Massachusetts Long Term Incentive Plan of Life Re Corp.

Description

How to fill out Long Term Incentive Plan Of Life Re Corp.?

Choosing the best lawful record template can be a struggle. Obviously, there are a variety of layouts available on the net, but how do you obtain the lawful develop you require? Use the US Legal Forms website. The assistance offers 1000s of layouts, such as the Massachusetts Long Term Incentive Plan of Life Re Corp., that you can use for enterprise and private requires. Each of the forms are checked out by pros and fulfill state and federal specifications.

In case you are already registered, log in to the account and click on the Acquire switch to have the Massachusetts Long Term Incentive Plan of Life Re Corp.. Use your account to look from the lawful forms you have ordered previously. Visit the My Forms tab of your own account and acquire one more backup of your record you require.

In case you are a whole new end user of US Legal Forms, listed here are straightforward directions for you to stick to:

- Initially, ensure you have chosen the proper develop for the town/county. You can look through the shape utilizing the Preview switch and read the shape information to make sure it will be the best for you.

- If the develop is not going to fulfill your requirements, take advantage of the Seach area to discover the correct develop.

- Once you are certain that the shape is suitable, click on the Get now switch to have the develop.

- Pick the costs program you need and type in the needed details. Make your account and purchase the transaction with your PayPal account or bank card.

- Opt for the file file format and down load the lawful record template to the product.

- Total, revise and produce and sign the obtained Massachusetts Long Term Incentive Plan of Life Re Corp..

US Legal Forms may be the biggest catalogue of lawful forms in which you will find a variety of record layouts. Use the service to down load skillfully-manufactured documents that stick to condition specifications.

Form popularity

FAQ

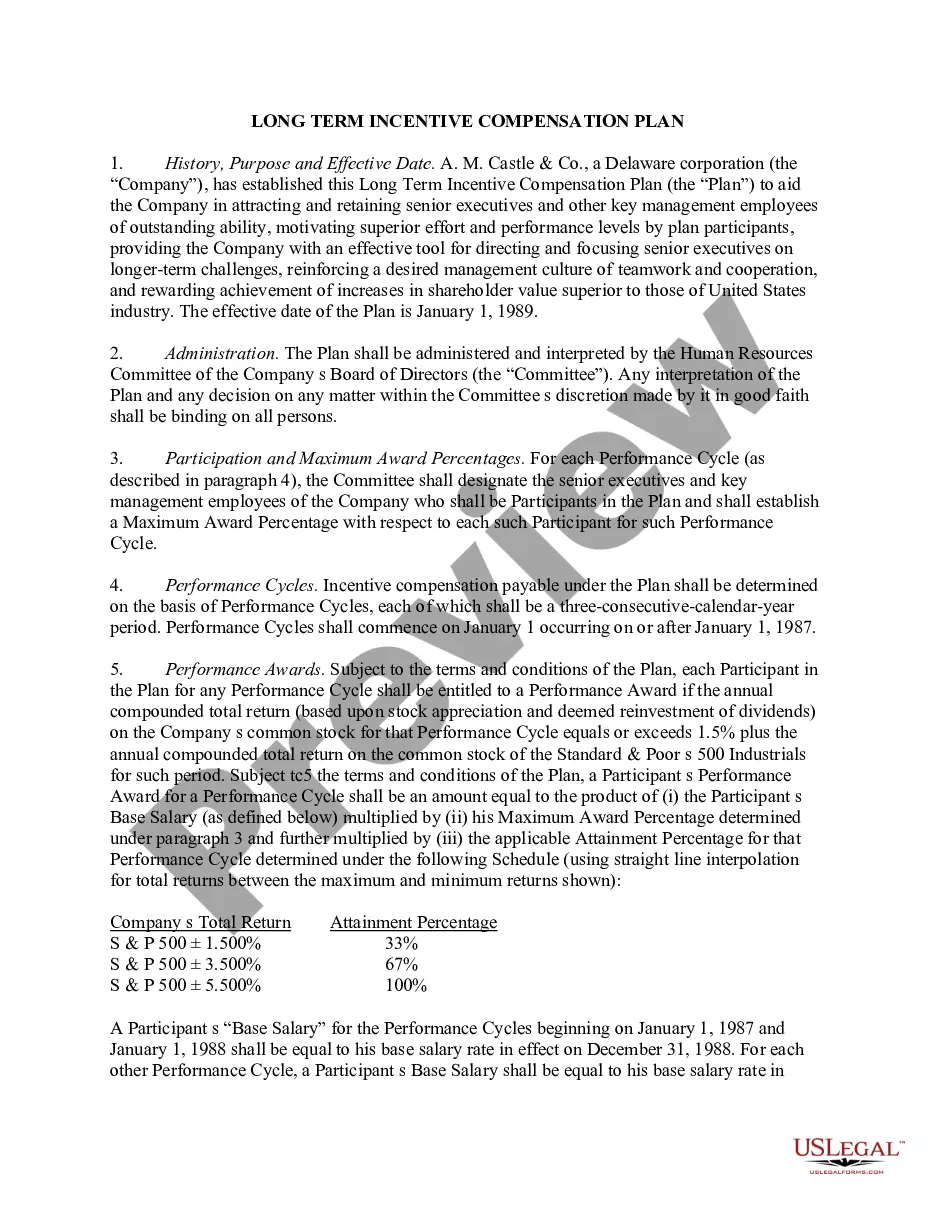

The most common long-term performance plan metrics are relative Total Shareholder Return (TSR), Return measures, and Earnings per Share (EPS). Many companies use a combination of financial and stock price metrics to balance line-of-sight for executives and direct alignment with shareholder outcomes.

Long-term incentives, or LTI as they're often called, are a valuable part of a total compensation package both for delivering rewards and focusing employees on desired future outcomes and objectives.

There're essentially four different types of long-term incentive plans ? Appreciation-based award, Time-based award, Performance-based award and Cash-based award.

Every employer has their own qualifications as to how an employee becomes eligible for the LTIP. Generally all employees are eligible to receive the benefits after three to five years as long as they meet the performance goals specified by the company.

An LTIP may reward and employee with shares, cash or other commodities such as cryptocurrency. The company can design the scheme in whichever way it feels will give the most appropriate outcome for the staff, the company and the shareholders.

LTIP Payout means any long-term incentive award paid to a Participant under the LTIP relating to services performed during any performance period, whether paid or not paid during such performance period or included on the Federal Income Tax Form W-2 during such performance period.

ESOPs are qualified retirement plans and they are designed to accumulate funds for retirement. While LTIPS and ESPPs could be used to accumulate savings for retirement, they are frequently used to accumulate savings for other financial goals, such as college tuition or a vacation home.

These plans are discussed below: Premium Bonus Plan. Under premium bonus plans, the time taken to complete a job is fixed based on a careful time analysis. ... Profit-Sharing and Co-ownership. ... Group Incentives. ... Indirect Incentive Plans.