Massachusetts Job Sharing Policy

Description

How to fill out Job Sharing Policy?

It is feasible to dedicate numerous hours online searching for the legitimate document template that aligns with the state and federal standards you require.

US Legal Forms offers thousands of legal documents which are vetted by experts.

You can conveniently download or print the Massachusetts Job Sharing Policy from my services.

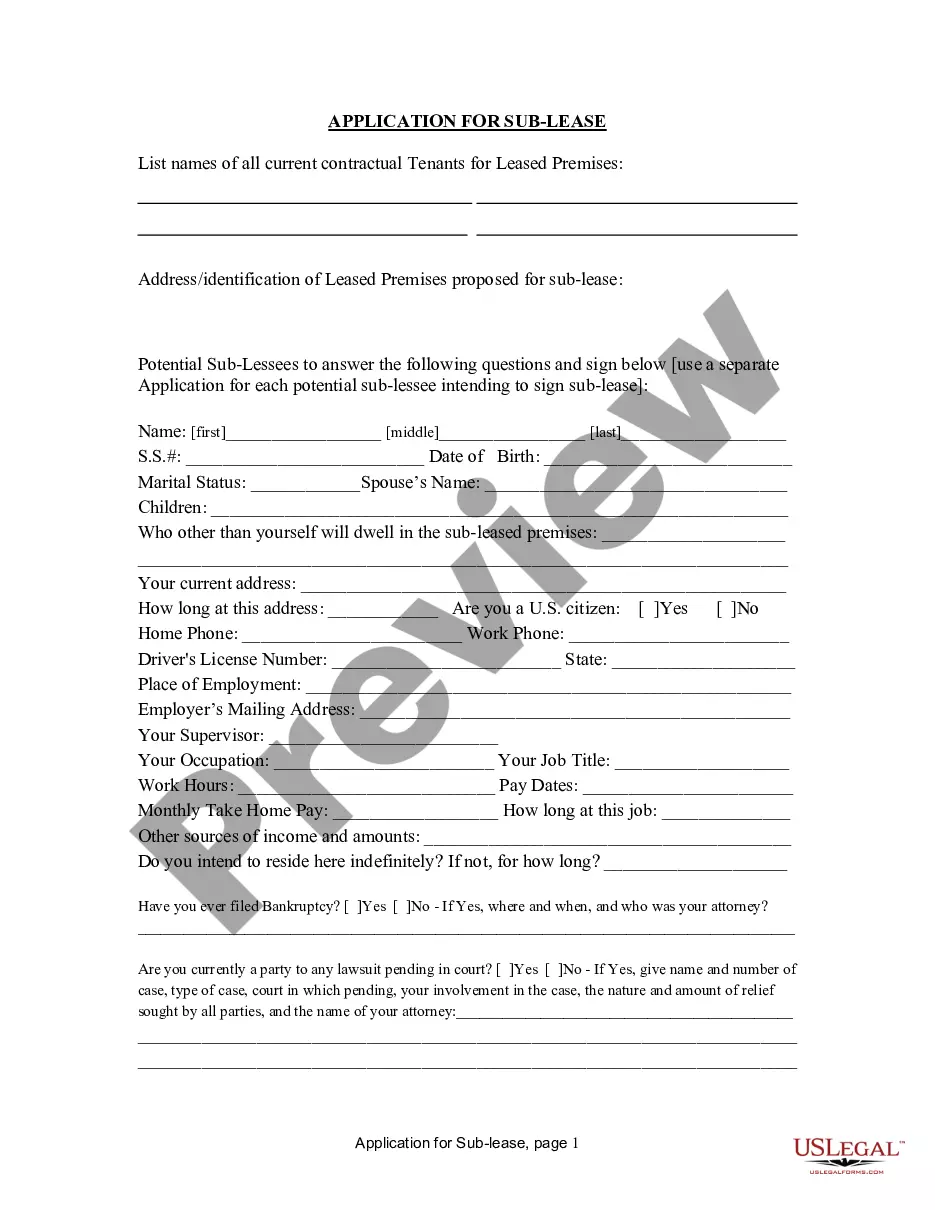

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Then, you can complete, modify, print, or sign the Massachusetts Job Sharing Policy.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any acquired form, visit the My documents tab and click the respective button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/region that you select.

- Review the form description to make sure you have chosen the appropriate form.

Form popularity

FAQ

An example of job sharing might include two teachers who each work three days a week, splitting the duties of one full-time teaching position. Each teacher handles lesson planning and classroom management on their assigned days. This approach can enhance collaboration while allowing both individuals to pursue other interests, aligning perfectly with the Massachusetts Job Sharing Policy.

Job sharing refers to an arrangement where two or more employees share the responsibilities of a single full-time position. This can allow flexibility in scheduling, creating a better work-life balance for those involved. Under the Massachusetts Job Sharing Policy, such arrangements are legally recognized, encouraging employers to adopt more inclusive workplace practices.

Job sharing is an arrangement whereby two people choose to share one full time job and the salary and benefits are divided between them according to the amount of time they each work. Each person's terms are equivalent to those of a full time member of staff, though pro-rata.

Five tips for managing a successful job shareDivide the role in the most effective way possible.Make the most of potential flexibility.Minimise common problems.Have clear contractual arrangements.Ensure arrangements for one job share partner leaving are clear.

For employers, the benefits of offering job share arrangements include: attracting a wider pool of applicants for new jobs. more part-time work available in the organisation. more skills and experience in a position (especially if employees have complementary skills)

How Many Hours Is Considered Full-Time? Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

Illegal in Massachusetts: Asking Your Salary in a Job Interview.

Legally speaking, there is nothing to stop an employee from having a second job. However, consideration needs to be given to the terms of the contract of employment as they may prohibit an employee from carrying out secondary employment.

Yes. Employers may legally limit the rights of their employees to work a second job (often called moonlighting), especially if that work substantially interferes or competes with the duties of their primary job.

The terms and conditions of your contract of employment may prohibit you from engaging in secondary employment. If so, engaging in secondary employment may constitute a breach of your employment conditions, placing you at risk of termination.