Massachusetts Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

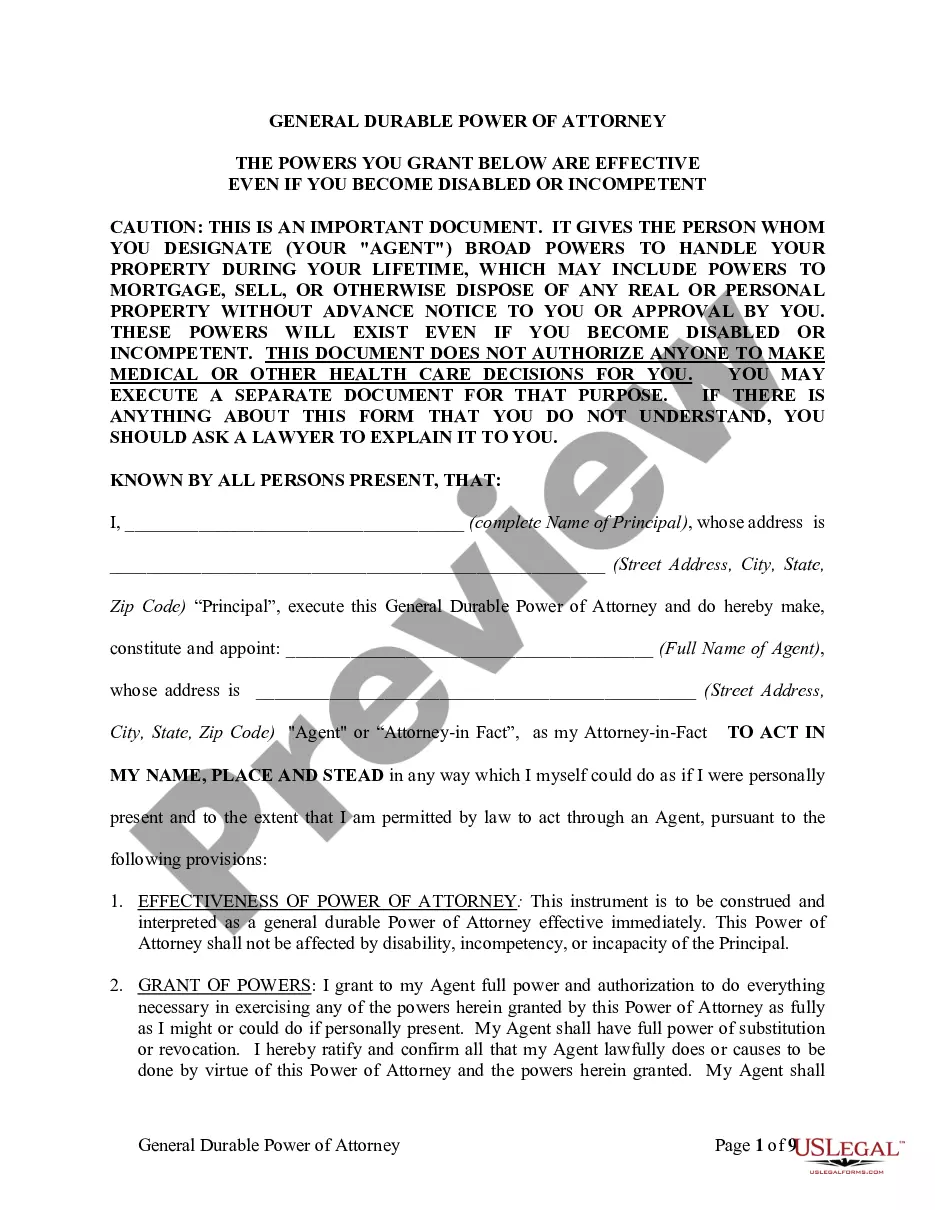

How to fill out Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

US Legal Forms - one of many biggest libraries of lawful kinds in the United States - offers a wide array of lawful document themes you may down load or print. Making use of the site, you can get 1000s of kinds for organization and individual reasons, sorted by groups, suggests, or keywords.You will discover the newest types of kinds such as the Massachusetts Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status in seconds.

If you already possess a monthly subscription, log in and down load Massachusetts Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status in the US Legal Forms catalogue. The Download button can look on each and every form you see. You have access to all formerly acquired kinds within the My Forms tab of your own account.

If you want to use US Legal Forms for the first time, allow me to share basic instructions to help you began:

- Be sure to have picked the proper form for your city/region. Click the Preview button to analyze the form`s content. See the form description to actually have selected the right form.

- In the event the form does not suit your demands, use the Research field on top of the display to find the the one that does.

- If you are satisfied with the form, confirm your option by visiting the Get now button. Then, select the costs program you favor and give your qualifications to sign up on an account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal account to finish the financial transaction.

- Find the format and down load the form on your own device.

- Make modifications. Complete, edit and print and sign the acquired Massachusetts Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status.

Every template you added to your bank account lacks an expiration date and it is the one you have eternally. So, if you would like down load or print yet another version, just proceed to the My Forms segment and then click on the form you will need.

Gain access to the Massachusetts Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status with US Legal Forms, the most extensive catalogue of lawful document themes. Use 1000s of professional and condition-specific themes that meet up with your organization or individual needs and demands.