Massachusetts Resolution of Meeting of LLC Members to Loan Money is a legal document that outlines the process for a Limited Liability Company (LLC) to loan money. This resolution is a crucial tool for members of an LLC when they need to provide financial assistance to the company or any other entity. It ensures that the loan transaction is conducted in a formal and organized manner, protecting the interests of all members involved. The Massachusetts Resolution of Meeting of LLC Members to Loan Money typically includes the following key elements: 1. Heading: The resolution begins with a heading stating the name of the LLC and specific details about the meeting, such as the date, time, and location. 2. Introduction: This section identifies the members present at the meeting and acknowledges the legal authority under which the resolution is being passed. 3. Purpose of the Resolution: The purpose of the resolution is described, stating the need for the loan and the specific objectives it aims to achieve. It may outline the terms and conditions, including the loan amount, interest rate, repayment schedule, and any other relevant provisions. 4. Approval of the Loan: The members formally vote to approve the loan by providing their assent to the resolution. The resolution should clearly state the number of votes in favor, any abstentions, and any members dissenting. 5. Signatures: Once the resolution has been approved, it must be signed by all participating members to acknowledge their consent. Each member's name, title, and signature should be included for authenticity. Types of Massachusetts Resolution of Meeting of LLC Members to Loan Money: 1. Short-term Loan Resolution: This type of resolution is used when an LLC needs immediate funds for a specific purpose, such as financing operational expenses or covering unexpected costs. The terms and conditions agreed upon should reflect the short-term nature of the loan. 2. Long-term Loan Resolution: Long-term loans are typically utilized for significant investments, expansions, or capital-intensive projects. This resolution outlines a more extended repayment schedule, potentially spanning several years, and may involve more complexities in terms of collateral, interest rates, or conversion options. 3. Bridge Loan Resolution: In certain situations, an LLC may require temporary financing to bridge the gap between two transactions, such as acquiring a new asset before receiving funds from a pending sale. This resolution enables the LLC to secure a bridge loan and specifies the terms and repayment plans until the subsequent transaction is completed. In conclusion, the Massachusetts Resolution of Meeting of LLC Members to Loan Money serves as a crucial legal document that allows LLC members to provide financial assistance to their company. It ensures proper documentation, transparency, and agreement among all members by outlining the loan purpose, terms, and approval process. Different types of resolutions may exist based on the loan's duration, utilization, or specific circumstances.

Massachusetts Resolution of Meeting of LLC Members to Loan Money

Description

How to fill out Massachusetts Resolution Of Meeting Of LLC Members To Loan Money?

Have you been inside a place where you need documents for sometimes company or person purposes virtually every working day? There are tons of authorized papers web templates available on the net, but discovering kinds you can trust isn`t straightforward. US Legal Forms delivers a huge number of type web templates, just like the Massachusetts Resolution of Meeting of LLC Members to Loan Money, that happen to be written to fulfill federal and state needs.

If you are currently acquainted with US Legal Forms website and have a free account, merely log in. Afterward, you may download the Massachusetts Resolution of Meeting of LLC Members to Loan Money design.

Should you not offer an account and want to begin using US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for the right town/region.

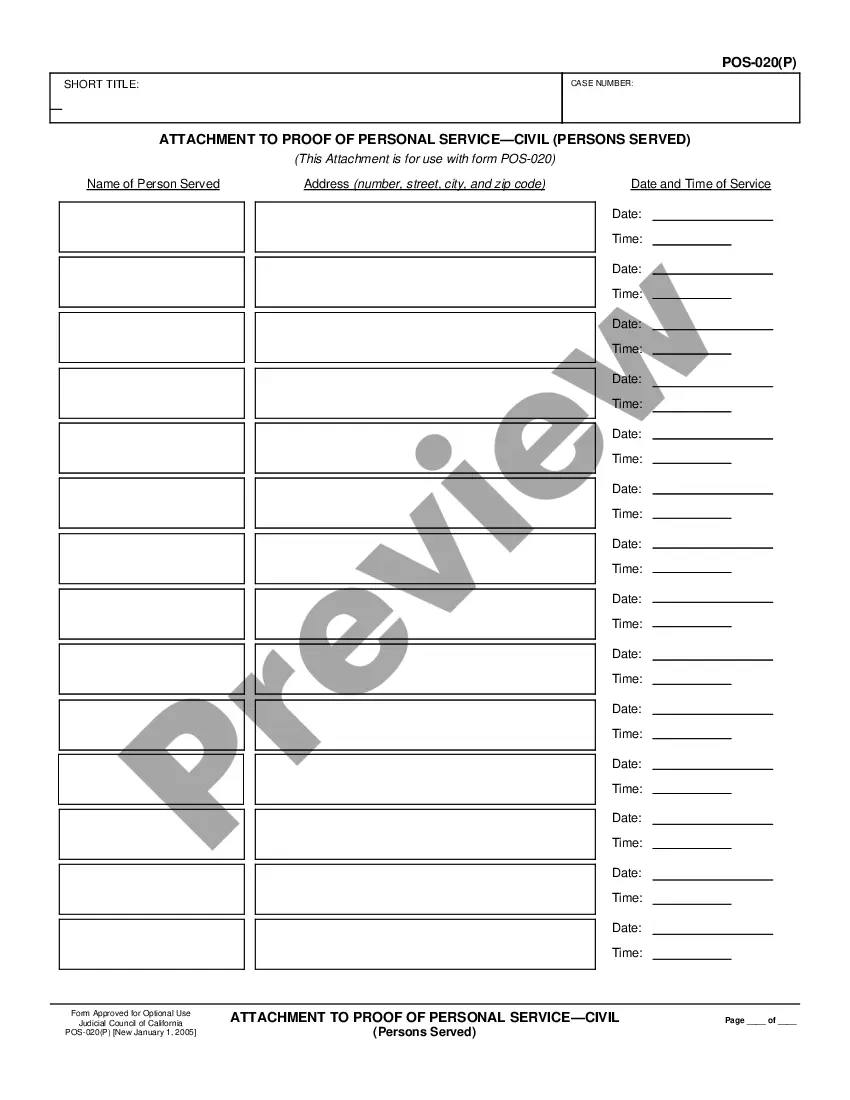

- Make use of the Review button to analyze the form.

- Look at the explanation to actually have selected the right type.

- In case the type isn`t what you`re seeking, use the Look for field to get the type that fits your needs and needs.

- Whenever you obtain the right type, click Buy now.

- Choose the prices plan you want, fill in the required info to create your money, and pay for an order making use of your PayPal or Visa or Mastercard.

- Choose a practical data file structure and download your duplicate.

Get every one of the papers web templates you may have bought in the My Forms food selection. You can obtain a additional duplicate of Massachusetts Resolution of Meeting of LLC Members to Loan Money anytime, if needed. Just click on the necessary type to download or print out the papers design.

Use US Legal Forms, probably the most considerable selection of authorized types, to save some time and prevent errors. The support delivers professionally made authorized papers web templates which you can use for a selection of purposes. Create a free account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

During the first meeting of the members (LLC) or Board of Directors (Corporation), it is common for a business to establish a board resolution top open a bank account. A banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.