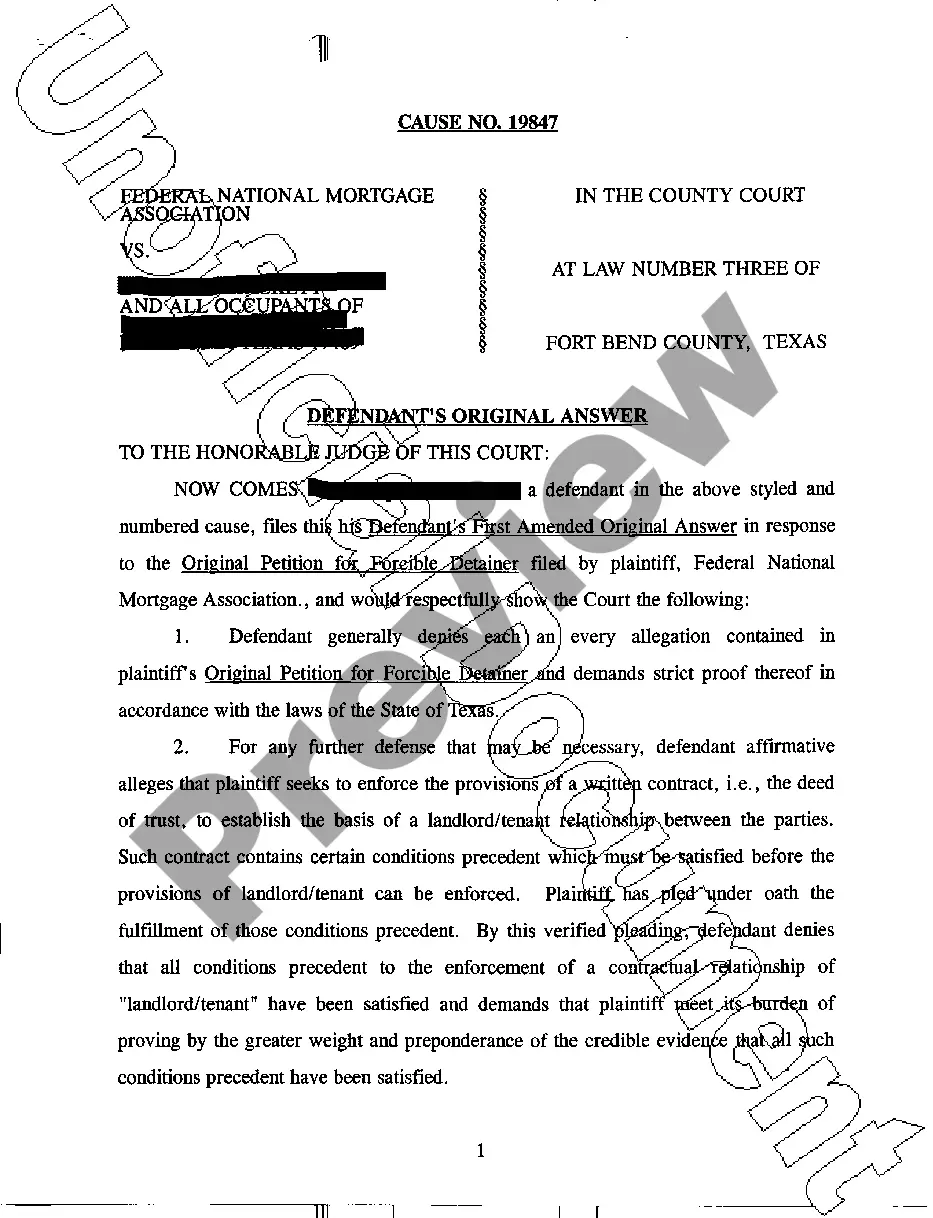

The Massachusetts Notice of Unpaid Invoice is an official document used to inform individuals or businesses that they have an outstanding debt or unpaid invoice. This notice serves as a formal communication to the debtor that they are obligated to settle the outstanding amount by a specified due date. It is imperative for creditors to issue a Notice of Unpaid Invoice in order to assert their rights and facilitate the payment process. There are different types of Massachusetts Notices of Unpaid Invoice, including: 1. General Massachusetts Notice of Unpaid Invoice: This is a standard notice that is sent to any individual or business entity that has failed to pay for their goods, services, or products within the agreed-upon timeframe. The notice outlines the total amount due, the original invoice details, and the date by which the payment must be received. It also highlights the consequences of non-payment, such as legal action or additional fees. 2. Massachusetts Notice of Unpaid Invoice for Contractors/Subcontractors: This specific type of notice is designed for contractors or subcontractors who have performed work or provided labor on a construction project but have not received timely payment for their services. It is governed by Massachusetts' mechanics lien laws and typically includes details about the project, the scope of work performed, the amount owed, and the necessary steps the contractor or subcontractor may take if the payment is not received. 3. Massachusetts Notice of Unpaid Invoice for Leases/Rentals: Landlords or property owners often issue this notice to tenants who have failed to pay their rent or adhere to the terms outlined in their lease agreement. It specifies the outstanding rent, the due dates for payment, any applicable late fees, and the consequences of continued non-payment, such as eviction or legal action. 4. Massachusetts Notice of Unpaid Invoice for Healthcare Providers: This notice is specific to healthcare providers, including doctors, hospitals, and clinics, who have provided medical services but have not received payment from patients or insurance companies. It outlines the outstanding medical bills, any insurance claims that have been denied, and the actions that may be taken if payment is not received, such as collections or reporting to credit bureaus. In conclusion, the Massachusetts Notice of Unpaid Invoice is a vital tool for creditors to assert their rights and ensure prompt payment. There are various types of notices, including general unpaid invoices, contractor/subcontractor notices, lease/rental notices, and healthcare provider notices. By utilizing these notices, creditors can effectively communicate their expectations, consequences of non-payment, and potential legal actions to debtors.

Massachusetts Notice of Unpaid Invoice

Description

How to fill out Massachusetts Notice Of Unpaid Invoice?

Discovering the right lawful file template can be quite a have a problem. Of course, there are tons of layouts available on the Internet, but how would you obtain the lawful develop you will need? Use the US Legal Forms web site. The service gives a large number of layouts, such as the Massachusetts Notice of Unpaid Invoice, that can be used for business and private needs. All the varieties are checked by pros and meet up with state and federal specifications.

Should you be currently signed up, log in to the account and then click the Acquire option to find the Massachusetts Notice of Unpaid Invoice. Make use of your account to search from the lawful varieties you have bought previously. Proceed to the My Forms tab of the account and acquire another duplicate from the file you will need.

Should you be a fresh user of US Legal Forms, allow me to share easy guidelines so that you can adhere to:

- Very first, ensure you have chosen the correct develop for your personal city/county. You can check out the shape while using Review option and browse the shape description to guarantee this is the best for you.

- In the event the develop is not going to meet up with your requirements, use the Seach discipline to discover the correct develop.

- Once you are certain the shape would work, select the Get now option to find the develop.

- Choose the pricing plan you want and type in the required information. Build your account and buy your order utilizing your PayPal account or bank card.

- Opt for the data file formatting and down load the lawful file template to the device.

- Full, modify and print out and signal the obtained Massachusetts Notice of Unpaid Invoice.

US Legal Forms is definitely the largest local library of lawful varieties where you can find numerous file layouts. Use the company to down load professionally-created paperwork that adhere to status specifications.

Form popularity

FAQ

What is a letter ID? The Letter ID is a unique number printed on all correspondence and has a letter prefix of L. The Letter ID is always in the upper right-hand corner of the letter.

DOR manages state taxes and child support. We also help cities and towns manage their finances, and administer the Underground Storage Tank Program. Similarly, our mission includes rulings and regulations, tax policy analysis, communications, and legislative affairs.

The general rule is 30 days from the invoice date. However, you can discuss this with your customer and either make it shorter or longer than 30 days. Regardless of what you agree upon, the payment terms and the due date should be clearly stated on the invoice.

The Department of Revenue administers the state's tax system, collecting state taxes including income, sales and use, corporate, estate, and other taxes. It offers taxpayers assistance by toll-free telephone. The department offers taxpayers assistance, audits tax returns, and enforces state tax laws.

The Massachusetts DOR has various types of notices and bills that are issued to individuals and businesses if it is determined that additional taxes might be or are owed. Notices and bills ask for and provide information and request payment when necessary.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.

DOR's mission is to gain full compliance with the tax, child support, and municipal finance laws of the Commonwealth. DOR is committed to enforcing these laws in a fair-minded and respectful manner.

A Letter Ruling (LR) is an advisory ruling issued by the Commissioner of Revenue in response to letters from individual taxpayers on specific issues relating to the interpretation or application of the Massachusetts tax laws.

Combined, the IRS and DOR send out millions of letters and Notices to taxpayers annually. They cover a broad range of subjects from errors on your tax return, to verification of your identity, or reminders that you may be eligible for certain credits like the Earned Income Tax Credit.