Massachusetts Computer Hardware Purchase Agreement with a Manufacturer

Description

How to fill out Computer Hardware Purchase Agreement With A Manufacturer?

Selecting the optimal legal document format can be quite a challenge.

Naturally, there are numerous templates accessible online, but how can you locate the legal template you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Massachusetts Computer Hardware Purchase Agreement with a Manufacturer, that you can employ for professional and personal purposes. All the forms are examined by professionals and meet federal and state requirements.

Once you are confident that the form is suitable, click the Buy now button to purchase the form. Choose the payment plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Massachusetts Computer Hardware Purchase Agreement with a Manufacturer. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that comply with state requirements.

- If you are currently registered, Log In to your account and click on the Download button to acquire the Massachusetts Computer Hardware Purchase Agreement with a Manufacturer.

- Use your account to access the legal forms you have purchased previously.

- Go to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm it is the right fit for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

Sales of custom software, personal and professional services, and reports of individual information are generally exempt from Massachusetts sales and use taxes.

A system of agreement is the connecting point for agreement processes that span SofR, SofE, and every business functioncontracts for Sales, employment offers for Human Resources, non-disclosure agreements for Legal, among hundreds of other agreement types.

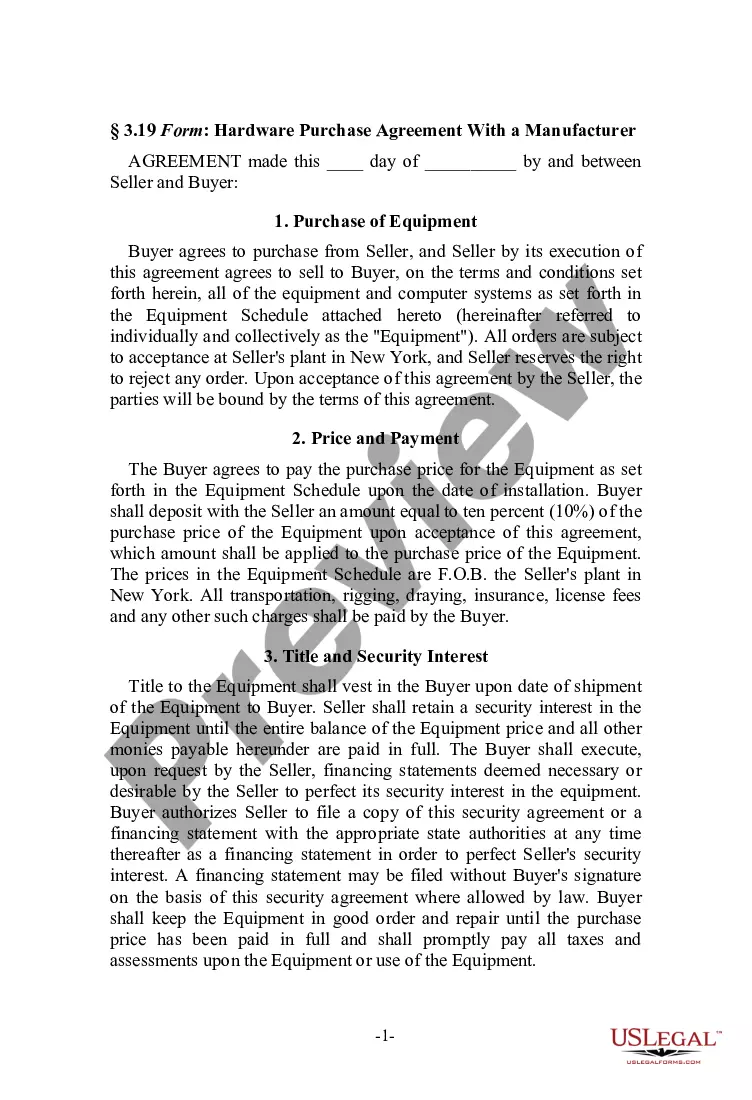

An agreement for the supply of hardware for use in a business-to-business transaction. Hardware is ordered using a purchase order which incorporates the terms set out in the main contract.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

The master service agreement for software development, also known as the software development agreement, describes the terms on which the developer sells and transfers customized software to the client for their own use in software, processes, or services.

In addition, sales of prewritten software, computer hardware, and hardware and software maintenance contracts involving software updates, upgrades and fixes are generally subject to the Massachusetts sales and use tax under the rules provided in the regulation.

Digital goods may be taxed like tangible goods The states that define tangible personal property very broadly to encompass digital goods are: Alabama, Arizona, New Mexico, Utah, and West Virginia. The states that define electronic versions as equivalents of tangible property are: Indiana, Louisiana, Maine, and Texas.

Sales of digital products are exempt from the sales tax in Massachusetts.

Hardware maintenance and support services are preventive and remedial services that physically repair or optimize hardware, including contract maintenance and per-incident repair.

Traditional Goods or Services Goods that are subject to sales tax in Massachusetts include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, gasoline, and clothing are all tax-exempt.