Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners is a legal document that outlines the process of terminating a partnership in Massachusetts and dividing the assets among the partners. This agreement is used when partners decide to dissolve their partnership and go their separate ways. The agreement consists of several key components, including: 1. Partnership Dissolution: This outlines the decision of the partners to dissolve the partnership and cease all business operations. It includes the effective date of the dissolution. 2. Assets Inventory: This section requires partners to compile a detailed inventory of all partnership assets, including real estate, equipment, inventory, intellectual property, and any other assets owned by the partnership. 3. Equal Division of Assets: The agreement stipulates that the assets will be divided equally among the partners unless otherwise agreed upon by all parties. It ensures that each partner receives a fair share of the partnership assets based on their initial capital contributions and any other agreed-upon arrangement. 4. Liabilities and Debts: The agreement specifies that all partnership debts, liabilities, and obligations should be paid off before the distribution of assets. It outlines the responsibility of each partner to settle any outstanding debts owed by the partnership. 5. Tax and Legal Obligations: Partners are required to comply with all tax and legal obligations associated with the partnership dissolution. This includes informing the appropriate authorities about the partnership's dissolution and settling any tax liabilities. 6. Distribution of Assets: The agreement outlines the process of distributing the partnership's assets. It includes detailed instructions on how assets should be liquidated, sold, or transferred to the individual partners. If there are any specific agreements or arrangements regarding certain assets, such as buyout options or exclusive ownership, they should be clearly stated in this section. 7. Release of Obligations: This section ensures that once the assets are divided, each partner releases the other from any future claims, liabilities, or obligations related to the partnership. Types of Massachusetts Agreements to Dissolve and Wind up Partnership with Division of Assets between Partners may include: 1. Voluntary Dissolution Agreement: This agreement is reached when partners decide to dissolve their partnership by mutual consent. 2. Dissolution Agreement due to Death or Incapacity: This agreement is used when a partner passes away or becomes incapacitated, leading to the dissolution of the partnership. 3. Dissolution Agreement due to Breach of Partnership Agreement: If a partner has violated the terms of the partnership agreement, resulting in irreparable damage or loss of trust, the remaining partners may opt to dissolve the partnership through this agreement. Remember, it is essential to consult with a qualified attorney or legal professional to ensure that the Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners is properly drafted and executed according to the laws and regulations of Massachusetts.

Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

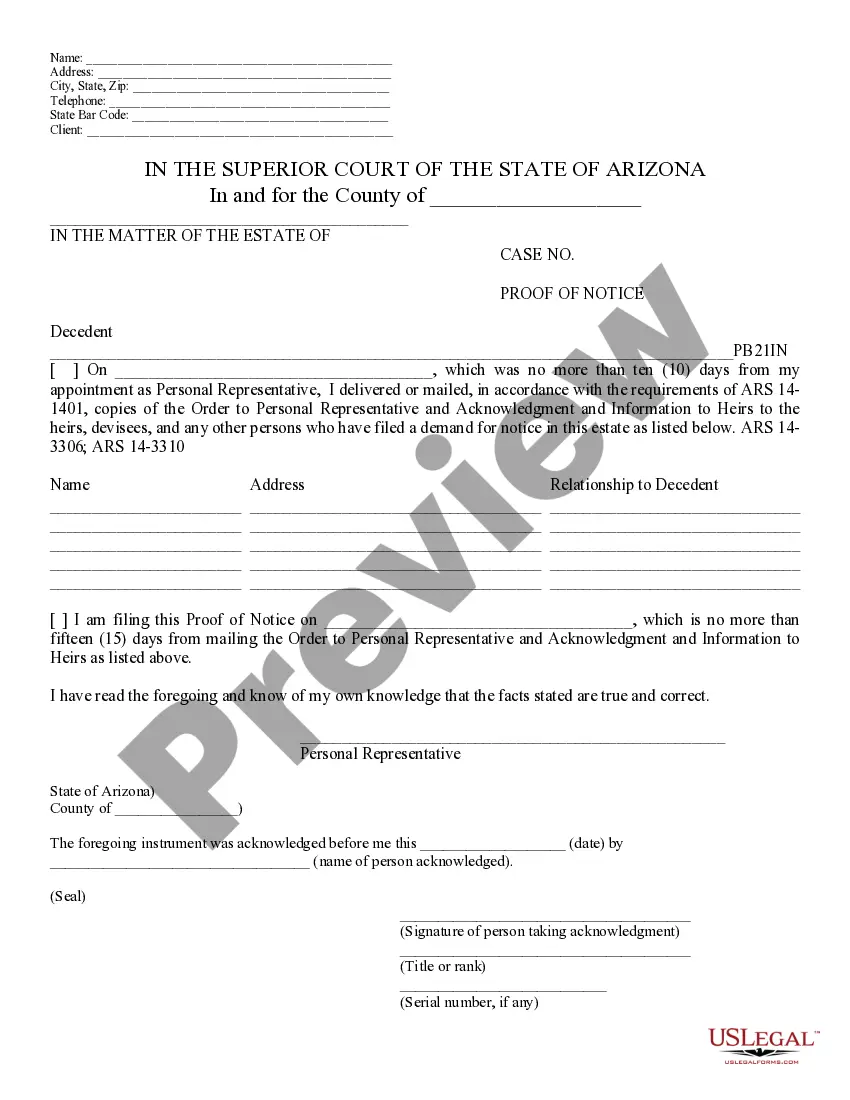

How to fill out Massachusetts Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

US Legal Forms - one of the largest libraries of legitimate types in the States - gives an array of legitimate file web templates you can acquire or produce. While using site, you may get 1000s of types for company and individual purposes, sorted by types, suggests, or key phrases.You can find the latest types of types just like the Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners in seconds.

If you have a subscription, log in and acquire Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners from your US Legal Forms catalogue. The Obtain button will appear on each and every type you see. You gain access to all in the past delivered electronically types within the My Forms tab of your own bank account.

In order to use US Legal Forms the very first time, here are basic guidelines to get you began:

- Be sure you have chosen the correct type to your city/county. Click the Review button to review the form`s content material. Browse the type outline to actually have selected the appropriate type.

- If the type does not satisfy your specifications, utilize the Lookup field near the top of the display screen to discover the one who does.

- If you are satisfied with the form, affirm your choice by visiting the Buy now button. Then, choose the costs prepare you like and give your qualifications to register on an bank account.

- Procedure the purchase. Use your credit card or PayPal bank account to complete the purchase.

- Find the format and acquire the form on the device.

- Make changes. Fill out, modify and produce and indicator the delivered electronically Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners.

Every template you put into your money lacks an expiry time and is also the one you have forever. So, if you want to acquire or produce one more version, just go to the My Forms area and click on around the type you require.

Get access to the Massachusetts Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners with US Legal Forms, probably the most comprehensive catalogue of legitimate file web templates. Use 1000s of skilled and status-specific web templates that meet your organization or individual demands and specifications.