Massachusetts Lease for Franchisor - Owned Locations

Description

How to fill out Lease For Franchisor - Owned Locations?

You are able to devote hrs on the web attempting to find the legal record web template that suits the state and federal requirements you require. US Legal Forms gives thousands of legal varieties that are examined by professionals. You can actually download or printing the Massachusetts Lease for Franchisor - Owned Locations from my services.

If you already have a US Legal Forms bank account, you are able to log in and click on the Acquire switch. Afterward, you are able to total, edit, printing, or indicator the Massachusetts Lease for Franchisor - Owned Locations. Each legal record web template you buy is your own property forever. To have yet another copy for any acquired develop, proceed to the My Forms tab and click on the related switch.

If you use the US Legal Forms web site the very first time, stick to the easy directions below:

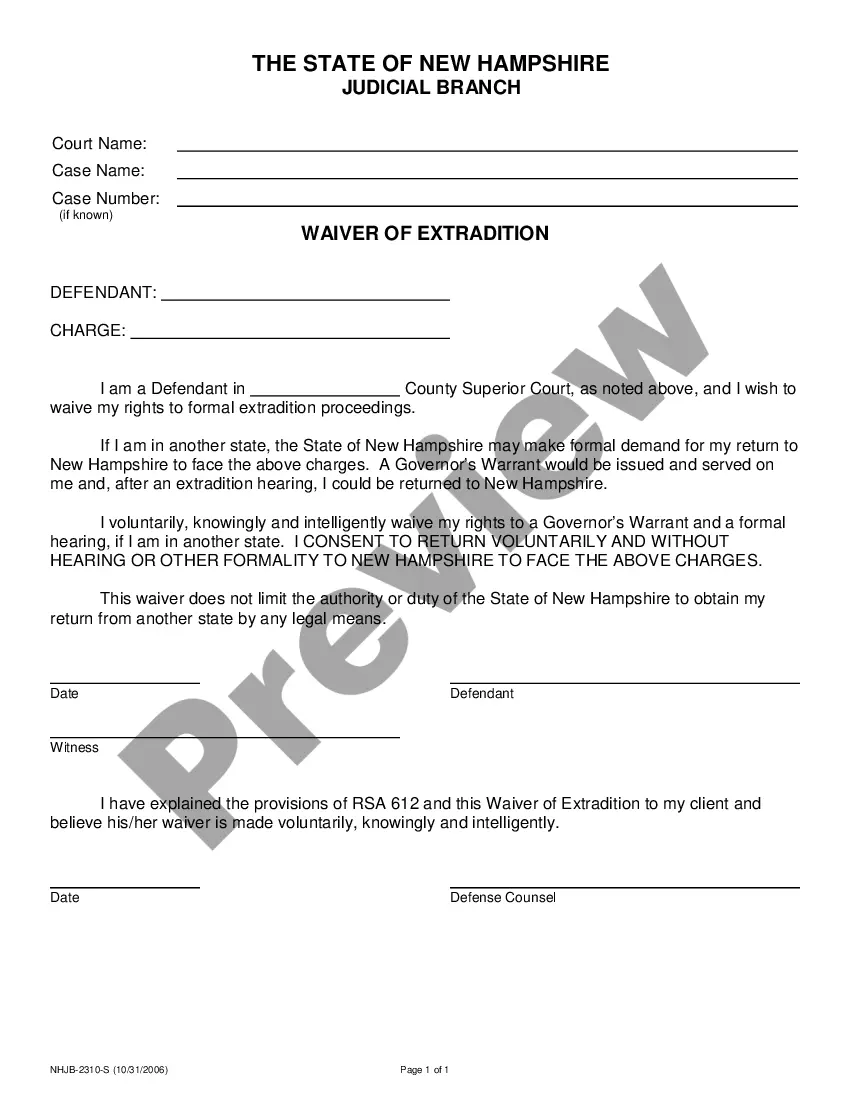

- Initial, be sure that you have selected the right record web template for the region/metropolis of your choosing. Look at the develop description to make sure you have selected the appropriate develop. If available, use the Review switch to look with the record web template at the same time.

- If you wish to get yet another variation of your develop, use the Lookup industry to find the web template that fits your needs and requirements.

- When you have identified the web template you desire, click Acquire now to carry on.

- Choose the pricing prepare you desire, key in your accreditations, and sign up for an account on US Legal Forms.

- Full the transaction. You should use your credit card or PayPal bank account to pay for the legal develop.

- Choose the file format of your record and download it to your device.

- Make changes to your record if required. You are able to total, edit and indicator and printing Massachusetts Lease for Franchisor - Owned Locations.

Acquire and printing thousands of record templates using the US Legal Forms Internet site, that provides the most important assortment of legal varieties. Use skilled and status-particular templates to take on your small business or person demands.

Form popularity

FAQ

Massachusetts is classified as a non-registration state because there is no state franchise registration, business opportunity exemption registration, or other franchise disclosures required by the state.

A franchisee is a business owner who is licensed to operate a branded outlet of a retail chain. The franchisee pays a fee to the franchisor for the right to sell its established products and use its trademarks and proprietary knowledge.

It generally takes the form of an additional agreement that is attached to the lease between the franchisee and the property owner, or it is sometimes a provision contained in the terms of the lease itself.

A franchise owner is an individual who has taken on the role of owning and operating a franchise business independently. Franchise owners have made an investment in the franchise and hold the rights and responsibilities associated with running that specific franchise location.

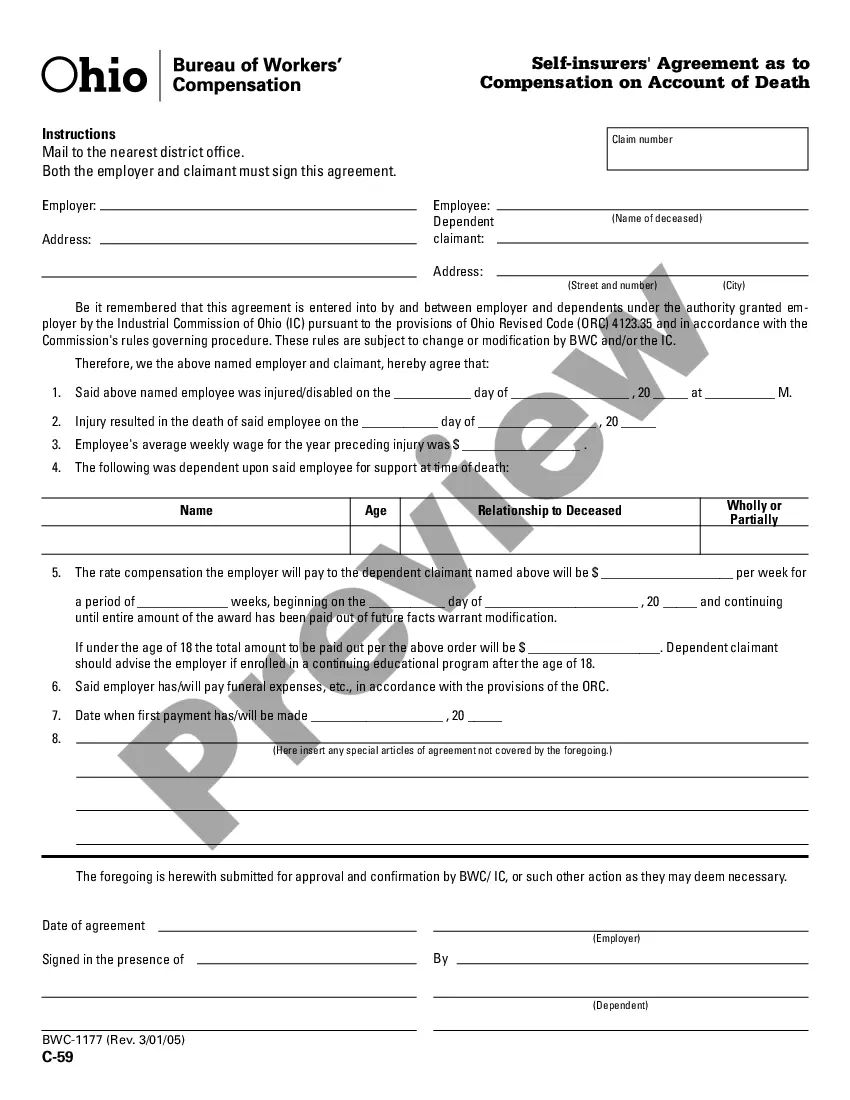

The property owner provides business space to a franchisee to operate the franchisor's business plan in return for a lease payment. Under the lease terms, the property owner gives rights to the franchisor to replace and assume the Franchisee Business Entity under certain conditions.

The franchisor makes store location recommendations based on things like vehicle traffic, foot traffic in the area and demographics. They have access to reports that help them decide if the location you're choosing, or the one they've suggested, has the potential to be a good one.

The owner of a franchise business is called a franchisor, while the licensee is known as a franchisee. Many locations of common retail chains such as McDonald's and Jiffy Lube are operated by franchisees instead of being owned by the parent company.

Simply put ? within a chain business, a parent company owns each location. With a franchise, different stores or branches are owned by separate individuals who are solely responsible for daily operations.