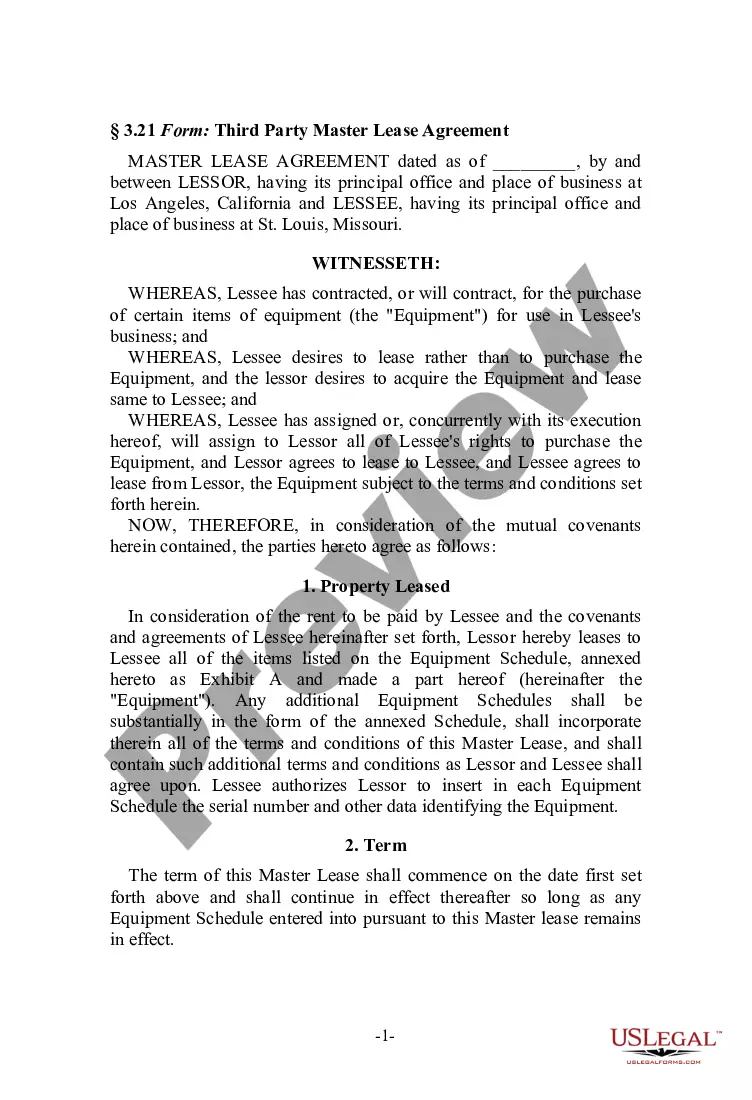

Massachusetts Fair Credit Act Disclosure Notice

Description

How to fill out Fair Credit Act Disclosure Notice?

Have you been in the situation the place you require papers for sometimes organization or specific functions nearly every time? There are tons of legitimate record templates available on the Internet, but getting kinds you can depend on is not easy. US Legal Forms delivers a huge number of develop templates, like the Massachusetts Fair Credit Act Disclosure Notice, which are written to satisfy federal and state requirements.

In case you are previously acquainted with US Legal Forms web site and also have a free account, simply log in. Following that, you may download the Massachusetts Fair Credit Act Disclosure Notice web template.

If you do not provide an account and want to begin to use US Legal Forms, adopt these measures:

- Get the develop you will need and ensure it is to the right city/area.

- Use the Review key to review the form.

- Read the explanation to ensure that you have chosen the right develop.

- In the event the develop is not what you are seeking, take advantage of the Lookup field to obtain the develop that suits you and requirements.

- If you get the right develop, just click Acquire now.

- Pick the costs prepare you want, complete the specified info to make your money, and buy the order making use of your PayPal or charge card.

- Pick a practical data file formatting and download your backup.

Locate each of the record templates you have bought in the My Forms food selection. You can obtain a more backup of Massachusetts Fair Credit Act Disclosure Notice anytime, if required. Just click the essential develop to download or print the record web template.

Use US Legal Forms, by far the most considerable collection of legitimate types, to conserve some time and prevent faults. The services delivers expertly produced legitimate record templates which you can use for a range of functions. Produce a free account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

The Fair Credit Reporting Act (FCRA), 15 U.S.C. 1681-1681y, requires that this notice be provided to inform users of consumer reports of their legal obligations.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A creditor must disclose the credit score used by the person in making the credit decision on a risk-based pricing notice. Credit score has the same meaning used in §609(f)(2)(a) of the FCRA. Most credit scores that meet the FCRA definition are scores that creditors obtain from consumer reporting agencies.

The Dodd-Frank Act also amended two provisions of the FCRA to require the disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing.

A credit file disclosure provides you with all of the information in your credit file maintained by a consumer reporting company that could be provided by the consumer reporting company in a consumer report about you to a third party, such as a lender.