Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. The Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. is an important decision-making process that allows the company to implement a comprehensive compensation plan to attract and retain top talent. This proposal aims to provide employees with long-term incentives and stock options as a means of aligning their interests with the company's long-term success. The purpose of this proposal is to request approval from the Massachusetts Board of Directors to adopt the Stock Option and Long-Term Incentive Plan, which will enable Golf Technology Holding, Inc. to grant stock options and other performance-based awards to its eligible employees. The implementation of this plan will benefit both the employees and the company by fostering a culture of ownership and incentivizing the achievement of strategic goals. The Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. encompasses various types of grants and awards that may be offered to eligible employees. These include stock options, restricted stock units (RSS), performance shares, and performance-based cash awards. Each type of award has its own requirements and vesting schedules, which are designed to motivate employees to contribute to the growth and success of the company over the long term. Stock options provide employees with the opportunity to purchase company stock at a predetermined price (the exercise price) within a specified period of time. This enables employees to benefit from the appreciation in the company's stock value over time. Restricted stock units, on the other hand, are granted to employees as an outright award of company stock, subject to certain conditions and restrictions. These units typically vest over a specific period, during which the employee must meet performance goals or remain with the company. Performance shares constitute another component of the proposal, which aligns the interests of executives and other eligible employees with the company's future performance. These shares are typically granted based on the achievement of predetermined performance targets, such as revenue growth or profitability. Successful attainment of these goals results in the conversion of performance shares into common stock or cash equivalent rewards. Lastly, performance-based cash awards provide eligible employees with the potential to receive cash bonuses if they meet certain performance milestones. These awards are generally tied to specific financial or operational objectives, ensuring that employees are motivated to contribute to the company's overall success. In conclusion, the Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. is aimed at creating a comprehensive compensation framework that rewards and retains key employees. By offering various types of grants and awards, this proposal ensures that employees are incentivized to contribute to the company's long-term growth and success.

Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc.

Description

How to fill out Massachusetts Proposal To Approve Adoption Of Stock Option And Long-Term Incentive Plan Of The Golf Technology Holding, Inc.?

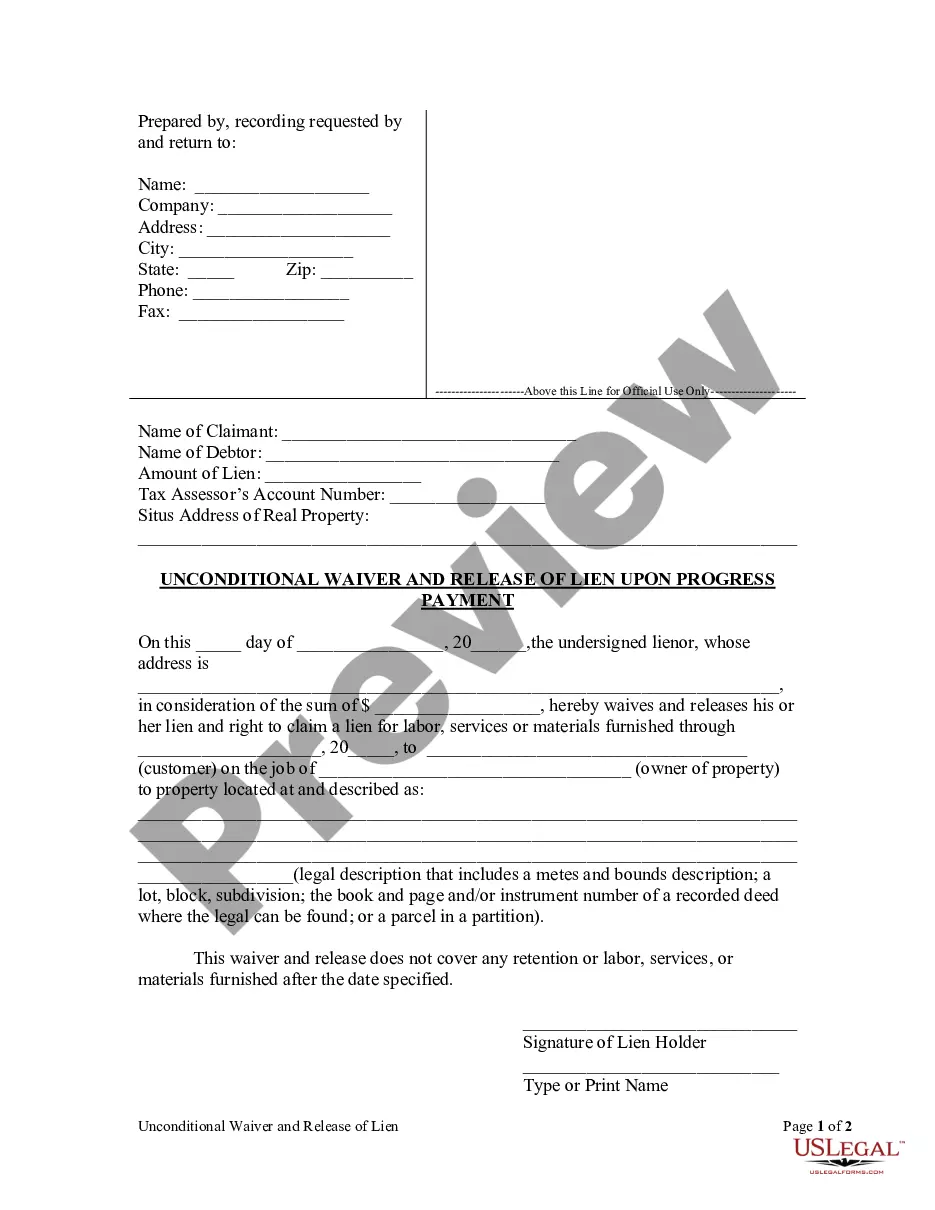

Finding the right legal record template can be a struggle. Obviously, there are plenty of layouts available online, but how would you find the legal kind you want? Use the US Legal Forms internet site. The assistance delivers a large number of layouts, for example the Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc., which can be used for company and personal requires. Every one of the types are checked by experts and satisfy state and federal needs.

Should you be currently authorized, log in for your profile and then click the Obtain option to obtain the Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc.. Make use of your profile to check from the legal types you may have ordered previously. Proceed to the My Forms tab of the profile and acquire an additional duplicate in the record you want.

Should you be a new consumer of US Legal Forms, here are easy directions that you should stick to:

- Initial, make sure you have chosen the correct kind to your metropolis/county. It is possible to look over the form using the Review option and study the form information to guarantee it will be the right one for you.

- In case the kind is not going to satisfy your preferences, take advantage of the Seach area to get the appropriate kind.

- When you are certain the form is proper, click the Purchase now option to obtain the kind.

- Select the rates program you want and enter the necessary info. Make your profile and purchase the order with your PayPal profile or bank card.

- Select the data file file format and acquire the legal record template for your device.

- Comprehensive, revise and print and indication the received Massachusetts Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc..

US Legal Forms will be the greatest library of legal types that you will find various record layouts. Use the company to acquire professionally-manufactured documents that stick to state needs.

Form popularity

FAQ

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

What Is an Employee Stock Option? Companies use various strategies to incentivize their workers. Cash compensation is the predominant way to motivate workers, but stock options are also a way to supplement employee compensation and encourage productivity.

With this type of incentive, participants are granted a right or option to purchase stock from the company at a specific price?usually the fair market value of the stock when the option is granted. The option to purchase shares continues over an extended period that is measured in years.

A stock option entitles the grantee the right to purchase shares of a company at a fixed price (known as the exercise price) in the future. Generally, the option's exercise price will be the stock's closing price on the date of the grant.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.