Massachusetts Agreement for Auditing Services between Accounting Firm and Municipality

Description

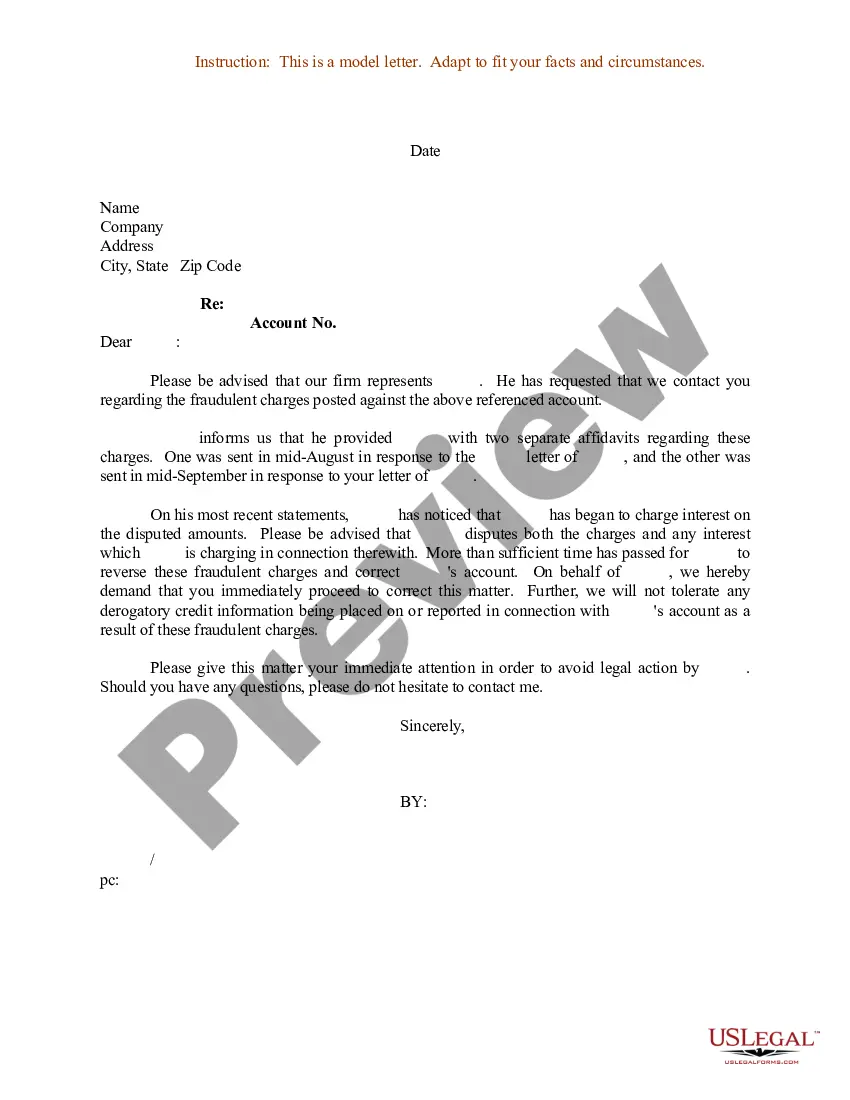

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

Are you presently inside a situation where you require documents for possibly enterprise or person uses nearly every working day? There are tons of legal file themes accessible on the Internet, but finding kinds you can rely is not straightforward. US Legal Forms provides thousands of form themes, like the Massachusetts Agreement for Auditing Services between Accounting Firm and Municipality, that happen to be published to satisfy state and federal needs.

If you are presently familiar with US Legal Forms internet site and have a free account, basically log in. Next, you may down load the Massachusetts Agreement for Auditing Services between Accounting Firm and Municipality template.

If you do not have an account and need to start using US Legal Forms, follow these steps:

- Get the form you want and make sure it is for the right area/area.

- Make use of the Review button to analyze the form.

- Read the outline to actually have selected the correct form.

- If the form is not what you`re looking for, take advantage of the Look for field to get the form that suits you and needs.

- Once you find the right form, just click Buy now.

- Opt for the prices prepare you would like, complete the desired info to make your money, and pay money for the order making use of your PayPal or credit card.

- Select a handy paper formatting and down load your copy.

Locate all the file themes you might have purchased in the My Forms menus. You can get a more copy of Massachusetts Agreement for Auditing Services between Accounting Firm and Municipality whenever, if required. Just go through the essential form to down load or printing the file template.

Use US Legal Forms, the most comprehensive collection of legal varieties, to conserve efforts and stay away from faults. The services provides professionally created legal file themes that can be used for a range of uses. Produce a free account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

The Public Company Accounting Oversight Board (PCAOB) is a non-profit organization that regulates audits of publicly traded companies to minimize audit risk. The PCAOB was established at the same time as the Sarbanes-Oxley Act of 2002 to address the accounting scandals of the late 1990s.

In fieldwork, auditors obtain and analyze program data and information to determine if the identified controls are working as intended. This is accomplished by completing the audit steps identified in the Audit Program.

A field audit is a face-to-face examination conducted at your place of business, or at your tax professional's office. This is the most comprehensive type of IRS audit, often involving a thorough examination of many items on a return.

Preparing for an Audit. Have all requested materials/records ready when requested. ... Step 1: Planning. The auditor will review prior audits in your area and professional literature. ... Step 2: Notification. ... Step 3: Opening Meeting. ... Step 4: Fieldwork. ... Step 5: Report Drafting. ... Step 6: Management Response. ... Step 7: Closing Meeting.

A field audit is the most detailed kind of IRS audit. In a field audit, an IRS representative will come to the taxpayer's home or place of business to examine records. The field audit is performed by an IRS Revenue Agent. IRS Revenue Agents are generally more skilled and knowledgeable than other IRS representatives.

The Comptroller and Auditor General (C&AG), Gareth Davies, is an Officer of the House of Commons and leads the NAO. We audit the financial accounts of departments and other public bodies.

Although every audit process is unique, the audit process is similar for most engagements and normally consists of four stages: Planning (sometimes called Survey or Preliminary Review), Fieldwork, Audit Report and Follow-up Review. Client involvement is critical at each stage of the audit process.