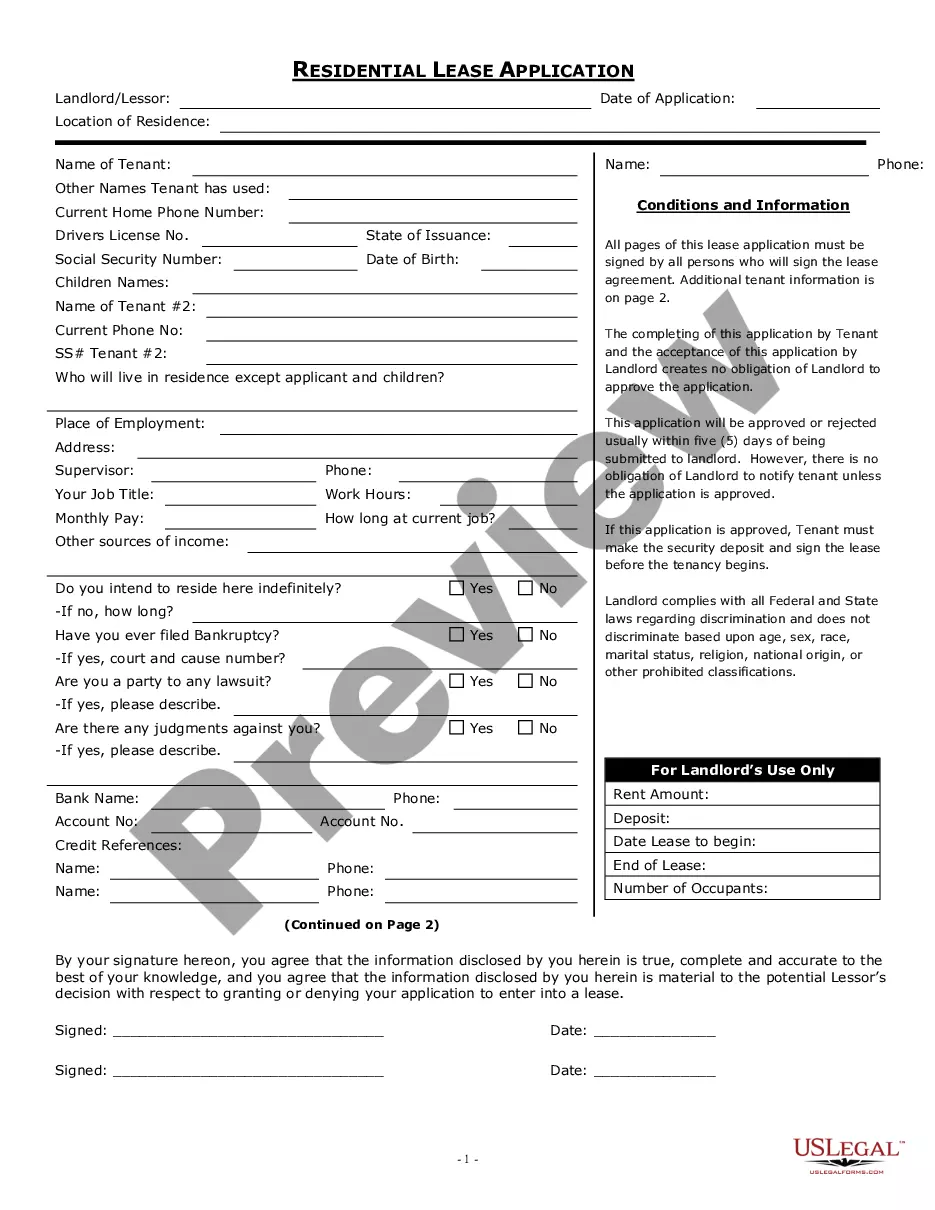

How to fill out Massachusetts Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

You may devote hrs online looking for the legitimate document template that fits the state and federal specifications you require. US Legal Forms gives 1000s of legitimate varieties that happen to be analyzed by specialists. It is possible to down load or printing the Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance from our support.

If you already possess a US Legal Forms account, it is possible to log in and click on the Acquire key. Next, it is possible to comprehensive, modify, printing, or indicator the Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Each and every legitimate document template you buy is the one you have forever. To have an additional duplicate for any bought form, proceed to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms site for the first time, adhere to the easy guidelines beneath:

- First, ensure that you have chosen the proper document template for your state/town of your choosing. Read the form description to ensure you have picked the appropriate form. If available, use the Preview key to appear with the document template too.

- In order to find an additional model from the form, use the Search field to get the template that meets your needs and specifications.

- Upon having identified the template you want, click Get now to continue.

- Choose the rates plan you want, enter your credentials, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You may use your bank card or PayPal account to fund the legitimate form.

- Choose the structure from the document and down load it to your gadget.

- Make adjustments to your document if necessary. You may comprehensive, modify and indicator and printing Massachusetts Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

Acquire and printing 1000s of document templates utilizing the US Legal Forms website, which provides the greatest selection of legitimate varieties. Use professional and status-specific templates to tackle your business or person demands.

Form popularity

FAQ

A NQDC plan is unfunded if either assets have not been set aside by your employer to pay plan benefits (that is, your employer pays benefits from its general assets on a "pay as you go" basis), or assets have been set aside but those assets remain subject to the claims of your employer's creditors (often referred to as

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.

Using life insurance in a qualified plan does offer several advantages, including: The ability to use pre-tax dollars to pay premiums that would otherwise not be tax-deductible. Fully funding the retirement benefit at the premature death of the plan participant.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

A qualified retirement plan is a retirement plan recognized by the IRS where investment income accumulates tax-deferred. Common examples include individual retirement accounts (IRAs), pension plans and Keogh plans. Most retirement plans offered through your job are qualified plans.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

A nonqualified plan does not fall under ERISA guidelines so it does not receive the same tax advantages. They are considered to be assets of the employer and can be seized by creditors of the company. If the employee quits, they will likely lose the benefits of the nonqualified plan.

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. They are non-qualified because they fall outside the Employee Retirement Income Security Act (ERISA) guidelines and are exempt from the testing required with qualified retirement savings plans.