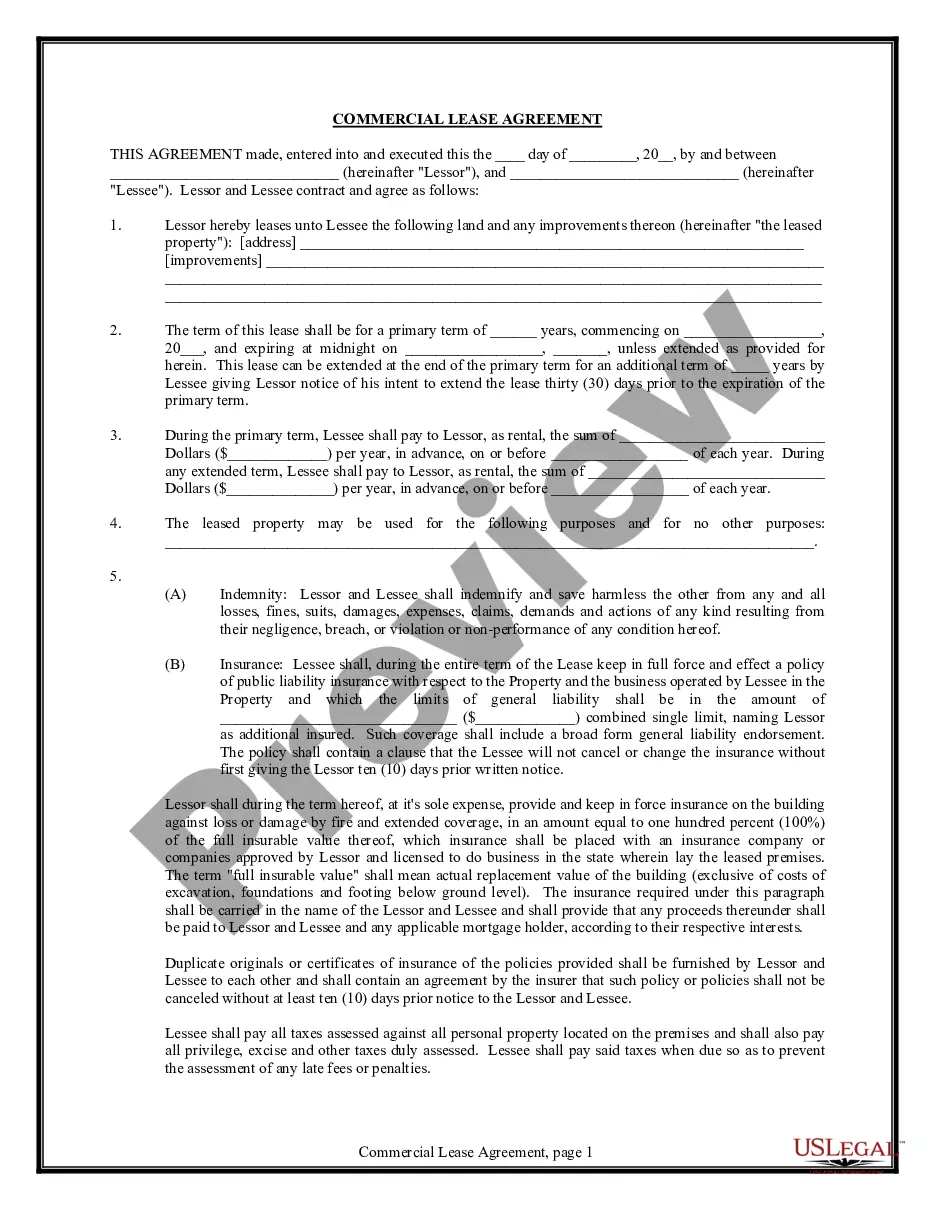

A Massachusetts Commercial Lease Agreement for Tenant is a legally binding contract that outlines the terms and conditions for renting commercial property in the state of Massachusetts. This agreement is specifically designed for business owners or entrepreneurs seeking to lease a commercial space to conduct their business operations. Key features of a Massachusetts Commercial Lease Agreement for Tenant include: 1. Property Description: It provides a detailed description of the commercial property being leased, including the address, size, and any specific features or amenities. 2. Lease Term: The agreement specifies the duration of the lease, including the start and end dates. It may also include provisions for renewal options if available. 3. Rent Payments: It details the monthly rent amount, the due date, and the acceptable payment methods. Additionally, it may specify any late payment penalties or grace periods. 4. Security Deposit: This agreement often includes information about the security deposit required by the landlord. It outlines the amount, conditions for its return, and any deductions allowed. 5. Use of the Premises: It defines the specific activity or business that the tenant is permitted to conduct on the premises. It may include restrictions on usage or provisions for change of use with landlord approval. 6. Maintenance and Repairs: The agreement typically outlines the responsibilities of the tenant and landlord concerning property maintenance, repairs, and any associated costs. 7. Improvements and Alterations: If the tenant is allowed to make improvements or alterations to the property, this section outlines the conditions, approval processes, and whether the changes can be removed at the end of the lease. 8. Utilities and Services: It specifies which utilities and services are included in the rent, such as water, electricity, heating, and waste management. If not included, provisions for payment and responsibilities need to be clearly defined. 9. Insurance and Liability: This section covers the required insurance coverage for the tenant, including liability insurance, and any obligations related to potential damages. 10. Default and Termination: It outlines the events that could lead to lease termination, such as non-payment of rent or violation of the lease terms. The consequences of default or termination, including penalties, eviction, or other legal actions, may also be described. Types of Massachusetts Commercial Lease Agreements for Tenant: 1. Gross Lease: With this type of lease agreement, the tenant pays a fixed amount of rent, and the landlord is responsible for covering operating expenses such as property taxes, insurance, and maintenance costs. 2. Net Lease: In a net lease agreement, the tenant pays a base rent, and in addition, they are responsible for a portion of the operating expenses, typically in the form of property taxes, insurance, or maintenance charges. 3. Triple Net Lease: A triple net lease requires tenants to cover all operational expenses related to the property, including property taxes, insurance, maintenance costs, and utilities, in addition to the base rent. 4. Percentage Lease: This type of lease is commonly used for retail businesses, where the tenant pays a base rent plus a percentage of their sales revenue. In conclusion, a Massachusetts Commercial Lease Agreement for Tenant is a comprehensive document that establishes the rights and responsibilities of both the tenant and landlord in a commercial lease transaction. It is crucial for business owners to carefully review and understand all the terms and conditions outlined in the agreement before signing.

Massachusetts Commercial Lease Agreement for Tenant

Description

How to fill out Massachusetts Commercial Lease Agreement For Tenant?

Discovering the right legitimate papers design could be a have a problem. Obviously, there are a lot of templates available on the net, but how would you find the legitimate develop you need? Make use of the US Legal Forms website. The service gives 1000s of templates, such as the Massachusetts Commercial Lease Agreement for Tenant, which you can use for company and personal demands. All the varieties are inspected by professionals and fulfill state and federal specifications.

Should you be previously signed up, log in to the profile and click on the Down load key to obtain the Massachusetts Commercial Lease Agreement for Tenant. Use your profile to appear from the legitimate varieties you may have bought formerly. Visit the My Forms tab of the profile and obtain one more version from the papers you need.

Should you be a new user of US Legal Forms, allow me to share simple instructions that you can comply with:

- Initially, make sure you have selected the appropriate develop for your city/county. You may check out the form making use of the Preview key and browse the form description to make certain this is basically the best for you.

- If the develop is not going to fulfill your expectations, use the Seach industry to discover the proper develop.

- Once you are positive that the form would work, go through the Acquire now key to obtain the develop.

- Pick the prices plan you desire and enter the required information and facts. Build your profile and pay for an order using your PayPal profile or Visa or Mastercard.

- Select the data file format and down load the legitimate papers design to the gadget.

- Comprehensive, revise and print and indicator the attained Massachusetts Commercial Lease Agreement for Tenant.

US Legal Forms is definitely the largest catalogue of legitimate varieties in which you will find numerous papers templates. Make use of the company to down load professionally-made documents that comply with status specifications.

Form popularity

FAQ

Landlords are normally responsible for any structural repairs needed to maintain commercial properties. This includes exterior walls, foundations, flooring structure and the roof.

No, a commercial lease does not need to be notarized in Massachusetts in order for it to be legal; however, any party to the lease may request that the commercial lease be notarized if they so choose.

At a minimum, the lease agreement should include the property address , amount of rent , and duration of the lease with an effective start date. It should also include any other costs that the tenant and landlord will be responsible for. Leases need to be signed by both the landlord and the tenant.

Your landlord is responsible for any aspects of health and safety written in the lease (eg in communal areas). You must take reasonable steps to make sure your landlord fulfils these responsibilities. If you get into a dispute with your landlord, you need to keep paying rent - otherwise you may be evicted.

The short answer is No a witness does not need to sign But, there are some exceptions and things to consider. Most agreements do not need witnesses to sign them. Most agreements do not even need to be signed by the parties entering into the agreement. Most agreements do not even need to be in writing.

However, it is usually the tenant who covers the cost regarding the lease document and requests the terms. Having said that, both parties should have legal representation and the particularities of the contract can be negotiated by their legal teams.

The responsibilities of landlord and tenant will be clearly set out in the lease. Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.

A commercial lease is a contract made between a business tenant and a landlord. This commercial lease contract grants you the right to use the property for commercial or business purposes. Money is paid to the landlord for the use of the property.

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.

No, lease agreements do not need to be notarized in Massachusetts. As long as the residential lease meets all the criteria required to be legally binding, notarization is not necessary. The landlord and tenant can agree to have the lease notarized if they wish, but it is not required by Massachusetts state law.