Massachusetts Proposed Additional Compensation Plan with copy of plan

Description

How to fill out Proposed Additional Compensation Plan With Copy Of Plan?

US Legal Forms - among the biggest libraries of legitimate types in the USA - gives a variety of legitimate record web templates you can download or printing. Utilizing the site, you will get thousands of types for business and person functions, categorized by types, claims, or keywords and phrases.You can find the latest models of types much like the Massachusetts Proposed Additional Compensation Plan with copy of plan within minutes.

If you currently have a registration, log in and download Massachusetts Proposed Additional Compensation Plan with copy of plan through the US Legal Forms local library. The Download option will appear on every single kind you see. You get access to all formerly saved types within the My Forms tab of your respective bank account.

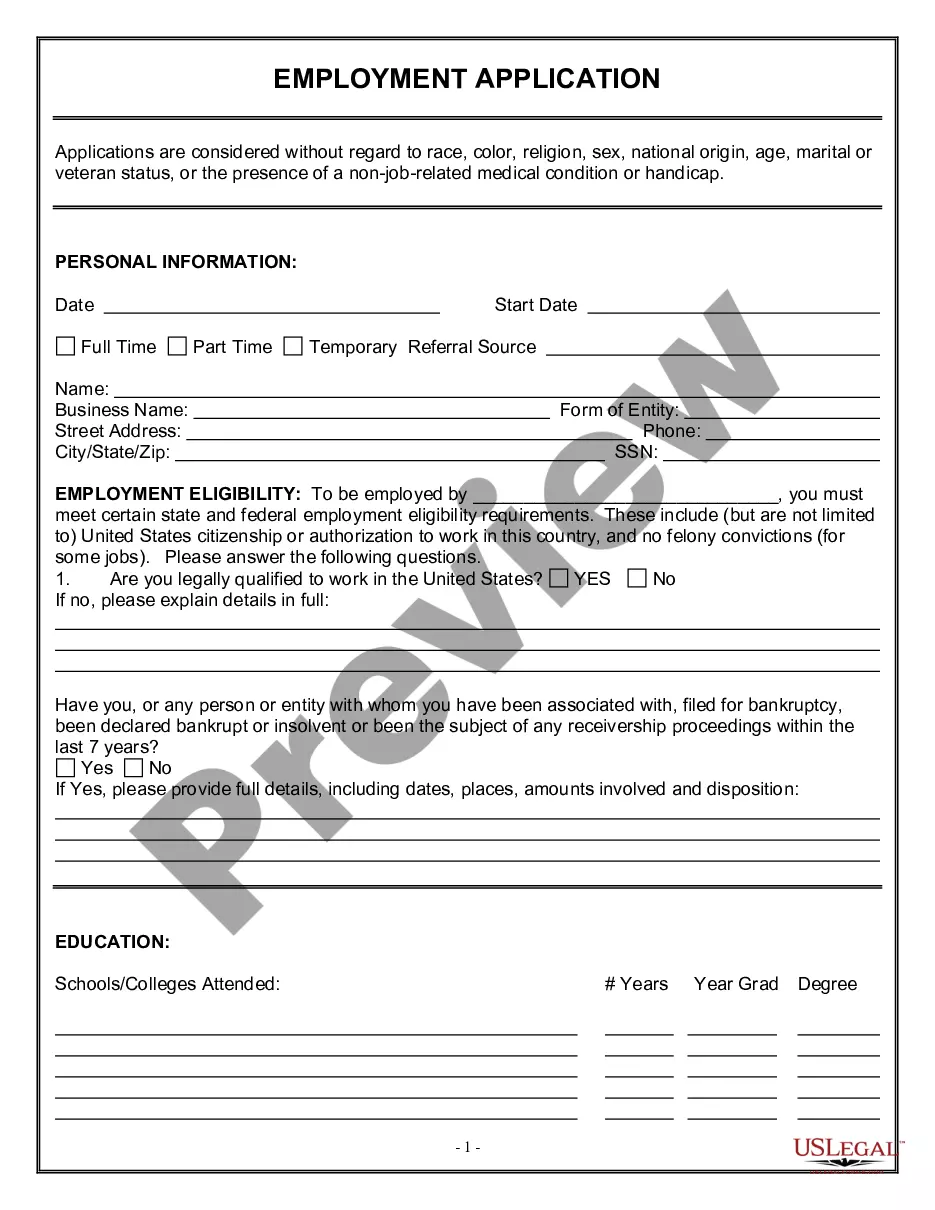

If you would like use US Legal Forms initially, listed below are easy guidelines to get you started:

- Be sure you have chosen the best kind for the town/region. Click the Preview option to examine the form`s articles. Browse the kind outline to ensure that you have selected the correct kind.

- When the kind does not fit your needs, make use of the Look for field at the top of the display to obtain the one who does.

- If you are content with the form, confirm your choice by simply clicking the Get now option. Then, choose the costs prepare you prefer and give your accreditations to register on an bank account.

- Procedure the financial transaction. Use your bank card or PayPal bank account to finish the financial transaction.

- Select the format and download the form on your system.

- Make modifications. Load, change and printing and signal the saved Massachusetts Proposed Additional Compensation Plan with copy of plan.

Each format you put into your money does not have an expiration day and it is your own eternally. So, if you would like download or printing an additional version, just check out the My Forms section and click on about the kind you require.

Gain access to the Massachusetts Proposed Additional Compensation Plan with copy of plan with US Legal Forms, one of the most extensive local library of legitimate record web templates. Use thousands of specialist and condition-particular web templates that satisfy your business or person requires and needs.

Form popularity

FAQ

Setting specific, measurable, achievable, relevant, and time-bound (SMART) objectives is a good way to plan the steps to meet the long-term goals in your grant. It helps you take your grant from ideas to action.

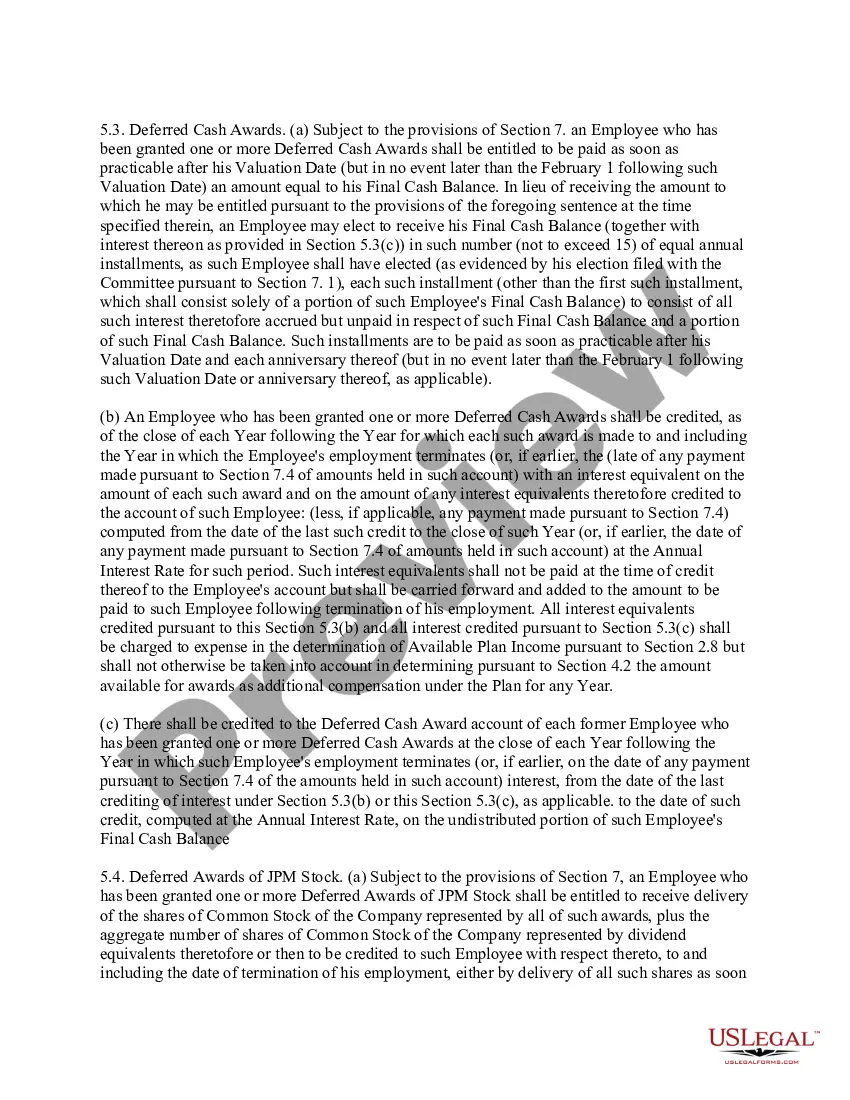

Deferred compensation plans are available mainly to high-income earners who want to put away funds for retirement and find the company 401(k) plan inadequate to their needs.

Annual limit: The minimum contribution amount to participate in the Massachusetts Deferred Compensation SMART Plan (SMART Plan) is 1% of your gross income or $10 per pay period. You can contribute a maximum of 100% of your includible compensation, not to exceed the annual IRS limit of $20,500 in 2022.

The plan is a voluntary savings program that allows employees to defer any amount, subject to annual limits, from their paycheck on a pretax basis.

You get all the benefits of the SMART Plan on your remaining balance. You will have to pay federal and state taxes on the amount you withdraw. You lose out on the potential for tax-deferred growth on the amount you withdraw. If you select a full lump-sum distribution, the full value of your account will be distributed.

The Massachusetts Deferred Compensation 457 SMART Plan is a retirement savings program available for Commonwealth of Massachusetts state and municipal employees. Eligible employees can save and invest before-tax and after-tax dollars through salary deferrals into our wide array of low fee investments options.

Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

The Massachusetts Deferred Compensation SMART Plan is a voluntary retirement savings program. Log in to your SMART Plan Account here. Participating in the Massachusetts Deferred Compensation SMART Plan may help provide a more comfortable and secure financial future.