Massachusetts FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

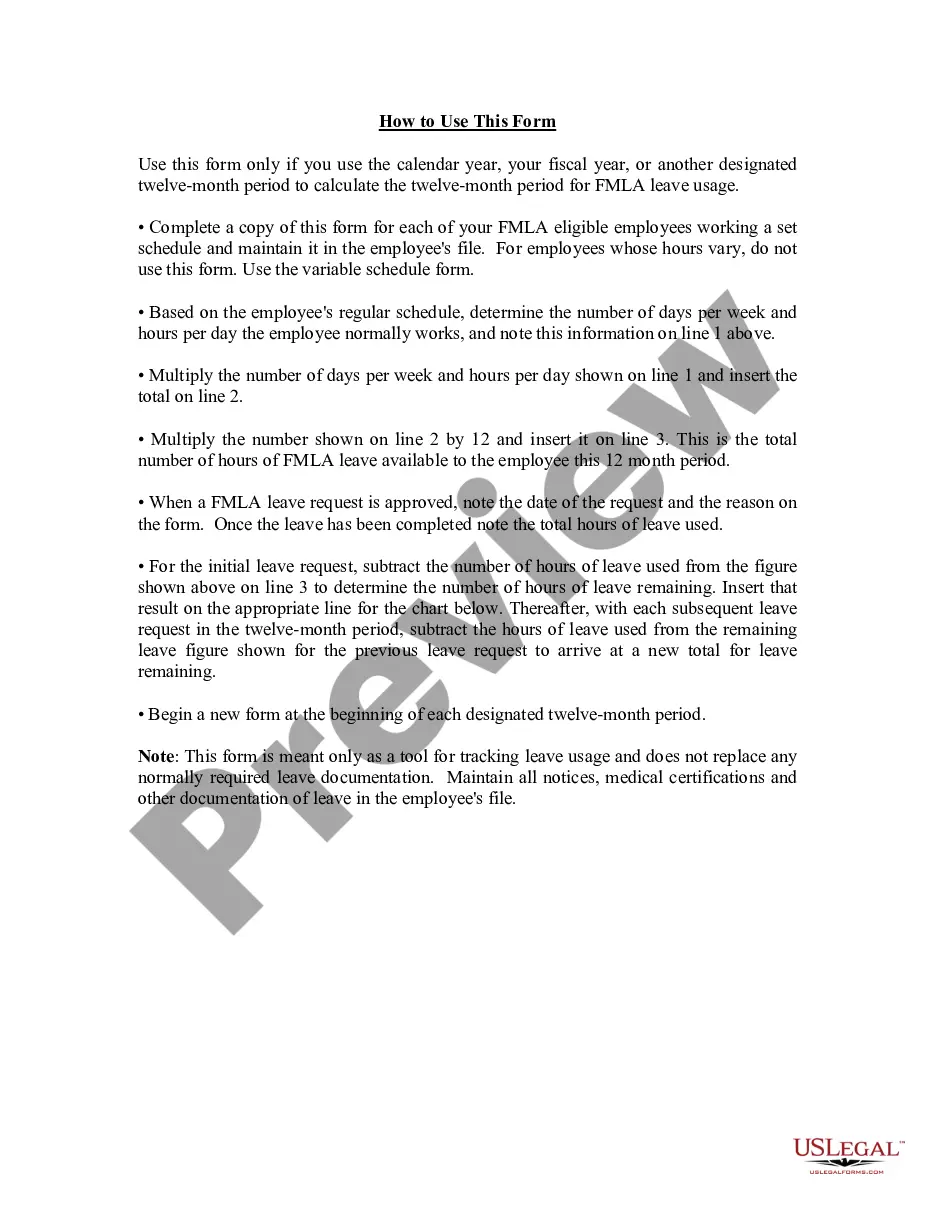

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

Are you presently in the location where you require documents for both business or personal reasons each day.

There are numerous legal document templates accessible online, but finding ones you can trust is not straightforward. US Legal Forms provides thousands of form templates, such as the Massachusetts FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Massachusetts FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule template.

Select a convenient format and download your copy.

Access all the document templates you have purchased from the My documents section. You may obtain another copy of the Massachusetts FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule at any time, if needed. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and confirm it is for the correct city/state.

- Use the Preview button to review the form.

- Check the details to ensure you have chosen the right document.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the appropriate form, click on Download now.

- Choose the payment plan you prefer, provide the necessary details to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

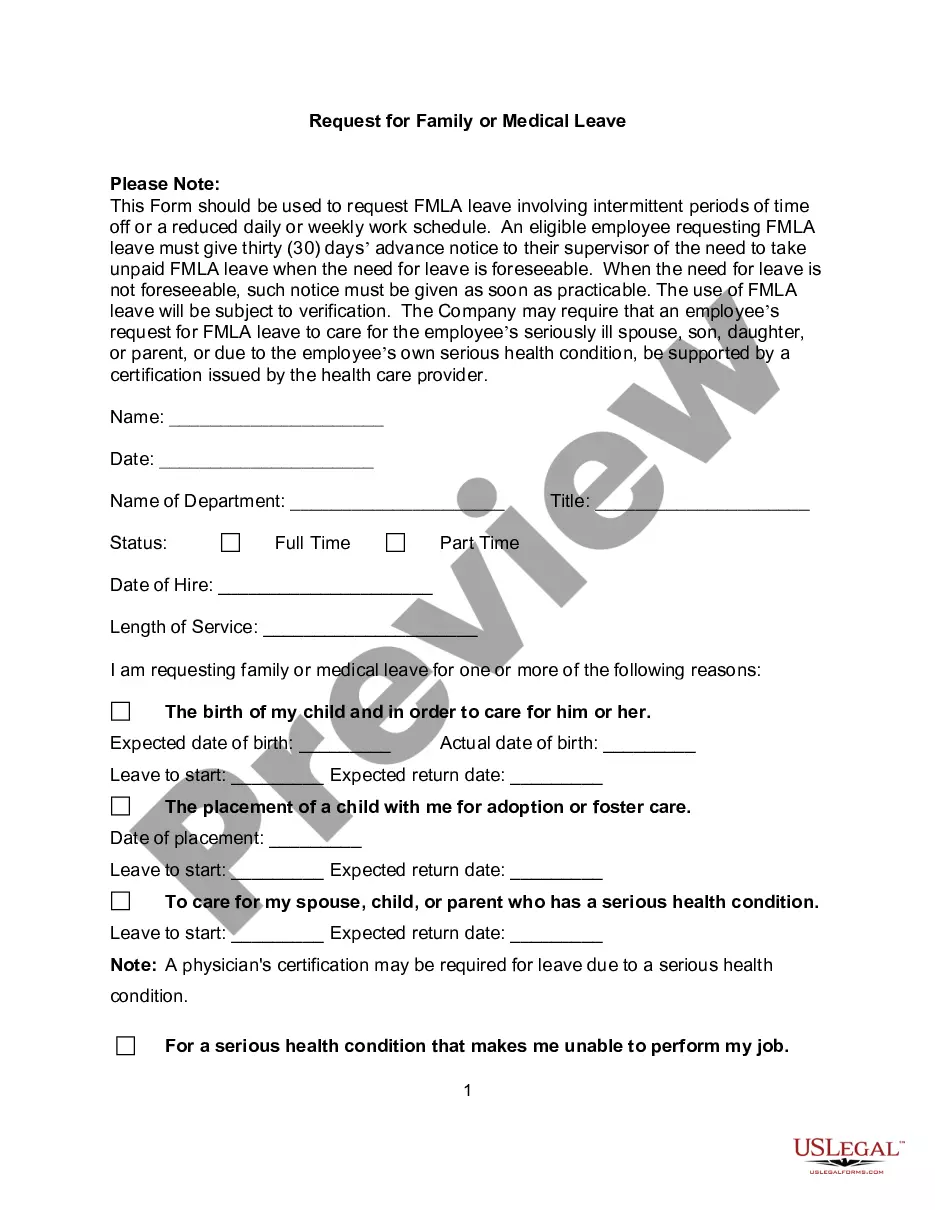

FMLA leave may be taken in periods of whole weeks, single days, hours, and in some cases even less than an hour. The employer must allow employees to use FMLA leave in the smallest increment of time the employer allows for the use of other forms of leave, as long as it is no more than one hour.

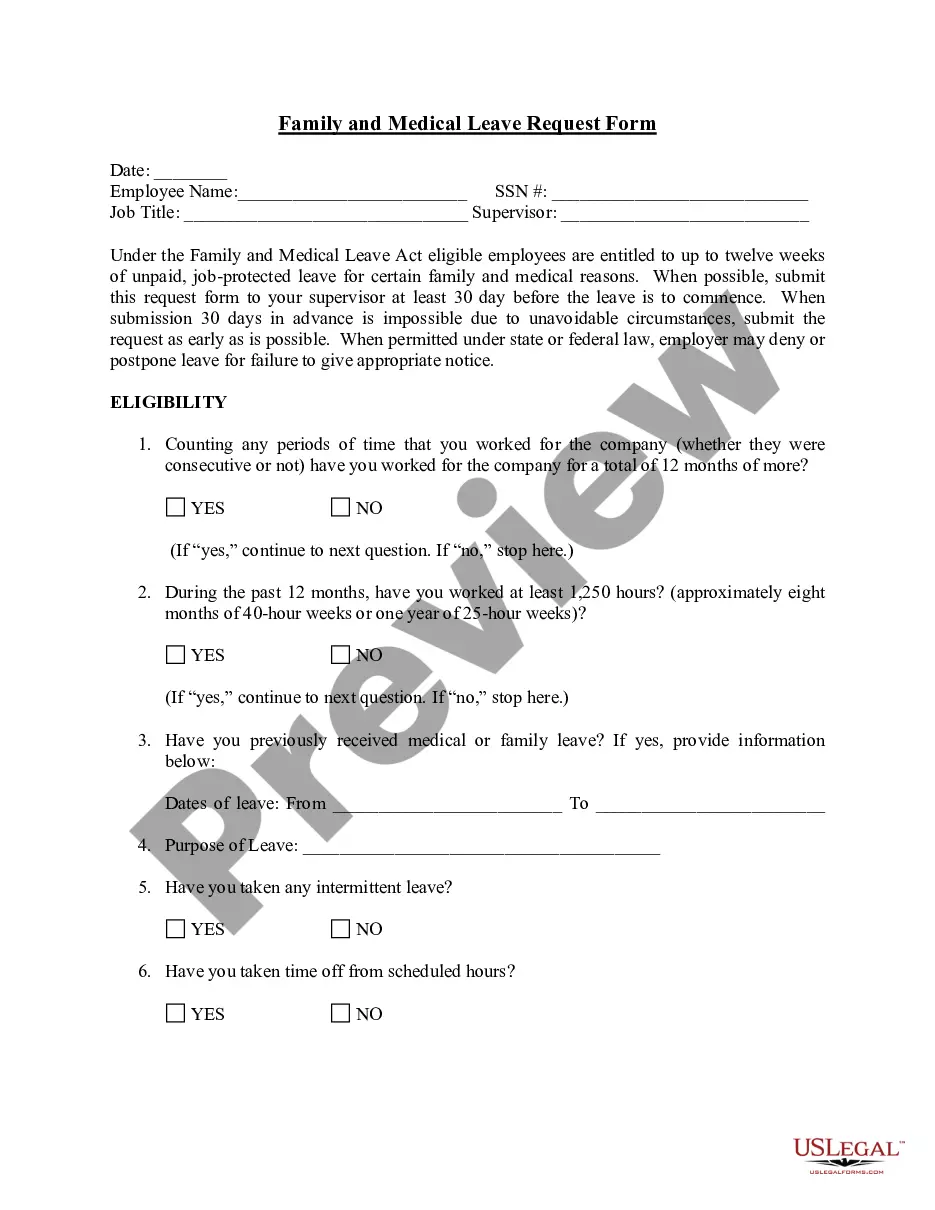

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

An eligible employee may take all 12 weeks of his or her FMLA leave entitlement as qualifying exigency leave or the employee may take a combination of 12 weeks of leave for both qualifying exigency leave and leave for a serious health condition.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.