Massachusetts Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

Are you presently in a role that necessitates paperwork for both your organization and particular tasks almost every day.

There are numerous authentic document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides thousands of template options, such as the Massachusetts Checklist of Considerations for Drafting a Verification of an Account, designed to comply with both state and federal requirements.

When you find the appropriate template, click Purchase now.

Choose the pricing plan you prefer, complete the required details to create your account, and pay for your order using PayPal or Visa or Mastercard. Select a suitable file format and download your copy. Access all the document templates you have purchased from the My documents menu. You can obtain another copy of the Massachusetts Checklist of Considerations for Drafting a Verification of an Account at any time if necessary. Simply access the desired template to download or print the document format. Utilize US Legal Forms, the most extensive range of authentic forms, to save time and minimize mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Massachusetts Checklist of Considerations for Drafting a Verification of an Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and confirm it is for the correct city/state.

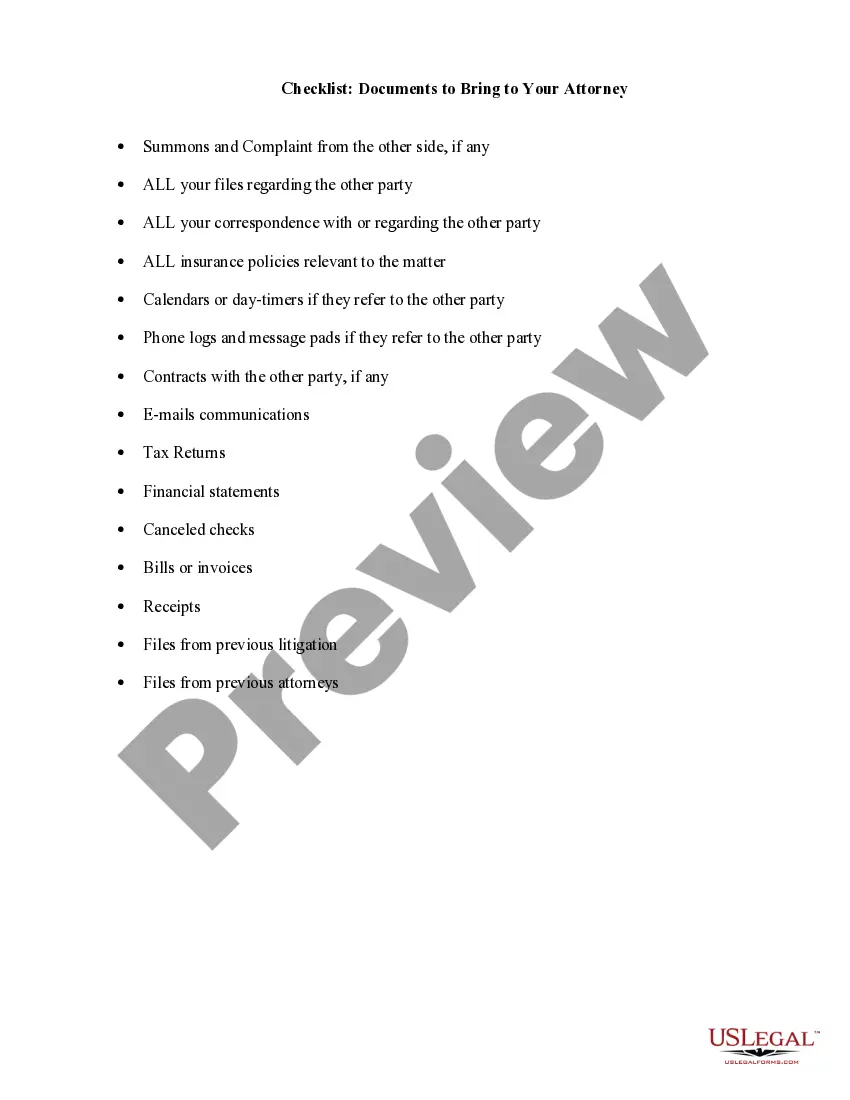

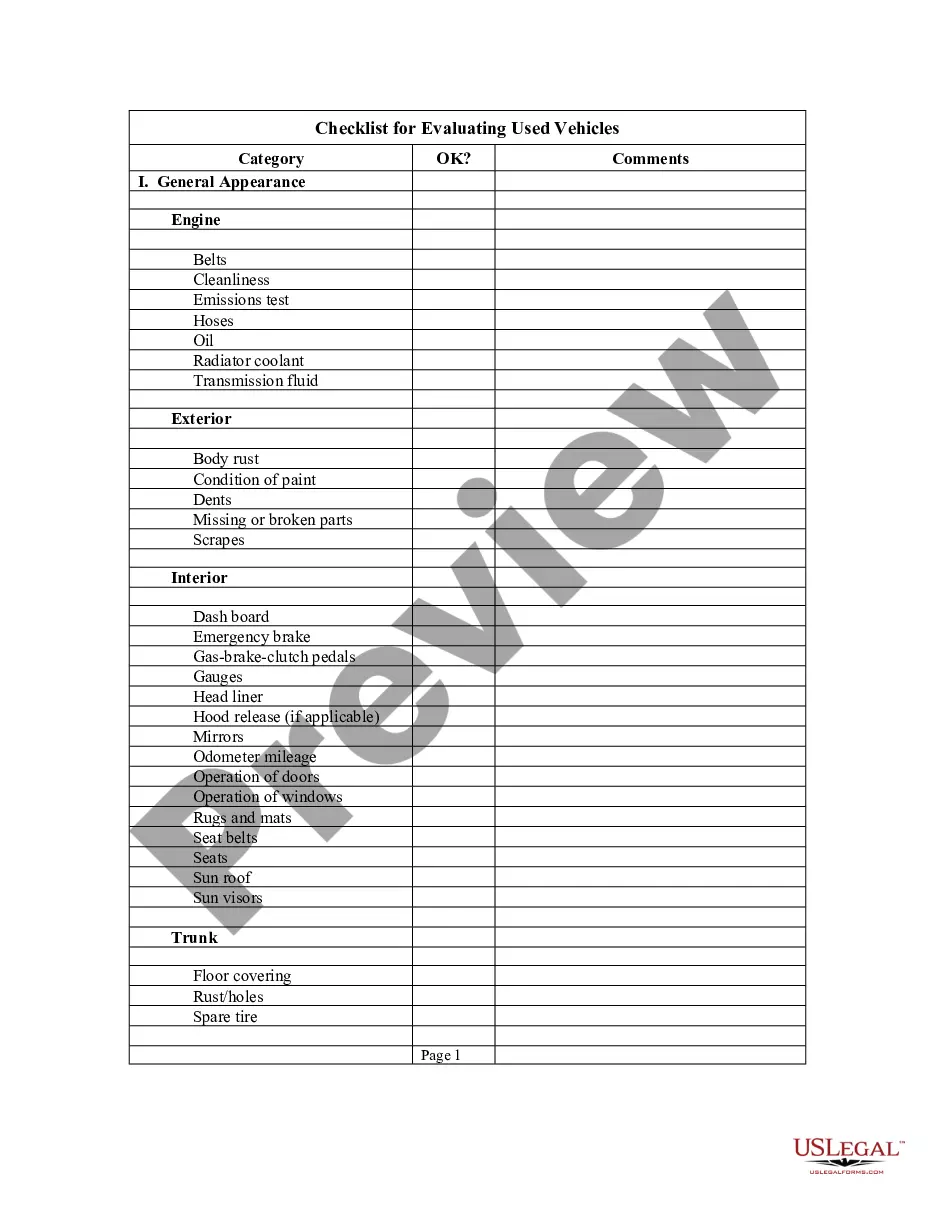

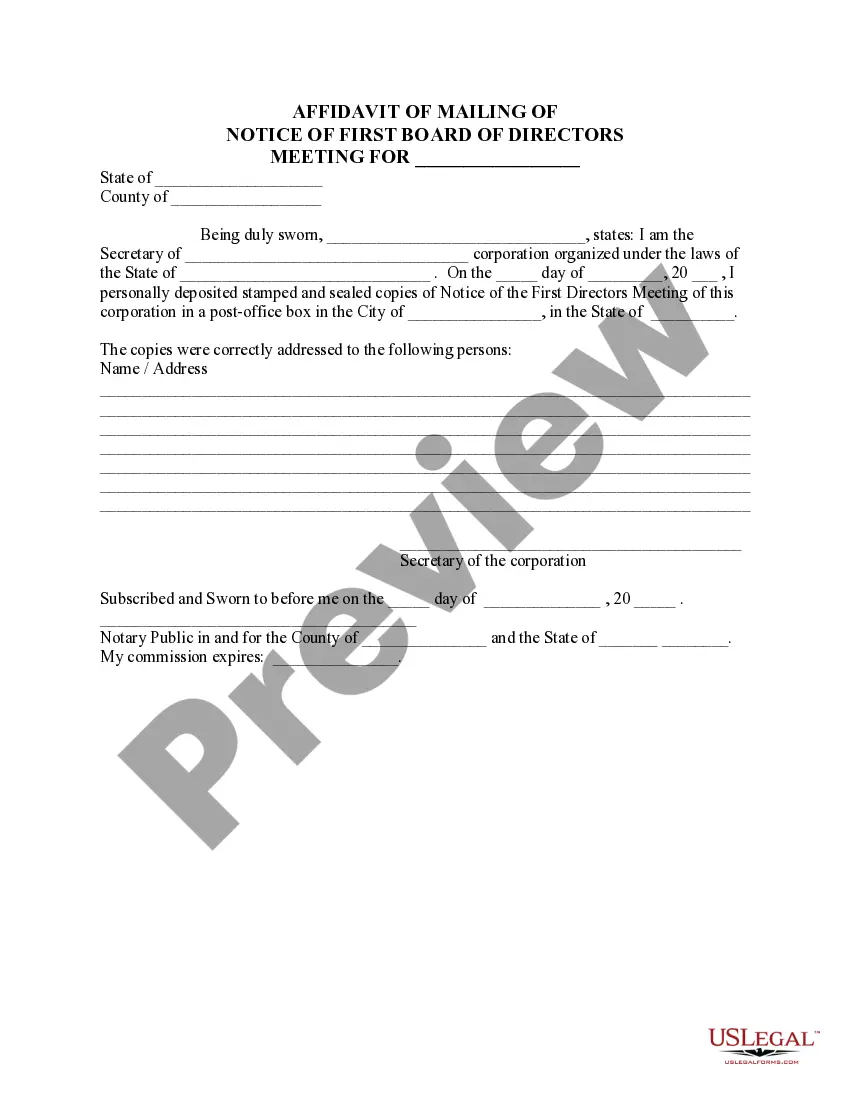

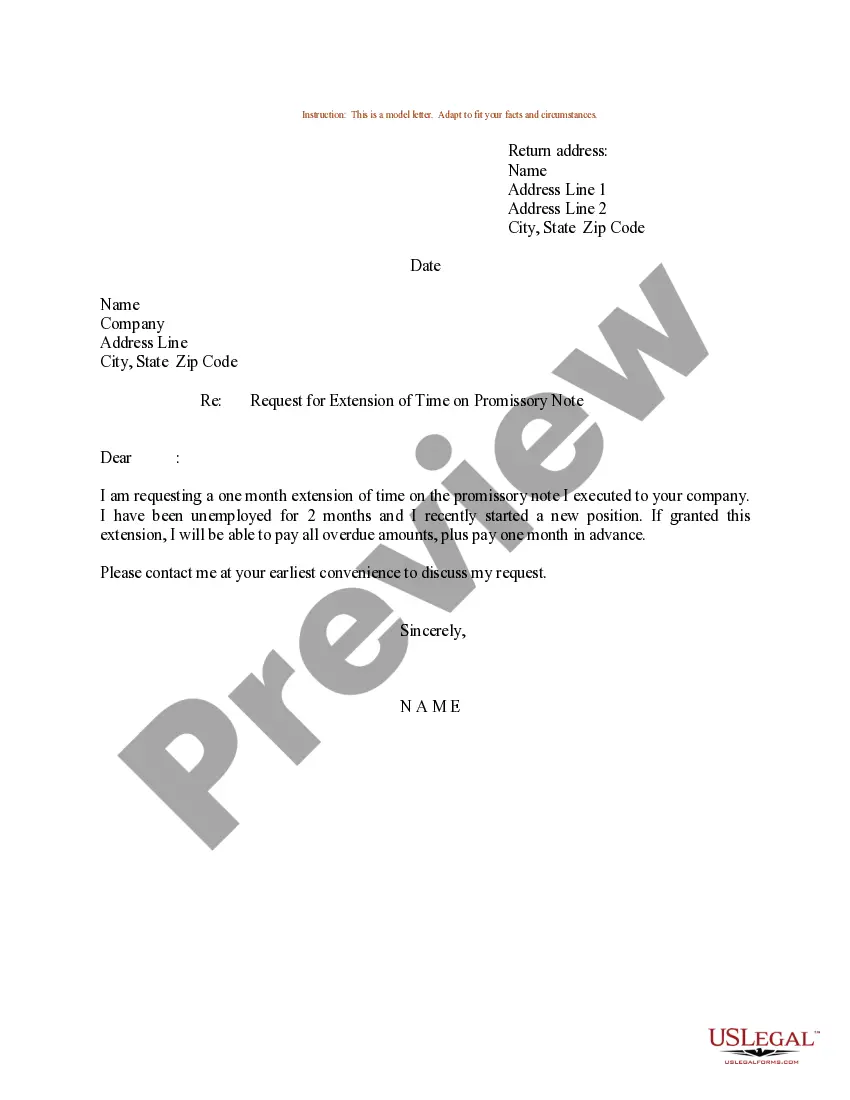

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct template.

- If the document is not what you are seeking, use the Lookup section to find a form that meets your needs.