Massachusetts Private Placement Financing

Description

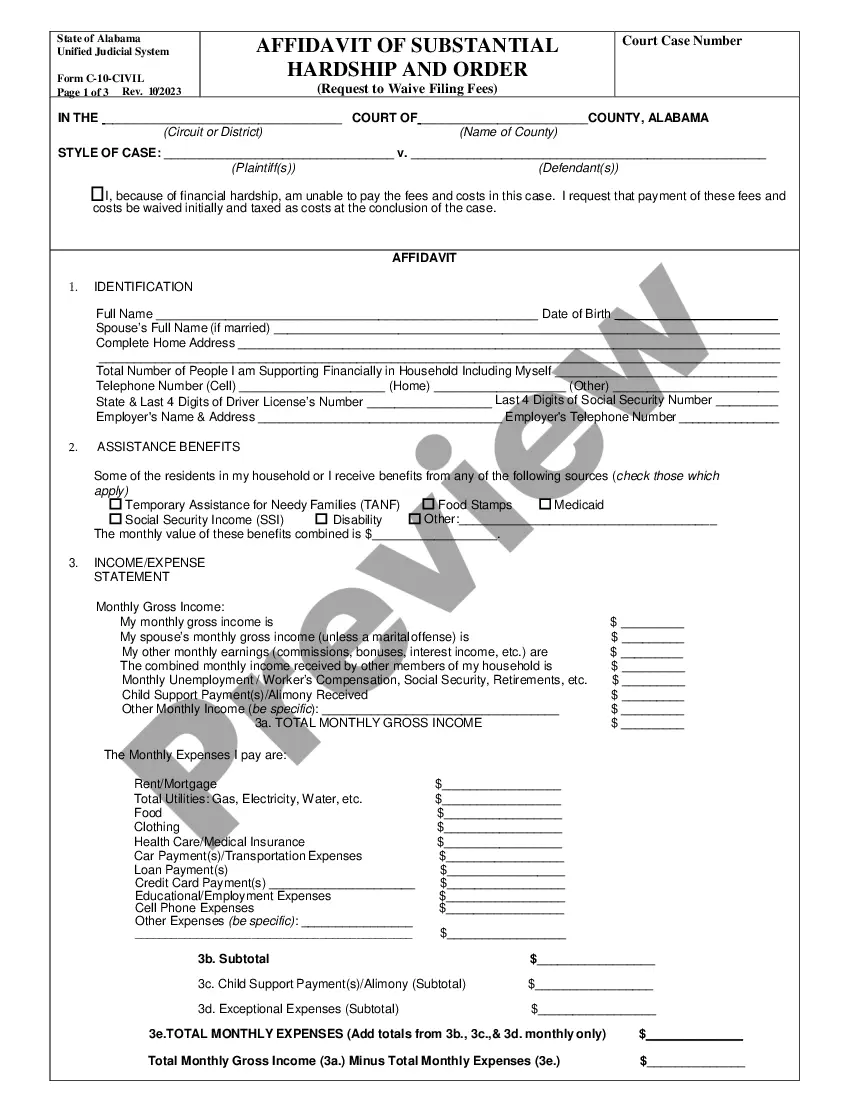

How to fill out Private Placement Financing?

If you need to comprehensive, download, or produce lawful record layouts, use US Legal Forms, the largest selection of lawful kinds, which can be found on-line. Utilize the site`s easy and handy research to get the papers you require. Different layouts for business and specific reasons are categorized by categories and suggests, or key phrases. Use US Legal Forms to get the Massachusetts Private Placement Financing within a number of clicks.

In case you are presently a US Legal Forms client, log in to your account and then click the Download button to get the Massachusetts Private Placement Financing. Also you can access kinds you formerly acquired inside the My Forms tab of your respective account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for your right area/land.

- Step 2. Utilize the Review method to look over the form`s articles. Never forget about to read the information.

- Step 3. In case you are not happy together with the kind, take advantage of the Lookup area on top of the monitor to discover other models of the lawful kind format.

- Step 4. Once you have found the form you require, click the Get now button. Select the rates prepare you favor and include your references to register on an account.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal account to finish the financial transaction.

- Step 6. Pick the formatting of the lawful kind and download it in your device.

- Step 7. Comprehensive, edit and produce or sign the Massachusetts Private Placement Financing.

Every single lawful record format you purchase is your own property eternally. You have acces to every single kind you acquired within your acccount. Go through the My Forms portion and choose a kind to produce or download yet again.

Be competitive and download, and produce the Massachusetts Private Placement Financing with US Legal Forms. There are thousands of professional and status-particular kinds you can use to your business or specific demands.

Form popularity

FAQ

Our office is responsible for the maintenance of public records, administration of elections, storage of historical data, preservation of historical sites, registration of corporations, and the filing and distribution of regulations and public documents.

Rule 701 exempts certain sales of securities made to compensate employees, consultants and advisors. This exemption is not available to Exchange Act reporting companies. A company can sell at least $1 million of securities under this exemption, regardless of its size.

Secretary of the Commonwealth William F. Galvin is urging voters who have not returned their mail-in ballots for next Tuesday's elections to . . . . . .

The Secretary of the Commonwealth, William Francis Galvin, is the constitutional officer who, through the Massachusetts Securities Division (also referred to as the "Securities Division" in this document), is entrusted with the task of administering and enforcing Massachusetts General Law, Chapter 110A, the Uniform ...

Commonwealth Of Massachusetts Customer Service Phone Number (800) 392-6090, Email, Help Center.

dealer is any person engaged in the business of effecting transactions in securities for the account of others or for his or her own account. Every business that performs such activities in the Commonwealth must register unless it is specifically excluded from the definition of brokerdealer.

The best answer is C. ADRs (American Depositary Receipts) are non-exempt securities and must be registered with the SEC under the Securities Act of 1933.