Massachusetts Adoption of Stock Option Plan of WSFS Financial Corporation

Description

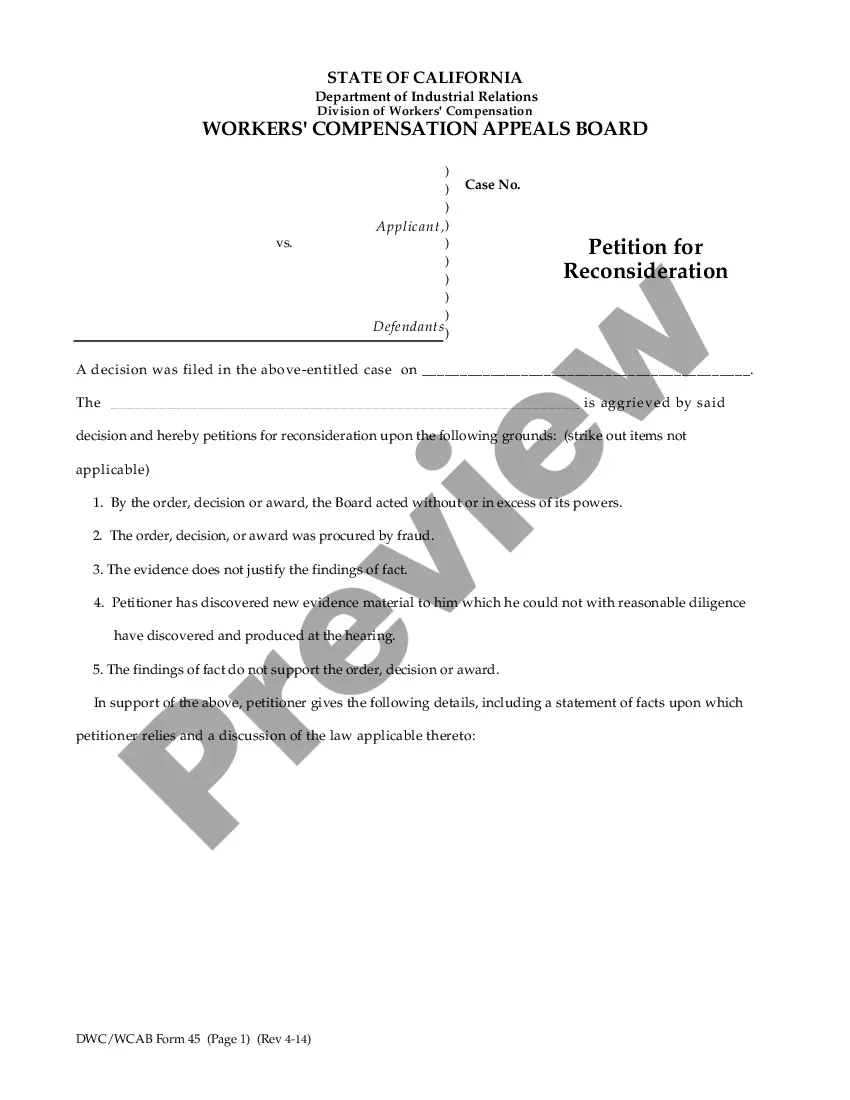

How to fill out Adoption Of Stock Option Plan Of WSFS Financial Corporation?

You may devote hours online looking for the authorized document format which fits the federal and state specifications you require. US Legal Forms gives a huge number of authorized varieties that are examined by professionals. You can actually obtain or produce the Massachusetts Adoption of Stock Option Plan of WSFS Financial Corporation from your services.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Acquire button. Afterward, it is possible to complete, revise, produce, or indication the Massachusetts Adoption of Stock Option Plan of WSFS Financial Corporation. Every authorized document format you acquire is your own property eternally. To obtain one more backup associated with a purchased develop, proceed to the My Forms tab and click on the related button.

If you are using the US Legal Forms site for the first time, keep to the easy recommendations listed below:

- First, ensure that you have chosen the right document format for that area/city of your choice. Look at the develop outline to ensure you have picked out the proper develop. If readily available, take advantage of the Preview button to check throughout the document format as well.

- If you wish to find one more edition of the develop, take advantage of the Look for discipline to find the format that suits you and specifications.

- Once you have discovered the format you desire, just click Buy now to move forward.

- Pick the rates prepare you desire, key in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You should use your charge card or PayPal accounts to pay for the authorized develop.

- Pick the file format of the document and obtain it to the product.

- Make adjustments to the document if possible. You may complete, revise and indication and produce Massachusetts Adoption of Stock Option Plan of WSFS Financial Corporation.

Acquire and produce a huge number of document templates using the US Legal Forms site, that provides the largest collection of authorized varieties. Use specialist and condition-distinct templates to tackle your business or specific demands.

Form popularity

FAQ

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

WSFS Financial Corporation is a financial services company. Its primary subsidiary, WSFS Bank, a federal savings bank, is the largest and longest-standing locally managed bank and trust company headquartered in Delaware and the Greater Delaware Valley.

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS.

WSFS celebrated its 35th year of being a publicly traded company with Chairman, President and CEO Rodger Levenson, joined by members of the executive leadership team, Associates and friends of WSFS, ringing The Nasdaq Stock Market Opening Bell.